Figma rides must-own status to IPO payday

Figma responded to runaway investor demand for its US$1.2bn NYSE IPO last week by dramatically increasing its valuation but not the size of the offering, forcing investors to purchase stock in the aftermarket.

The digital design software provider’s stock soared 250% on Thursday's debut, the strongest first day ever on a US-listed IPO larger than US$500m, according to Renaissance Capital, an independent US research firm.

Morgan Stanley, Goldman Sachs, Allen and JP Morgan priced 36.9m shares, including 24.5m from selling shareholders, at US$33, one dollar above the upwardly revised US$30–$32 marketing range and a step change from the US$25–$28 range at launch.

With a book more than 40 times subscribed, the banks concentrated 70% of the shares sold with 25 institutions, significantly scaled back other orders and zeroed half of the institutions who put in for the deal.

Figma management played an active role in doling out stock, with long-only mutual funds figuring prominently, bankers said.

Figma closed on Thursday at US$115.50, after a lengthy wait for an initial trade at US$85 and first-day volume of 64.4m shares, nearly double the amount sold.

“From an institutional perspective, Figma is viewed as a must-own asset that is ahead of larger incumbent competitors from a technological perspective,” said one senior ECM banker involved in the offering.

“But there is also a massive swell of retail interest in this offering, which I have rarely seen for a company of this size.”

At pricing, Figma was valued at a US$19.8bn market capitalisation – just below the US$20bn valuation in Adobe's failed acquisition in 2023 – rising to US$69.4bn on the first-day close. The latter valuation requires a long-term view.

In the second quarter, Figma grew revenue by 40% to US$248.5m, or roughly US$1bn on an annualised basis. Extrapolating that current growth through 2028 would result in revenue of US$2.9bn, valuing the stock at 24 times 2028 revenue.

Snowflake and Datadog both trade at about 16x EV/revenue for 2025, and Adobe at 6.5x revenue for this year. It requires a long-term view to justify owning Figma stock. The scarcity from a 7% free-float also plays a part.

Figma’s software suite is phenomenally popular. Net dollar retention, a measure of clients adopting new products, in the first quarter was 132%. And while its basic software is free, the number of large enterprises paying US$10,000 and US$100,000 annually grew by nearly 40% and 50% in the first quarter to more than 11,000 and 1,000 respectively.

Show me your hand

To tamp down investor demand, the banks leading the Figma IPO required investors to submit orders with a specific price and number of shares.

“I don’t know if it really affects our process,” said one buysider. “It does require us to show our hand a week before we need to. I think [Morgan Stanley] is trying to develop a process that is constructive.”

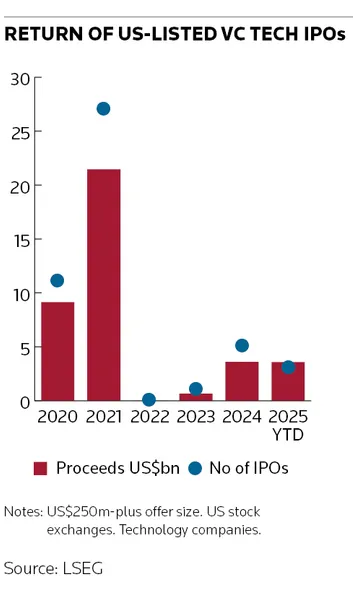

Figma is only the third VC-backed tech company to go public in the US this year whose IPO was larger than US$250m, following the debuts of SailPoint and Chime Financial in February and June, according to LSEG data.

In the case of SailPoint, whose security software is used to validate identities, strong investor demand allowed it to price 60m shares at US$23. But shares fell 4.4% on debut and now trade at US$22.99.

Investors were critical of the SailPoint IPO for being overly aggressive on valuation. Morgan Stanley, Goldman Sachs and JP Morgan were involved in both SailPoint and Figma IPOs.

Nothing ventured

Figma is one of the biggest IPO paydays ever.

CEO and co-founder Dylan Field collected US$77.6m from stock sold on the IPO and still holds US$6.3bn of stock at the current valuation. As part of an award package, he is due to collect up to 11.25m additional shares if Figma is valued above US$15bn, US$20bn and US$25bn.

Venture capital firms are counting their windfall. Greylock Partners, which led a US$3.9m seed round in 2013 at a US$10m valuation, took a US$6.8bn mark on the IPO, including 3.1m shares sold on the IPO. Index Ventures, Kleiner Perkins and Sequoia Capital, all of which also sold on the deal, are sitting on US$7.3bn, US$6.1bn and US$3.8bn worth of Figma stock.

Other privately held software companies are most certainly taking note.

“We believe Figma is an ideal IPO candidate to lead the way for additional software IPOs over the next 12–18 months,” wrote DA Davidson head of tech research Gil Luria in a note to clients earlier last week.

Canva, a competitor to Figma, Databricks and Genesys Software, all of which are venture backed, are among the IPO candidates on Luria’s list.