Equity Derivatives House

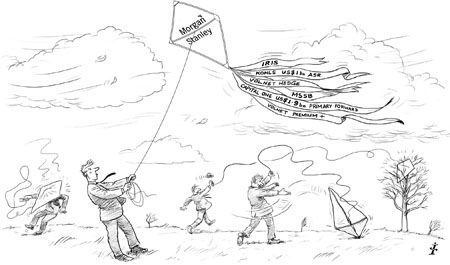

Defying the sceptics: Many firms beat a hasty retreat in 2011 amid market turmoil after pursuing golden opportunities in equity derivatives following the 2008 crisis. For continuing on its ambitious path to become a top-tier global player in spite of speculation surrounding its own financial strength, Morgan Stanley is IFR’s Equity Derivatives House of the Year.

While many banks ran for the hills after taking multi-billion dollar hits to their equity derivatives businesses in the wake of the 2008 crisis, others viewed the market meltdown as an opportunity. For many, the extreme market volatility proved to be the final nail in the coffin for ambitious growth plans, but for Morgan Stanley, which faced an immense uphill struggle given the bank’s own escalating CDS levels, the ambitious equity derivatives build-out that got under way in 2008 continued to thrive.

Through 2011, the US dealer opened more than 1,700 new OTC accounts with more than 600 clients, executed more than 20 hedges of more than US$1bn – including short and long-dated trades in excess of US$4bn – and made gains in a variety of investor polls and surveys across all regions, giving the franchise top-tier recognition in many areas, including US structured derivatives and European flow derivatives trading.

The developments were impressive by any standards, but during a year in which volatility ravaged markets and banks came under increasing scrutiny over their own exposure to eurozone risk and resulting counterparty strength, the achievements were all the more striking.

Counterparty risk back on the agenda

Just three and a half years after the US dealer embarked on its equity derivatives expansion plan with the appointment of Luc Francois to head the business, Morgan Stanley was gripped by speculation over the extent of its own exposure to French financial institutions. The rumours were enough to send the bank’s CDS level close to 2008 wides and threatened to undermine the growing business, as counterparty risk pushed its way back to the top of the client agenda once again.

After trading at about 160bp in June, protection on Morgan Stanley senior debt ballooned to 650bp at the peak of the turmoil in August. Rivals were quick to predict the end of the bank’s equity derivatives aspirations, but the growing list of investors remained loyal, undaunted by unsubstantiated rumours.

“Our structured notes business saw US$8bn of new issuance to the end of September and half of that was done in the third quarter,” said Francois. “Our customers continued to do business with us and were comfortable with our financial strength as a bank with US$180bn of liquidity and a balance sheet that is under control with a strong capital position.”

Building liquidity

In addition to solid relationships built over the years, the bank puts its success down to a commitment to providing full two-way markets regardless of market conditions. For the structured products business, placed at the centre of the bank’s build-out plans, the creation of a dedicated secondary market trading desk proved invaluable in bringing liquidity to the 4,000 products that are traded over the platform by 1,700 clients and 300 distributors.

“When our clients look at Morgan Stanley paper, it’s not just a question of value but also one of liquidity,” said Frank Copplestone, head of retail structured products. “You can’t underestimate the value of having an active secondary market – demand for our products actually increased through the second half.”

A focus on technology was key in building market share and 2011 saw the launch of new analytics tools on the IRIS platform that was first introduced in mid-2010.

“One of our big competitive advantages is as a leading provider of client tools. Clients like to see their portfolios in dynamic environment and be in control. They want access to liquidity and the ability to trade without too much latency,” said Copplestone.

“We’ve been rolling out our web-based platform to clients, allowing them to pull up information on positions instantaneously and trade online within seconds. The only latency is when the client actually wants to trade. We’re now supporting more than 3,000 client positions online,” he added.

While rivals work on similar web-based analytics offerings, IRIS goes a step further in allowing clients to design, price and trade their own tailored structured products based on their individual pay-off requirements and risk appetite. Although still in its early stages, one Swiss client has already automated more than 10,000 pricings since going live in July.

Since launch, IRIS has attracted almost 700 unique users and generated more than 50,000 hits. The bank has an aggressive plan for attracting more clients through 2012. “When we look at the Morgan Stanley Smith Barney venture, there are 20,000 brokers and advisers and we can easily see the application sitting with most of them,” said Copplestone.

Market share in flow derivatives grew through the year with a 24% increase in single name options revenue while index options revenue was up 65% on 2010 levels.

“We’ve got a very good handle on activity and volumes. We’ve spent money getting ready for a world that is seeing a massive decrease in volume and as a consequence we’re seeing a 40%– 60% increase. We execute around a third of all the trades we see in the index space and have a hit ratio of almost 25% in single stocks,” said Matt Renirie, head of equity derivative sales.

“When things are quiet, we don’t tighten up to win business as this is a five to 10-year plan for us. We feel we have an edge in the way our index desk is set up. We map out the client base so well that we know what they need to do on a daily basis. It all comes down to the strength of our relationships.”

In a year dominated by volatility, VIX-based hedging solutions gained further traction as new products launched on almost a weekly basis. Morgan Stanley’s answer to the complex problem of capturing volatility spikes while avoiding the negative carry associated with rolling front-end futures came in the form of two index strategies – VolNet Hedge and VolNet Premium+ to offer both net long and short strategies.

The index provides investors with volatility exposure that adjusts dynamically according to the prevailing market conditions, combined with stringent risk management methods to help smooth returns. While most volatility indices plummeted immediately after hitting August highs, VolNet Premium continued to trade just a few points short of its August highs well into November.

“Our strategies aren’t produced in isolation – there’s a lot of client feedback incorporated into these indices and our clients appreciate that,” said Sophie Barnett, VP structured products at the bank.

Going large

In US corporate equity derivatives, the bank dominated large public trades, leading a US$1bn collared accelerated share repurchase for Kohls, a US$1.75bn dual-tranche ASR for Express Scripts and a US$1.94bn primary forward sale for Capital One. Five additional trades of more than US$500m were completed in Europe and Asia.

Other large transactions completed through the year include US$4bn-plus hedging optimisation trades for European pension funds using equity and interest rate hybrids, and similar size ALM hedges for European and US insurance companies using both exotic and vanilla derivatives. With quantitative easing driving equity rate hybrids, the bank completed a variety of exotic trades with asset managers to express macro views on the joint behaviour of equity, rates, FX and commodities with single trades exceeding US$1bn.

“We don’t see another firm with stronger momentum than we have,” said Francois. “We’ve demonstrated that we have a clear strategy going forwards and that is client focus. We have very tight risk management and strong communications between regions and products. We’re always very active in trying to mitigate risk and are able to warehouse massive size but we always try to cover our positions as quickly as possible. Our ability to reach out to new clients has improved our risk management.”