The actual 'Trump bump': tariff turmoil delivers for bank trading desks

Investors scrambling to adjust positions in response to the US tariff announcement on April 2 look set to deliver another bumper payday for bank trading desks, which continue to capitalise on volatile moves and record client activity this year across financial markets.

Equities plunged, government bonds surged and the US dollar skidded lower after president Donald Trump announced harsher-than-expected tariffs on US trading partners. Investment banks were prepared for the mayhem, executives say, staffing up trading desks across the globe in the kind of wargaming usually reserved for major elections.

That meant banks were well positioned to react to the widespread investor dismay and confusion over Trump’s plans – and the sharp increase in trading volumes that followed as fund managers reshuffled exposures across equities, foreign exchange and bond markets.

"We are always ready to serve our clients and provide access to liquidity in the FX markets wherever needed, and this was no exception," said Fuad Muvdi, head of FX trading for the Americas at Citigroup.

Muvdi reported increased levels of client activity, particularly in the 24 hours following Wednesday evening's tariff announcements with total daily client volumes over one-and-a-half times higher than their February averages across some trading channels.

"We had all our teams ready and working in close coordination across centres to ensure clients had continued coverage before, during and after every relevant announcement," he said.

Trump’s reelection was supposed to usher in a new golden age for investment banks, but his first few months in office have been a mixed bag. The so-called “Trump bump” has yet to materialise for dealmakers underwriting equity issues or advising on mergers and acquisitions as the uncertainty over tariffs has prompted many companies and investors to shelve their plans.

That same uncertainty helped push US investment-grade debt issuance volumes to record levels in the first quarter as companies frontloaded their borrowing. It also provided a meaningful shot in the arm for bank trading desks.

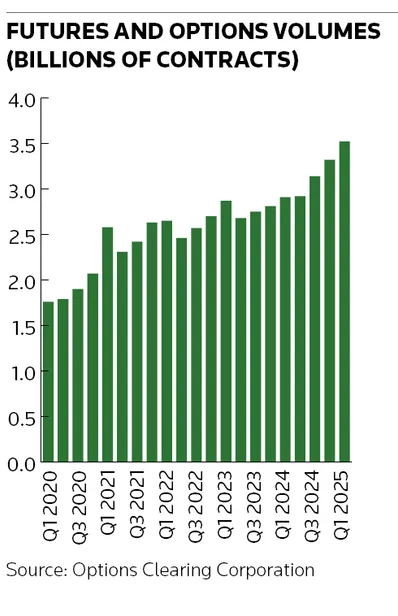

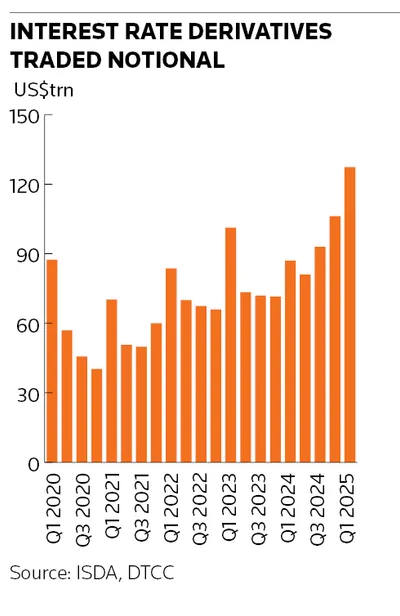

The first quarter saw record trading volumes across many major financial markets. Futures and options volumes rose 21% from a year earlier with 3.5 billion contracts changing hands, according to the Options Clearing Corp. Interest rate derivatives volumes were up 46% at US$127trn, according to ISDA, while credit default swap index volumes also hit a fresh quarterly high. More US corporate bonds changed hands on average each day than ever before, according to market-wide data from MarketAxess.

All that played into the hands of bank trading desks that make their money by buying and selling securities on behalf of clients. BCG Expand, a research and data provider owned by Boston Consulting Group, said global markets' revenues would rise as much as 9% in the first quarter – a forecast that implies the big five US banks had one of the best starts to the year on record in sales and trading.

There are early signs that the trading bonanza is set to continue into the second quarter as concerns intensify over the impact of tariffs on the global economy. Cboe's VIX, which measures S&P 500 volatility, rose above 40 on Friday for the first time since August as the selloff gathered pace after China announced retaliatory tariffs.

Heightened volatility has posed problems in the past for trading desks handling complex exposures such as structured equity derivatives, although banks say they have since improved the risk management of these products. Banks will hope, in any case, that increased client activity in trading of simpler "flow" products will offset any immediate pain from the extreme market moves.

About 77 million futures and options contracts changed hands on Thursday, according to the OCC, the second-highest daily total on record. Citi's Muvdi said there have been trading sessions in which volumes in some of the most relevant currency pairs have been as much as three-and-a-half times higher than their 30-day moving averages.

Traders say hedge fund clients had dialled back risk ahead of Wednesday's announcement but the scale of the moves in financial markets on Thursday suggests most investors were woefully unprepared.

"We expect levels of activity to be elevated as portfolios continue to be strategically rebalanced and as tariffs start to influence more structural investment decisions both for institutional investors as well as our corporate client base," Muvdi said. "I would expect volatility to remain elevated given there is still plenty of uncertainty on how these measures will ultimately affect the economy and trade in the short and medium term, while the adjustments are made."

Dealmaking drought

The trading boom contrasts with a slow start to the year in investment banking, with equity capital markets suffering from a particularly painful drop-off. Bankers say tariffs will stifle dealmaking further.

“We’re into a period of increased uncertainty over the next few months, which is never a good thing for M&A and equity issuance, and inevitably feeds through into leveraged finance," said Tom Johnson, global co-head of capital markets at Barclays. “It’s too early to be overly pessimistic for the full year, although in the short term we’ve got a lot to digest.”

There were just seven global IPOs – worth US$156m – between March 28 and April 3, the lowest total for that period in at least 21 years, according to LSEG data.

For the first time this year, no US leveraged loans launched at the start of the week. Meanwhile, borrowers marketing leveraged facilities have been forced to make lender-friendly concessions to get their transactions over the line.

“It’s expected for people to be sitting on their hands a bit, given the uncertainty,” said Michael Anderson, global head of credit strategy at Citi. “The Trump tariffs are a significant headwind to new [mergers and acquisitions] talks. It’s natural that you don’t want to undertake a transaction that you may not be able to finance."

M&A loans that have closed have been for smaller “bolt-on” acquisitions, despite ample liquidity for larger deals. During the first quarter, investment-grade M&A loan volume totalled less than US$6bn, a 91% drop from the first three months of 2024, according to LPC data.

Even the resilient US investment-grade corporate bond market has taken a breather in recent days. Issuance from Monday to Thursday totalled just US$6bn, the lowest since 2015 for this week and well below the US$25bn–$30bn anticipated by syndicate desks polled earlier by IFR.

“In 25 years I’m not sure there have been many periods where the crystal ball has been murkier than it is right now," said Tom Swerling, global co-head of ECM at Barclays. “From a dealmaking perspective, the outlook appears tough in terms of the level of confidence people have, although things can change quickly.”

Bank shares, often seen as a proxy for economic growth, have been among the hardest hit since Wednesday's tariff announcement. More than US$130bn was wiped off the market value of the big five US banks on Thursday.

Europe's banking index was down more than 14% as of midday on Friday since the tariff announcement, putting it on course for its biggest weekly drop since February 2022 when Russia invaded Ukraine. Japanese and Asian bank stocks also tumbled.

Additional reporting by Michelle Sierra, Rhys Adams, Sunny Oh, Paul Kilby and Owen Wild