Derivatives House

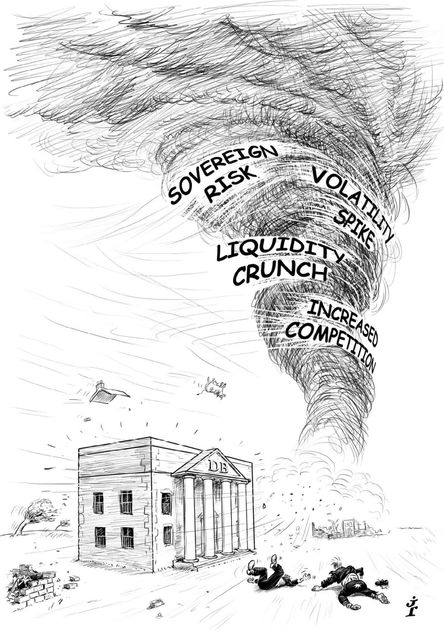

Navigating the storm: The market normalisation that most had predicted for 2010 failed to pan out and another round of extreme volatility put many houses’ derivatives ambitions on hold. But a resilient and flexible business model allowed one bank to adjust to the new environment with relative ease. For avoiding many of the pitfalls and continuing to build its successful franchise while others struggled to tread water, Deutsche Bank is IFR’s Derivatives House and Commodity Derivatives House of the Year.

Bankers began 2010 with high hopes of a return to the norm. With volatility in decline for the first few weeks of the year and business steadily picking up, many were lulled into a false sense of security. While none were able to predict the full extent of what was to come, Deutsche Bank was one of the few that forecast the key role sovereign risk could play in shaping the year’s events.

As an active primary dealer across eurozone government bond markets and a top-ranked dealer in European sovereign credit default swaps, the German lender warned as early as August 2009 that Greece would probably face payment difficulties.

“We understood the issue better than any other bank and became more involved than any other financial institution at the most senior levels, giving us the confidence to continue to serve clients in the market while others withdrew,” said Anshu Jain, chief executive of Deutsche’s corporate and investment bank.

Making the right call was crucial in 2010 and that was evident in the bank’s quarterly results. Debt sales and trading revenues topped €8bn over the first three quarters, despite reduced primary issuance and a fall in margins as competitors crept back into the fray. Equity sales and trading revenues proved volatile, hampered by a lull in primary issuance and a lack of client activity across the board, but the bank avoided the derivatives-based losses suffered by some of its competitors.

Indeed, against a backdrop of reduced activity, squeezed margins and high-profile errors by a number of houses, Deutsche emerged from a turbulent year with its balance sheet intact and its derivatives business stronger and more internationally diversified than ever.

The groundwork laid back in 2009, which was done as a result of lessons learnt during the difficult period post the Lehman Brothers bankruptcy, proved vital. Having already restructured its balance sheet and moved more than 500 structuring professionals into a new multi-asset class Global Markets Structuring Group, the bank further integrated its Markets and Banking businesses into a single Corporate and Investment Bank mid-way through 2010.

The integration continues, with client-facing engines being brought together to offer improved derivatives solutions across the platform, which has already reaped benefits in the form of foreign exchange hedges on M&A transactions, and hedging via third parties.

“All of the things that we did in 2009 served us well this year and 2010 was the closest we’ve come in recent years to realising our exact vision. It’s difficult to achieve excellence while changing your vision, but we correctly predicted the problems associated with Europe and the euro,” said Jain.

While adopting a client-based, solutions-driven model, the bank maintained its substantial focus on flow, enabling the lender to provide two-way prices in markets where many of its competitors struggled to find liquidity, particularly at times when volatility peaked.

“Deutsche Bank was called a ‘flow monster’ from 2003 onwards – our focus on flow hasn’t been invented as a policy response to the crisis,” added Jain. “Our success in capturing high market share is all down to good execution. There’s not too much difference between the big players in terms of strategy, but there’s a huge difference in execution.”

The geographical breadth of Deutsche’s business was also central to its success. The bank made particularly large gains in US fixed-income markets. In addition, a long-term focus on emerging markets reaped rewards – EM derivatives trading volumes soared during the year as clients increasingly sought solutions in the high-growth economies of Asia and Latin America.

A regulatory overhaul of the over-the-counter derivatives market continued to drive many of the year’s themes. A shift towards central clearing stepped up a gear and Deutsche was well-placed with the launch of its multi-asset clearing platform dbClear, eventually clearing the first interest rate swaps and CDS through the platform in the first quarter.

In anticipation of a shift away from OTC markets and towards exchange trading, the bank also created a new listed derivatives unit, doubling the size of its team and investing in infrastructure to speed up operations and achieve real time processing on a wide range of contracts.

Commodity growth continues

As sovereign concerns escalated through the second quarter, volatility spiked across all asset classes, and commodities were no exception. For those banks that invested heavily in their commodity businesses over the past couple of years, 2010 was a true test with revenues down across the board. But for Deutsche Bank it was a very different story.

“We had a very different year from most of our competitors,” said David Silbert, the bank’s global head of commodities. “Our business has been growing for the last four years and that continued in 2010 with ongoing investment to build out a balanced business with a focus on clients.”

That client-driven model helped to drive growth in a year where others were cutting back, with the business unit achieving revenue growth of 30% a year ever since it set a goal to become a top-tier player in the market back in 2007.

“Our revenues aren’t down on 2009 levels, and in the context of the competition that’s truly remarkable,” said Silbert. “This business has made money every year and stood the test of numerous challenges. A lot of houses chasing the likes of Goldman Sachs and Morgan Stanley have fallen away this year, but we have a very lean cost base and are managing to close the gap every year.”

That has been possible in part due to the bank’s risk management capabilities, which are managed by the complex risk group, responsible for multi-asset positions and correlation exposures. “When you build a business from scratch, like we’ve done, you need to have control over it,” said Silbert. “A strong risk management platform means that when we see risk that we like, we can go for it.”

By focusing on client solutions and diversifying into new revenue streams, Deutsche’s commodities business continued to flourish while many of the more energy-focused businesses struggled to gain momentum. As well as embracing new markets for steel, iron ore and minor metal derivatives, which flourished in 2010, Deutsche led the development of new classes such as sugar derivatives.

In its iron ore business, the bank developed a variety of innovative solutions including a sale and repurchase structure for a trading company that was struggling to raise secured financing for expansion because of the time lag between purchases and sales. The solution sees the bank hold title to the iron ore while goods are in transit, providing additional credit to the client and improvement to the operational efficiency.

“Other banks spent much of the year cost-cutting and re-engineering their businesses, but we’ve remained innovative in this market,” said Louise Kitchen, global head of commodity sales and structuring. “The ability to adapt to the market environment is what builds assets under management, which is what drives growth.”

“Because we are a very cohesive group, we can adapt our product offering very quickly,” she added. “We’ve been the first out of the door with many solutions throughout the year and once we get in the door, no-one can give the sort of bespoke solutions that we are able to offer.”

The bank’s recent build-out in the physical commodity trading businesses in metals, gas and power resulted in the expansion of its capabilities on the financing side through 2010. In the first quarter, the bank led a US$200m financing for an oil refiner by buying and leasing back oil that the client was under obligation to store, successfully executing the deal despite an asset representing hundreds of millions of barrels of oil stored many miles from the nearest point of sale.

While demand for hedging solutions was high amid an uptick in volatility, plain vanilla options and forwards became an expensive way to protect against asset price shifts. As such, Deutsche Bank developed an array of hybrid hedges, including a deal for an oil producer that needed protection against a rise in natural gas costs that it used as feedstock. To avoid the client paying an upfront premium, the bank designed a solution based on a dislocation in the relationship between natural gas and oil prices, ultimately providing a natural gas option where the payments are linked to index option prices.

And in Asia, the bank helped an oil refiner finance its platinum use by taking ownership of the asset and providing it on a rolling, short-term lease basis to reduce the cost of financing and provide the client with clarity on price.

“We’re here to build something that will last for 20 years, we’re not just here to chase the flow,” said Silbert. “Our product range is fully built out and we’re able to use that capability to replicate and develop solutions for a variety of clients.”

Credit where it’s due

Deutsche Bank’s early call on the potential credit contagion stemming from Greece’s repayment concerns stood the bank in good stead to prepare for a bumpy ride.

“The European sovereign crisis has been the centrepiece of the credit markets this year and when it comes to Europe, there is no house out there with the insight that we have,” said Colin Fan, head of global credit trading.

“We were one of the first banks to make a call that Greece would stand and a bail-out package would succeed. If you fundamentally believe that there will be a default, then you shouldn’t buy at all as you can’t predict the timing. We were able to go long and short and you can only do that if you have a view – our risk limits were slightly higher than usual given the strength of that view,” he added.

An early call put the bank in a leading position to serve clients as they navigated the unprecedented volatility that saw five-year credit default swaps on the Greek sovereign soar above 1,000 basis points, while other sovereign names hit levels that none had envisaged. The result was record revenues, increased market share with gains across all regions, and a flood of new clients seeking advice.

During the first quarter, Deutsche Bank was trading more than €2bn of euro sovereign CDS each day, allowing the bank to compete for big corporate deals including high-yield basis trades for as much as US$2bn.

Despite the focus on flow, Deutsche Bank also maintained an active structured credit desk. The business was heavily involved in bespoke problem solving such as restructuring complex positions such as distressed mezzanine in synthetic CDS – the bank completed more than €3bn of mezzanine and €30bn of super-senior risk trades in the first half alone. In July, the bank completed one of the largest unwinds for the past two years, for a US$20bn super-senior tranche.

With volatility high and interest rates low, Deutsche opened opportunities for retail clients through the development of “short” exchange traded funds such as on Gilts, Treasuries and Bunds for investors looking to express a bearish view on credit. The bank set up a new credit-linked note platform with more than €1.5bn of notes issued to date, representing more than 50 transactions.

Low rates, high visibility

Interest rate derivatives saw a flood of competitors return, offering aggressive pricing that forced margins lower. As one of the biggest and most global players in this market, Deutsche Bank continued to provide liquidity throughout periods of heightened volatility. A 50-50 split between vanilla and non-vanilla business helped the bank to maintain a competitive edge.

“We’ve got better diversification in the business than we’ve ever had and we continue to look for opportunities to win market share,” said Michele Faissola, head of rates and commodities.

One of the bank’s more visible achievements was a £3bn longevity hedge for BMW’s UK pension scheme, representing the largest such trade to date and underscoring the bank’s leading position in this nascent market that is predicted to burgeon in the coming years.

During 2010, Deutsche was able to increase its global footprint, making especially big gains in North America. Through the assistance of its revamped electronic platform, the bank was also able to protect its leading position in the flow space.

In the exotics business, Deutsche continued to offer innovative solutions, particularly in asset and liability management, which dominated many client concerns through the year. In the summer months, as rates began to rally and equity prices fell, many clients saw their asset values decrease while their liabilities surged. Deutsche devised a solution that was a leveraged play on the purchase of short-dated options on long-dated receiver swaps, allowing clients to hedge in large size – as much as €4bn or more in some cases.

Equity completes the jigsaw

In 2009, Deutsche Bank’s equity derivatives business was focused on its own restructuring, allowing many competitors to jump ahead. But in 2010, the bank made significant inroads in both flow and structured products to create a competitive and diversified platform.

“We maintained a diverse business model while our competitors were scaling back on the more balance sheet intensive side of the business such as over-the-counter, exotics and corporate solutions,” said Roger Naylor, global head of equity derivatives.

The bank is keen to ensure that no more than 25% of revenues are generated from a single area of the business, and the team has recently seen retail business make a significant return, validating the decision to remain active throughout the turmoil.

“In 2010 we saw the fist validations of the decisions we made in 2009 – not just in terms of risk, but core strategic decisions like expansion of the warrants business in South Korea and Turkey,” said Naylor. “This is the year that we’re starting to see a return on our investment.”

On the exotics side of the business, the bank enjoyed a number of successes, attracting more than US$500m to its Emerald suite of products that allow non-specialist investors to benefit in the event that weekly volatility is lower than daily volatility – a scenario that is typical due to mean reversion and frequently played by specialist investors through variance swaps.

In the corporate market, the bank led a number of high-profile trades including a groundbreaking Dutch auction of bank-related warrants that raised US$2.7bn for the US Treasury. It also acted as sole bookrunner on the largest ever corporate warrant sale in which Veba Trust, the healthcare and retirement fund of Ford Motors, raised US$1.78bn through the sale of warrants referencing its parent.

Helen Bartholomew