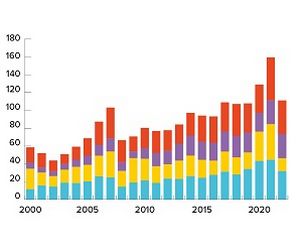

Americas ESG Financing House: Bank of America

Powering up

Bank of America claimed a leading position in all the major areas of ESG financing in the Americas in 2022, building on a major expansion of its team and shooting up the league tables. It is IFR’s Americas ESG Financing House of the Year.