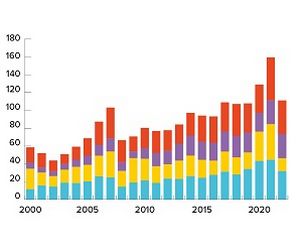

North America Equity House: JP Morgan

Taming the bear

For positioning itself better than peers to withstand the collapse in US ECM volumes and playing off its strengths in healthcare, energy and FIG to lead many of the year’s biggest offerings, JP Morgan is IFR’s North America Equity House of the Year.