Klarna taps into US IPO renaissance

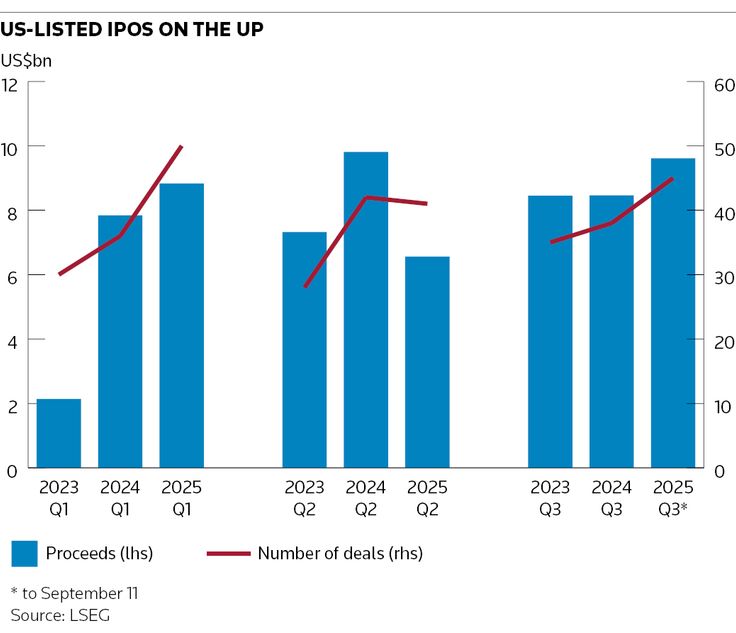

After a lackadaisical summer, the US IPO market is running at issuance levels not seen since 2021, highlighting a combination of pent-up supply and investor willingness to engage in new issues to close performance gaps.

This is not the near-zero interest rate environment that fuelled speculative investments in 2021, but rather an awakening of a backlog of companies that have waited a long time to go public.

“The expectation was that a lot of this product would come to market at the beginning of the year,” said one global head of ECM. “Market volatility and uncertainty surrounding tariffs impacted those plans. [But] investor demand was built into many of these IPOs [as a result].”

Klarna, the Swedish buy now, pay later fintech, raised US$1.37bn from its IPO last week – one of seven US listings, over the week – having seen its hopes dashed for an April listing by the US tariff announcement on April 2.

Arguably, the company has benefited since then as it has broadened its operations beyond BNPL to debit cards and deposit accounts, as well as solidifying ties with US retail giant Walmart.

“While best known for buy now, pay later, Klarna has ambitions across financial services,” said one long-only asset manager whose firm participated in the offering. “Klarna is also new to the US market, so there are lots of vectors for growth.”

It didn’t hurt that shares of US rival Affirm, which Klarna replaced at Walmart, have more than doubled since US president Donald Trump's “liberation day” tariff announcement.

Goldman Sachs, JP Morgan and Morgan Stanley priced Klarna’s offering of 34.31m shares at US$40 each, above the high end of the US$35–$37 marketed range, thanks to demand covering the deal more than 25 times.

Klarna shares closed on their NYSE debut on Wednesday at US$45.82, 14.6% above offer.

That aftermarket performance narrowed the valuation gap between Klarna and Affirm. IPO pricing valued Klarna at a mid-20s EV/Ebitda for 2026, a steep discount to the 32 times multiple where Affirm trades.

Timeline

The timeline to go public is well established at about six months, from bake-off, through confidential filling, auditing, regulatory reviews, pilot-fishing, a public filing, launch 15 days after that, then pricing.

“When tariff announcements hit in early April, our advice to all our clients was stay prepared, be ready if and when things come back because you want to be able move quickly,” said Keith Canton, co-head of Americas equity capital markets at JP Morgan.

Blockchain-focused consumer lender Figure Technology Solutions launched the marketing on September 2 for its Nasdaq IPO, 15 days after publicly filing, and publicly marketed for seven days ahead of pricing on Wednesday.

Goldman Sachs, Jefferies and Bank of America were joint bookrunners on Figure’s upsized IPO of 31.5m new shares at US$25, above the high end of the upwardly revised US$20–$22 marketing range on a deal that launched as 26.3m shares at US$18–$20.

Figure shares closed on debut on Thursday at US$31.11, 24% above offer.

Coffee retailer Black Rock Coffee Bar, crypto exchange Gemini Space Station, PE-backed industrial Legence and software provider Via Transportation all followed the same 15-day post-Labor Day launch timeline ahead of pricing their IPOs late on Thursday.

Adding LB Pharmaceuticals’ US$285m Nasdaq IPO that priced on Wednesday, the seven US$50m-plus IPOs last week is the most in a single week since 2021, and for what it’s worth, there were 23 weeks in 2021 when at least seven US IPOs priced, according to LSEG data.

Star turn

Meanwhile, StubHub resuscitated its IPO plans with the launch of an US$851.1m Nasdaq IPO, one of four deals scheduled to price in the coming week. The US online ticket broker confidentially filed to go public in late 2021 and publicly filed in March for a planned April launch.

JP Morgan and Goldman Sachs are lead joint bookrunning managers on StubHub’s all-primary IPO of 34m shares marketed at US$22–$25 each.

Outperforming

A big reason for high investor demand is that IPOs are outperforming the market. The 52 IPOs priced in 2025 are trading an average 33.7% above offer, more than double the 14.1% year-to-date gain of the Nasdaq Composite.

The current IPO market has taken a while to heat up. Smartstop Self Storage REIT, up 28.9% after its US$810m NYSE IPO priced April 1, the eve of Trump’s tariff announcement, was the only company to go public in April.

Apollo Global-backed speciality insurer Aspen Insurance (+25.3%) and American Integrity Insurance (+25.3%), a home insurer focused on Florida, were “tariff-resistant” companies that went public in May.

That tariff-resistance theme broadened to Israeli online brokerage eToro (–14.6%) in May, USDC stablecoin producer Circle Internet (+331.3%) in June, web design software provider Figma (+69.6%) in July and crypto exchange Bullish (+45.9%) in August.

Sprint to year-end

The overlay of retail investor participation on new issues is notable, particularly for crypto-related financings.

“We want to break the mould here and wanted retail to participate,” Bullish CEO Tom Farley said in an interview with CNBC. “Retail may be the marginal price setter. But frankly, we feel retail is underestimated with respect to their sophistication.”

More than 20% of Bullish’s IPO was allocated to retail investors, far more than the typical 5%.

The Bullish IPO also featured the unique delivery of proceeds raised in the form of stablecoin rather than cash.

Gemini pushed retail contribution to 30% on its US$433.3m Nasdaq IPO. Oversized retail participation creates scarcity for institutions and momentum in the bookbuild.

Gemini added to that retail-institutional pricing tension by looping in a US$50m investment from Nasdaq late in the bookbuild, corresponding with a jump in the marketing range to US$24–$26 from US$17–$19 at launch.

In addition to StubHub, this coming week’s scheduled pricings include cybersecurity software provider Netskope, ecommerce expeditor Pattern Group and E&P water services provider WaterBridge Infrastructure.

Those deals will push year-to-date US-listed IPO issuance to US$30bn, in line with the US$30.8bn raised in all of 2024 and marking the busiest year since 2021 with an unrepeatable US$149.4bn.

JP Morgan’s Canton sees a sightline to US$40bn for 2025, even though the near-term backlog of companies that have publicly filed is virtually barren.

“There are some companies that are looking to accelerate,” he said. “Those who were thinking about going public in the first half [of 2026] are asking 'if we sprint, can we accelerate?’ That is a conversation we are absolutely having with clients.”