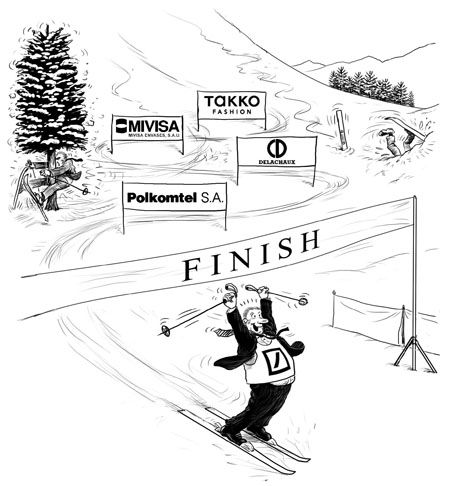

EMEA Leveraged Loan House

Committed to the cause: Deutsche Bank’s strategy in 2011 was to be number one in European leveraged loans. Lending conditions deteriorated throughout the year, but the bank remained at the forefront of the market. For its consistency, and the ability to deliver the most challenging deals, Deutsche Bank is IFR’s EMEA Leveraged Loan House of the Year.

The European leveraged loan market faced an uphill battle in the second half of 2011 and many banks stopped underwriting deals. Deutsche Bank took a committed and consistent approach to the market throughout the year, supporting new buyouts and helping clients to refinance and amend and extend existing loans.

This approach made Deutsche the biggest arranger of European leveraged loans, entrenching the bank’s position at the top of the league tables for a second consecutive year and fulfilling its strategy to be number one.

Dedication to the leveraged loan market with the help of a powerful high-yield bond franchise brought key roles on some of the year’s most notable buyouts including the buyout of Polish mobile operator Polkomtel – IFR’s EMEA Leveraged Loan of the Year.

“We have been keen to drive the leveraged loan market and build a US equivalent in Europe to provide an alternative source of liquidity for sub-investment grade companies,” said Nick Jansa, the firm’s head of European loans and high-yield bonds.

Strong start

Deutsche started the year off strongly and wasted no time by acting as bookrunner and facility agent on the €667.5m senior credit facilities backing the acquisition of Spanish food can maker Mivisa by Blackstone from CVC Capital Partners.

The deal was Blackstone’s first European LBO since the credit crunch and the firm made the lowest equity contribution to an all-senior post-crunch buyout financing of 33%, reduced from 37% at signing.

Benign market conditions at the beginning of the year created a perfect climate for Mivisa’s LBO. A lack of deals in the market met hungry CLO funds seeking to spend the cash they had received after record high-yield refinancings in 2010.

This led to a big oversubscription, which produced a double reverse flex – the first structural flex of the year and the largest reverse flex of a European LBO since 2007. It was also the only double reverse flex in a difficult year.

Underwriting Mivisa was still a risky undertaking for Deutsche, as the deepening sovereign debt crisis cast a cloud over Spanish risk as well as other peripheral European sovereigns.

“We were first out of the blocks testing the market with Mivisa. We were then at the forefront of the market for the next six months,” Jansa said.

Fashion world

Deutsche continued to underwrite large deals with an underwriting and joint global co-ordinator and bookrunner role on the €850m senior facilities backing Apax’s acquisition of Germany’s Takko, which was the largest all-senior European buyout since the crisis.

The underwriting presented several challenges, not least because the company is a value fashion retailer and consumer spend was coming under pressure. The company had also undergone a restructuring between 2004 and 2005. Deutsche and three other bookrunners closed the deal oversubscribed with about 20 new lenders.

Deutsche then acted as joint global co-ordinator on the €565m senior credit facilities backing CVC’s public-to-private acquisition of a majority stake in French rail equipment maker Delachaux.

The deal was launched in mid-June, before the markets started to wobble. The arrangers started to discuss margin flex, structural changes and introduce discounts but the deal was successfully allocated at par on July 21 with a margin of 425bp – the lowest pricing seen on any buyout in 2011.

By June the market was overheating and Greece started to implode, spreading contagion fears across Europe. Like other active arrangers, Deutsche was caught with a couple of deals in a market that was repricing, but took a pragmatic view out of necessity and worked hard to find a clearing price on the debt and get rid of the backlog.

“During 2011 Deutsche Bank has been helpful, client-focused and still tried to provide liquidity although it has been difficult in the current environment,” one investor said.

Deutsche got stung on the €465m loan backing KKR’s buyout of Versatel, which failed to fully syndicate despite its low leverage multiple. The lender said it was a tough syndication, but luckily one of the smallest deals they could have been left hung on.

Unlike many houses, Deutsche maintained a strong underwriting presence in the second half of 2011 and used flex and documentation changes to clear its positions, although it had managed to avoid heavier losses on many of the other difficult deals in the market.

The bank was a bookrunner on the €1.34bn loan backing the buyout of French electrical and mechanical engineering group Spie by a private equity consortium led by Clayton, Dubilier & Rice, AXA Private Equity and Caisse de depot et placement du Quebec.

Cocktail of measures

Pricing on the loan was flexed by 50bp while an original issue discount of 97 and most-favoured-nation status was added to place the deal, which allowed the deal to allocate in August.

Com Hem was another difficult deal as it was denominated in Swedish krona, highly leveraged and generally seen as aggressive. A cocktail of measures was applied to the deal including a large OID of 93, changes to the structure like the inclusion of a PIK facility and flexes on the pricing. However, the banks managed to clear their positions – albeit at a loss.

“Deutsche Bank was a slick player this year, very professional and very present in the market,” another investor said.

Other than a dedicated presence in the new issue market, Deutsche also saw the importance of supporting clients’ ongoing financing needs, and was at the forefront of a wave of refinancings and amend-and-extend exercises.

The bank was bookrunner on nine out of 17 refinancing transactions this year, including Merlin, KDG, Gala Coral, Virgin Media, Tata Steel and Wind as well as R Cable – one of the few dividend recapitalisations of 2011 which was very well received in the market.

In the absence of new issues, A&Es became an important part of the leveraged market in 2011 and provided essential intelligence on rapidly changing investor liquidity. Deutsche saw the importance of this and led the way as bookrunner on two high profile and complex A&Es: Danish services company ISS and German Broadcaster ProSiebenSat1 Media.

“Amend and extends are viewed as very, very important. We have been chasing companies such as ProSieben for three years to get into their A&Es,” Jansa said.

2012 could be a very different market, one with more emphasis on A&E’s rather than LBOs. Deutsche’s consistent performance in 2011 and dedication to being a top player in the market leaves it well positioned going into next year.

“We market to people through good and bad times and they trust us in volatile times when things are tricky. In a bull market it is more challenging as clients have about 20 banks to go to but in volatile and tricky markets the clients come to Deutsche Bank,” Jansa said.

He added: “We are positioned for the next wave [and] to underwrite the next set of LBOs on different terms. The list of banks is fewer now as other banks are running to the hills.”