Lucid binds ties to PIF with US$875m CB refi

Lucid rolled a problematic convertible bond maturity by selling a new US$875m six-year CB last week that was linked to a fresh equity investment from its majority owner, Saudi Arabia’s Public Investment Fund, further binding the high-end electric vehicle maker to the sovereign wealth fund.

Building a car manufacturer from scratch is expensive. Lucid burned through nearly US$1bn of cash in the third quarter, making regular equity issues a necessity.

The company is paying a 7% coupon on the new CB that is convertible at a share price of US$20.81, a 22.5% premium to Tuesday's US$16.59 close and reference price.

Citigroup and Bank of America wall-crossed investors for two days before launching on Tuesday evening at a 6.5%–7% coupon and 20%–22.5% conversion premium. In doing so, they guided accounts towards a credit spread of SOFR plus 1,900bp and implied vol of 50, implying a 20%-plus equivalent straight-debt cost of funding.

ICR Capital was an independent adviser.

Shorting Lucid stock is constrained by PIF’s 54.6% equity stake.

“This is a tricky situation,” said one rival equity-linked banker. “There is no stock borrow so there had to be a solution engineered. This is a company that continues to lose a lot of money.”

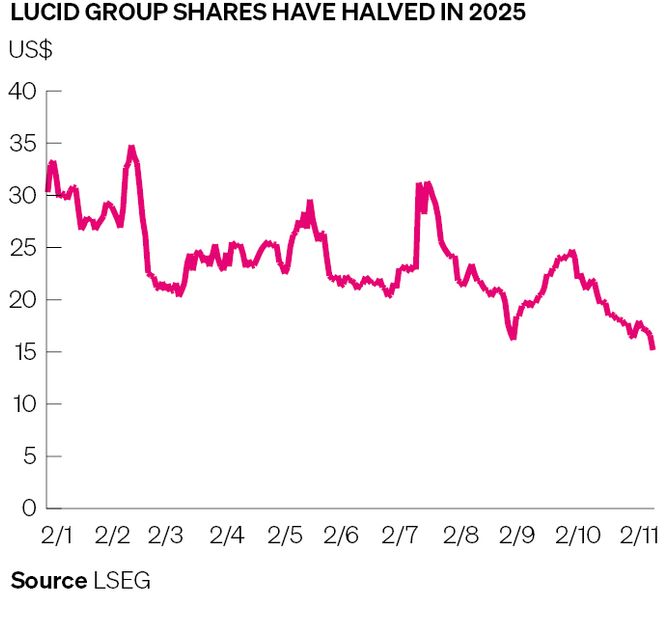

The engineering saw PIF subsidiary Ayar purchase US$636.7m of Lucid stock under a prepaid forward transaction. Those shares were offered on swap to arbitrage accounts buying the convert and wanting to hedge their equity exposure. Shares have halved in 2025 and profits are not yet on the horizon, making arb accounts the natural buyers.

The prepaid forward allowed Lucid to maximise proceeds from the bond sale. The company used US$755.7m of the proceeds to repurchase US$752.2m principal of a 1.25% CB that matures in December 2026, trimming that obligation to roughly US$200m.

Saudi ties

On the surface, this is a bullish bet by PIF on Lucid over the long term.

This is a repeat of the trade in April that raised US$1bn from the sale of a 5% CB maturing in 2030 that was used to repurchase US$1.05bn of the 2026s. That offering also saw Ayar step in with a US$430m prepaid forward purchase of equity to facilitate stock borrow.

Citi is counterparty to the April forward purchase agreement at US$24, adjusted for a 10-for-1 stock consolidation in August to prop up Lucid's share price.

While not a party to the prepaid forward, Lucid is paying a 0.5% fee annually on that US$430m equity investment, the company disclosed in securities filings.

Lucid’s shares slid nearly 10% after the new CB priced to close on Thursday at US$15.17 – the 2030 CB now trades at 78 cents on the dollar and the new 2031 at 94, according to LSEG data.

Bridge to…

PIF has poured money into a capital-intensive business so is essentially “pot committed”.

PIF recently agreed to enlarge a delayed draw term loan to Lucid to US$2bn, from US$750m, to increase total liquidity to US$5.5bn. That is on top of the roughly US$5.6bn already invested through equity and convertible preferred investments over the years, plus the US$1bn pledged to the two prepaid forwards this year.

There may be a path forward and, if so, PIF is integral to it.

In 2023, the Saudi government entered an agreement to purchase up to 100,000 EVs from Lucid over a 10-year period, a minimum of 50,000 with an option for an additional 50,000. Of the US$137.6m in accounts receivable Lucid booked as of September 30, more than 60% came from the Saudi EV purchase agreement.

Lucid struck a deal in July with Uber Technologies to sell a minimum 20,000 Lucid Gravity EVs to support the ride-hailing company’s autonomous driving network. Uber invested US$300m as part of that agreement.

Lucid has a strategic collaboration with Nvidia to co-develop next-generation Level 4 autonomous driving technology. It also has an agreement to supply powertrains to Aston Martin, which is due to produce its first EV later this decade.

PIF owns stakes in Lucid (54.6%), Aston Martin (16.7%) and Uber (3.5%), according to LSEG data.

The path to profitability has Saudi Arabia acting as a bridge to international expansion, to Saudi and China, and licensing of EV technologies to other automakers.

That long-term vision is bound by the reality that Lucid is losing money on each of the 4,000 EVs it made in the third quarter, a dwindling cash pile that stood at US$1.64bn as of September 30, and total liquidity of US$5.6bn that includes credit extended by PIF.