India's IPO market faces significant test

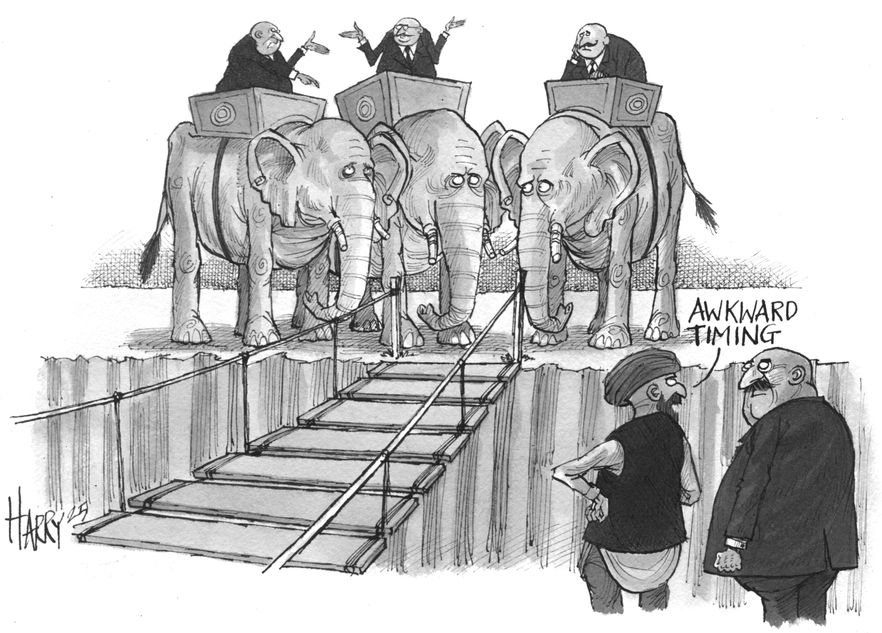

India's IPO market is facing a moment of truth with several large deals simultaneously vying for investors' interest at the tail end of what has been a lacklustre year for the country's primary equities market.

With a combined size of Rs301bn (US$3.4bn), the IPOs of Tata Capital, LG Electronics India and WeWork India Management are set to raise more than India's largest IPO to date, the Rs278.7bn float of Hyundai Motor India in October last year. Books close in the week beginning October 6 for all three IPOs.

Other IPOs totalling up to US$11bn could also come to the market in the fourth quarter, according to IFR records, exceeding the US$10.5bn raised in the first nine months of the year.

The 240 IPOs earlier this year were relatively small and easy to absorb, even though the BSE Sensex Index is up only 3.9% this year, vastly underperforming Hong Kong's Hang Seng Index (+35%) and China's Shanghai Composite Index (+15.8%).

But the large deals on the runway have had to compromise on valuation to attract investors.

Nonbank financial company Tata Capital has launched an up to Rs155bn IPO, compared with Rs170bn previously planned. The top of the Rs310–Rs326 IPO range implies a market capitalisation of US$15.5bn, lower than its earlier target of US$17bn–$18bn. Still, this would make Tata Capital the largest Indian IPO this year ahead of HDB Financial Services' Rs125bn float in June.

LG Electronics India has launched an all-secondary Rs116bn IPO at a valuation of US$8.71bn, consistent with recent investor feedback of an US$8bn–$9.4bn valuation but well down from the US$10.5bn–$11bn that the country's largest electronic goods manufacturer had hoped to achieve. It put the deal on hold in April following the turmoil unleashed by the US tariff announcements and due to the valuation mismatch with investors.

Shared office provider WeWork India Management has launched an all-secondary IPO of up to Rs30bn, lower than the previously planned Rs40bn, although the number of shares on offer has increased to 46.3m from 43.8m.

Bankers said sellers are slowly accepting that they need to leave more on the table for investors.

"Vendors know they will get more attractive windows upon listing if they are not too greedy at the time of the IPO," an ECM source said.

Among the larger IPOs planned for the rest of the year are ICICI Prudential AMC (US$1bn), Groww (US$800m), Lenskart (US$1bn), PhonePe (US$1.35bn), Zepto (US$1.25bn), Zetwerk (US$700m), PhysicsWallah (US$500m), Meesho (US$700m), Pine Labs (US$700m), CleanMax Enviro Energy Solutions (US$595m), InfiFresh Foods (US$400m), Credila Financial (US$600m), Fractal Analytics (US$500m) and Prestige Hospitality Ventures (US$300m).

Mixed outlook

The outlook for the Indian economy remains mixed, as the full impact of the 50% tariffs on exports to the US is not yet clear, although positives for the market include a generally dovish Reserve Bank of India and a recent cut in the goods and services tax on several consumer items.

Still, foreign investors remain relentless sellers of Indian shares. According to National Securities Depository data, foreign portfolio investors have sold a net Rs1.59trn of shares this year compared with net purchases of Rs4.27bn in 2024.

Tata Capital does not have time to wait for a better valuation as it needed to list by the end of September to comply with the Reserve Bank of India's requirement for "upper layer" NBFCs to list within three years of being included in the category. Tata Capital was declared an upper layer NBFC on September 30 2022.

Other finance companies have put their IPO plans on hold because of margin pressures, lower loan growth to small and medium-sized enterprises and higher credit costs. These include Avanse Financial Services (a potential US$400m IPO), Veritas Finance (US$318m), SK Finance (US$194m), Aye Finance (US$165m) and Belstar Microfinance (US$150m).

Strong secondary components

The secondary component is strong in the Tata, LG and WeWork deals.

The Tata Capital offer comprises 210m primary and 265.8m secondary shares. Tata Sons, the controlling shareholder, is selling 230m shares and the International Finance Corporation 35.8m. The IPO represents 11.2% of the post-issue capital. Books close on October 8.

Axis Capital, BNP Paribas, Citigroup, HDFC Bank, HSBC, ICICI Securities, IIFL Capital, JP Morgan, Kotak and SBI Capital Markets are lead managers.

South Korea's LG Electronics is selling 101.8m shares, or a 15% stake in its Indian unit, at Rs1,080–Rs1,140 per share. Books close on October 9.

Axis Capital, Bank of America, Citigroup, JP Morgan and Morgan Stanley are bookrunners.

Embassy Buildcon, a unit of property developer Embassy Group, and investor 1 Ariel Way Tenant (a WeWork entity) are selling 33.3% of WeWork India Management at Rs615–Rs648 per share. The IPO closes on October 7.

JM Financial, ICICI Securities, Jefferies, Kotak and 360 ONE WAM are bookrunners.