Equity House

Judgement and execution: Equity market conditions were hostile throughout 2011, so judgement and execution were critical to serve clients effectively. Morgan Stanley showed both, held a leading position in every region and led the year’s benchmark deals. It is IFR’s North America Equity House of the Year and Equity House of the Year.

Between natural disasters, sovereign debt concerns and democratic uprisings, news-driven volatility shutdown the global equity capital markets for extended periods in 2011, creating a risk-on/risk-off sentiment that defined equity markets around the world.

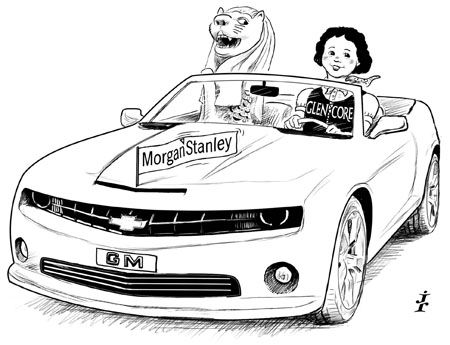

And yet in every region Morgan Stanley led benchmark trades that illustrated the strength of its franchise. The IPO of General Motors showed the bank’s standing with the government; the US$10bn IPO of Glencore seemed impossibly large yet was structured to create scarcity; a series of sole bookrunner mandates from Singapore sovereign fund Temasek showed huge confidence in the bank’s execution capabilities; and a focus on the future meant the bank dominated the new wave of internet stocks coming to market.

A leading position made Morgan Stanley an award contender in every region and ultimately IFR’s Americas Equity House for the second consecutive year and IFR’s Equity House.

“In a year where it was constantly changing between risk-on and risk-off it was not just about who had the most mandates. It was about who got deals done”

“In a year where it was constantly changing between risk-on and risk-off it was not just about who had the most mandates,” said Emmanuel Gueroult, co-head of EMEA ECM. “It was about who got deals done.”

Through it all, Morgan Stanley proved up to the challenge of meeting the ever-changing demands of investors. Whether it was funnelling high-yielding equity through its Morgan Stanley Smith Barney brokerage operation, or dominance in underwriting emerging technologies, Morgan Stanley proved a unique capacity to execute all types of transactions in a variety of market conditions.

“We run an equity solutions business,” said Paul Donahue, the bank’s co-head of ECM in the Americas. “Our top managers started out as investment bankers. The shared background creates continuity across multiple product platforms.”

Motoring ahead

Morgan Stanley began the IFR award year of November 16 2010–November 15 2011 with two landmark transactions for the US Treasury Department that continued its longstanding role as adviser to the US government. General Motors’ two-tranche US$23.1bn sale of equity, the largest ever US IPO, and mandatory convertible preferred were vital to the recovery of the bailed out automobile manufacturer. Similarly, the US$10.5bn overnight secondary sale of Citigroup stock, which placed the stub of the government’s stake, was a significant step on the US lender’s march back to respectability.

Given such a dramatic head start, it is not surprising that Morgan Stanley has, once again, found itself atop the Americas equity league tables. During the consideration period, the bank participated in 134 transactions that raised US$29.7bn, 66% higher than in 2010, when it was credited with US$17.9bn of business and was IFR’s Americas Equity House of the Year.

The bank expanded its market share in the US from 9.1% to 15%, despite a significant increase in overall volume to US$194.9bn, from US$137.8bn.

“We are proud of our performance in the Americas, because it was the deepest, most active and consistently open of all of the global markets in 2011,” said Raj Dhanda, Morgan Stanley’s global head of capital markets.

Internet 2.0

Morgan Stanley’s position as Wall Street’s pre-eminent underwriter of growth capital has never been more evident than it was in 2011. The bank’s close investment banking ties with Silicon Valley’s venture capital community, a historical hallmark of the franchise, came to the forefront amid the growing influence of social media on the capital markets.

As lead-left and stabilisation agent for LinkedIn on its US$405.7m IPO in May, Morgan Stanley priced the first true social media IPO and set the mould for a succession of similar companies to follow. Since then, the bank has been at the centre of the sector’s hottest IPOs, including the debuts of Pandora Media, HomeAway and Groupon.

None proved as controversial as Groupon. Pitched at valuations exceeding US$20bn, the daily-deal provider accepted a US$12.7bn market capitalisation on the pricing of its US$805m IPO. The company drew an unprecedented level of public scrutiny, with investors ridiculing everything from the business model and accounting practices to its leadership.

Nevertheless, Morgan Stanley led a syndicate of 14 banks in underwriting 35m shares at US$20, well above a US$16–$18 indicative range. An intentionally tight allocation strategy that used a select group of institutions to anchor the book was evident in the aftermarket, where Groupon shares initially popped 50% in early days of trading.

The bank will look to continue the tradition as lead-left books on the US$1bn float for social-gaming pioneer Zynga – an offering scheduled to price on December 15. Facebook, which is rumoured to be contemplating listing in early 2012, represents a larger potential prize. And while the social networking magnate has yet to officially mandate, Morgan Stanley is poised to play a prominent role.

Complex solutions

The bank’s leadership in FIG underwriting was also on display, through key mandates for regional US banks KeyCorp and SunTrust as part of their exits from TARP in March. Both the US$625m and US$1.04bn equity placements launched and priced prior to the market open on March 18, reflecting reverse enquiry on the expectation of TARP repayment and the ability to distribute substantial trades on an accelerated basis concurrently.

Morgan Stanley’s FIG presence was not limited to bailout-era monetisation. Working with Barclays Capital, the firm assisted in a US$2bn, all-primary raise for Capital One Financial that was structured as a forward sale of equity. The advice to lock-in the cash component of the acquisition of ING Direct USA proved prescient as a subsequent sell-off in the bank’s share price meant dilution would have been far higher as a result of waiting. The July trade priced at US$50 per share, but less than four weeks later the stock had sunk to US$37.63, where 30% more shares would have been needed to reach required proceeds.

FIG clients can be the most demanding for investment banks, but that seems to be something that Morgan Stanley relishes. “We take particular pride in our relationships with financial institutions and sponsors. They are our colleagues; they know our business, our distribution channels, and they expect the most from us,” said John Moore, co-head of Americas ECM.

The bank was also a lead on some of the largest capital increases for financials in Europe with the rights issues for BBVA (€5bn) and Intesa Sanpaolo (€5bn) and the €609m IPO of Spanish savings bank Banca Civica. The latter deal was smaller than the IPO of Bankia and was launched against the larger peer to some criticism, but subsequent market performance showed if the leads had waited to price in the wake of Bankia then the deal would not have got done.

Illustrative of the bank’s execution and advice is the relationship forged with the Swedish government around its stake in Nordea. In February Morgan Stanley worked with Nomura as joint bookrunners on a SKr19bn (US$2.9bn) secondary sell-down by the government in the Nordic bank. In a rare move the trade was not underwritten. Nomura had been advising the government about the sale, but Morgan Stanley now has the closer relationship.

The government had seen what Morgan Stanley had done around Citigroup and was interested in the concept of dribble out sales. A pitch from the relevant US banker and Morgan Stanley was appointed to advise on the disposal of the government’s remaining 13.5% stake. The sale is on hold due to the poor performance of the share price, but the bank will bring a new sales technique to Europe in 2012.

Defining deal

The US$10bn IPO of Glencore in May was the defining trade of 2011. The sheer volume was the first challenge with bankers repeatedly cursing the shrinking ticket sizes of major investors – frequently US$100m orders were cut to nearer US$20m on European IPOs due to volatility and fund outflows.

To cope with the size and take advantage of relationships forged through a pre-IPO convertible bond, a Hong Kong listing was added, which made including a US$3.1bn cornerstone tranche simpler. The cornerstones were used to build momentum and even create scarcity when their excess demand flipped into the book. The US$10bn deal was covered after one day of bookbuilding.

Market conditions were not conducive to the sale with silver prices falling 20% during the bookbuild, yet there were no orders pulled as a result. The book was also boosted by the decision to allow Glencore immediate entry to the FTSE 100, showing both the scale of the company and the competition for benchmark listings around the world.

Over 900 accounts participated in the trade and one Swiss private wealth manager put in the top order – US$2bn – helping the firm achieve its day one market capitalisation of US$59.2bn.

“Success was all about creating a fan club for the company,” said Gueroult. “That was the only way to breach the negative and de-risk such a large IPO.”

In any environment the trade would have been a significant moment. But in 2011 it could have closed the market if it had gone wrong.

The trade relied on a massive syndicate, but bankers involved point to Morgan Stanley as the leader.

The negative aftermarket drew attention due to the large numbers involved, but Glencore has outperformed its peer group and the price at the IPO was moderate.

“Other trades have not been as covered and closed flat on day one,” said Martin Thorneycroft, head of EMEA syndicate. “We could have priced higher as there was a lot of unsatisfied demand. People were shouting about their allocations.”

While Glencore dominated the headlines it was just one IPO in a remarkably busy area for the bank in Europe. The bank had its fair share of cancellations, but still managed to price four other floats and two effective re-IPOs to be the top IPO house in EMEA.

A measure of good judgement was the bank’s decision, along with other joint bookrunners, to cancel the IPO of ISS. The Danish cleaning firm had completed its bookbuild just as Japan suffered the devastating earthquake and tsunami. The deal could have priced but concerns about the aftermarket led the banks to pull the deal instead. In hindsight, the deal could have priced as equity markets recovered their losses very quickly, but the postponement showed that while Morgan Stanley would do everything it could to sell a company to investors, it did not try to force the market to buy.

Petting the Merlion

In Asia-Pacific, meanwhile, Morgan Stanley spent 2011 competing hard with Goldman Sachs for supremacy in the equity markets. While it ended second in the league tables, it had completed more deals, with only UBS pricing more issues.

Hidden among the US$9bn of league table credit earned from accelerated bookbuilds in the region were four trades for Temasek, all of which were path-setting.

In January, the bank was the sole bookrunner as Temasek Holdings sold its entire 4% stake in Australian iron-ore miner Fortescue Metals Group to raise A$877m (US$864m).

The book was covered within an hour of launch. Several international mining sector-focused funds, hedge funds and Australian asset managers were in the final book of more than 100 accounts.

Temasek was clearly impressed by Morgan Stanley’s execution capabilities because it gave the bank a sole books mandate on three further accelerated disposals during the year.

In August, in far from ideal market conditions, the bank completed a Bt9.1bn (US$291m) block as sole bookrunner in Thailand’s Shin Corp capitalising on increased investor confidence resulting from a change in political leadership in the country.

The bank also led the largest block in Thailand in Indorama Ventures, which was notable as proceeds of Bt12bn followed an upsize of the deal by 80% and final sizing that was nearly three times the size of the IPO only a year earlier.

Temasek’s sell-downs in China Construction Bank and Bank of China showed Morgan Stanley’s superior capabilities in block execution and leadership in the FIG sector. The deals were run concurrently in July and yet the seller trusted the bank to execute both without any assistance and raise HK$28.2bn (US$3.62bn). The trades came on the back of a short run of positive trading sessions and made the most of existing shorts on CCB as investors positioned for a sale of Bank of America’s stake.

The bank raised over US$9bn for issuers through 23 block offerings and executed the highest number of sole bookrunner blocks under the review period, totalling above US$7bn.

Passports packed

The cross-region floats for Chinese social networking site Renren and US/European luggage maker Samsonite show the bank’s success in IPOs for listing tourists. The challenges of 2011 crystallised the need to match up issuers and the investors most keen to buy – a lesson Morgan Stanley saw close up when investors bought the IPO of Perform when it listed in London, but quickly fell out of love with the online video firm.

US investors are willing to back technology firms at an early stage, while Asian investors proved keen to buy high-end fashion names. Morgan Stanley was involved in both trends which will be crucial with challenging markets set to continue into 2012.

To see the full digital edition of the IFR Review of the Year, please click <a href="http://edition.pagesuite-professional.co.uk/Launch.aspx?EID=94eeb650-a02a-483d-9646-a7f2c0593171" onclick="window.open(this.href);return false;" onkeypress="window.open(this.href);return false;">here</a>.