Singaporean data centre company STT GDC took Asia’s sustainability bond market into uncharted territory on Monday when it priced Asia’s first subordinated perpetual sustainability-linked bond.

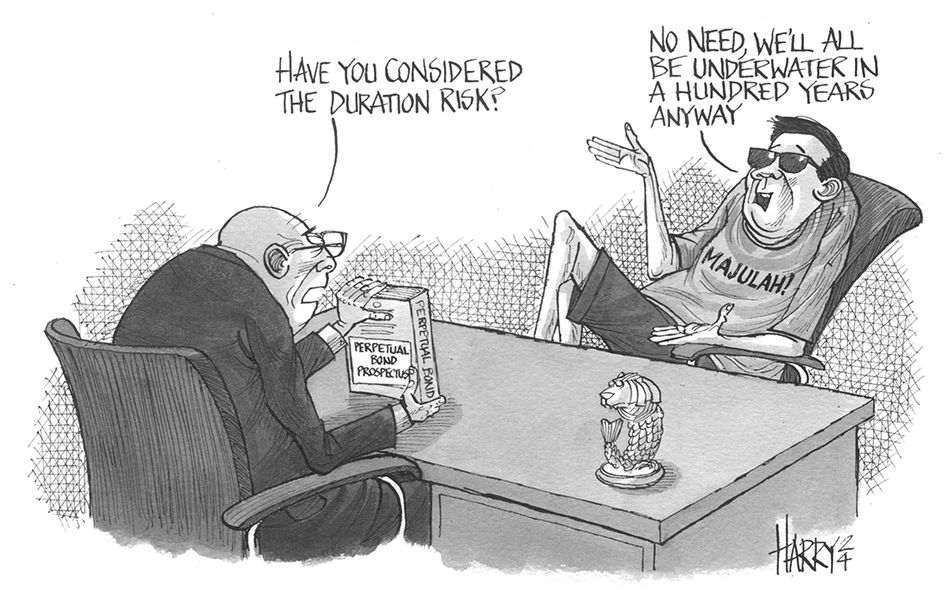

The S$450m (US$338.4m) transaction will not be easily followed, as the combination of a subordinated perpetual corporate bond, which in this case comes with a reset and 100bp step-up from year six, and a sustainability-linked step-up, in this case 25bp from January 2028 if key performance indicators are not met, will test the creativity of issuers, investors and regulators alike.

The structure means there is a lot of uncertainty for investors when trying to calculate the future coupon payments they might receive.

“We were not sure … what the market reception would be,” said Nelson Lim, group chief financial officer at STT GDC, calling the structure “untested” in Asia. “We spent time initially trying to explain the structure, but I think the market and institutions get that.”

STT GDC’s 5.7% notes, which were sold at par or an initial spread of 298bp over SORA, ticked boxes that other issuers may not be able to match. A banker on the deal said STT GDC is unlisted and unrated, giving it more flexibility to sell a hybrid. In addition, the investor pool in Singapore is largely private banks, which are generally comfortable with perpetual bonds and step-up structures, he said. The offering came with a 25-cent incentive for private bank orders.

“Very few [companies] will have this freedom to structure in this way,” said the banker, explaining the specificity of the deal.

STT GDC has the additional benefit of being backed by Singapore’s state-owned investment company Temasek Holdings, and it operates in the booming data centre sector across Asia and Europe.

Even standard sustainability-linked bonds have become a rarity in the past year as issuers and investors are grappling with greenwashing concerns and trying to find the proper balance between ambitious goals and incentivising step-ups.

Lim said STT GDC is cognisant of greenwashing concerns and was careful in its choice of a key performance indicator and deal structure to best meet the market standards.

“The sustainability angle is no longer nice to have. It’s a must-have,” said Lim.

STT GDC began watching the market about nine months ago, but the groundwork for the trade started even before that.

The company sold its first Singapore dollar bond in 2019, followed by another senior deal in 2020. It announced an ESG strategy in early 2021 and a sustainability-linked financial framework in 2022, building a track record for measuring its sustainability efforts and reporting them publicly.

“It was not easy,” said Lim. “We had to very clearly define, among the many KPIs in our ESG targets, what would be relevant for our [sustainable] financing framework. It has to be relevant. It has to be material. And it has to be benchmarked to our peers.”

The company identified three focused targets, and took just one, its use of renewable energy, to be the measurable KPI for the perpetual deal. STT GDC will need to use electricity from renewable sources for at least 60% of total aggregate usage, up from the current 52%, in order to avoid the step-up. It plans to have carbon-neutral data centre operations by 2030, but it needed to have a measurable KPI early enough before the perpetual’s first call date to allow for a step-up if necessary.

STT GDC could have opted for a more standard sustainability-linked bond structure with a bullet maturity, but it was focused on using a subordinated perp. “We felt that this was really the right time to consider a perp structure to broaden our capital base,” said Lim.

The response to the transaction was strong, with the order book reaching S$1bn from 70 accounts, including S$15m from the leads, at reoffer. That allowed the borrower to upsize from its S$300m target and price inside 5.75%, which was considered the high end of a fair value range, said the banker. Initial price guidance had started at the 6% area.

Private banks were allocated 65% and banks and funds the other 35%. Some of the investors are holders of the issuer’s senior notes.

“They like the story of our industry, and they like it even better that you are linking it with a very clear … sustainable measurement,” said Lim.

Bankers on the deal are hopeful that the successful trade demonstrates there is still appetite for sustainability-linked products in Asia, and more deals could follow.

“Sustainability-linked structures can work for other suitable issuers with credit profiles that are familiar and well-accepted by investors," said a second banker on the deal. "They should ideally also have a robust sustainability-linked financing framework established beforehand.”

The proceeds will be used for general corporate purposes, including refinancing, acquisitions and working capital. The issuer and the Reg S notes are unrated.

DBS and UOB were the global coordinators. They were also bookrunners and lead managers with HSBC and Standard Chartered.