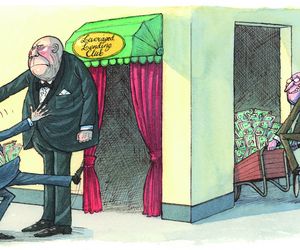

North America Loan: AbbVie’s US$18bn acquisition loan

Pills ‘n’ thrills

Biopharmaceutical company AbbVie’s landmark US$18bn bridge financing backing its US$21bn acquisition of cancer drug-maker Pharmacyclics emerged in the first quarter and set the tone for the rest of 2015.