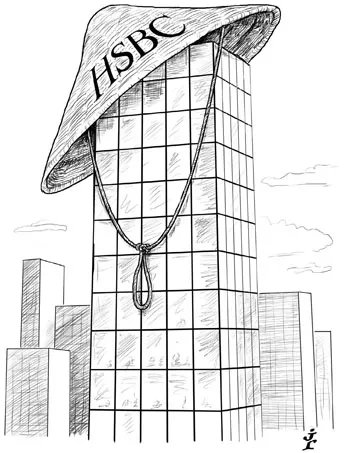

Financial Bond House

Fingers in all pies: Throughout this difficult year, the ability to offer clients the full range of products has been crucial. For its holistic approach, supporting top-tier and infrequent borrowers in the funding market, providing indispensable advisory services in the capital sector and maintaining its standing as a bank of choice for liability management, HSBC is IFR’s Financial Bond House of the Year.

In a year characterised by uncertainty born of either the sovereign instability that has bedevilled all markets or the shifting sands of regulatory preference, issuers have favoured banks able to provide unpartisan advice and execution across currencies and formats.

Whether bringing tried and tested regular issuers to the senior market, innovating in the capital space, exploring the ultra long-end in sterling or steering difficult credits to a place in investors’ portfolios, HSBC has been at the forefront of much of 2010’s most notable activity.

The funding market has seen some of the bank’s greatest successes during a period when the term “flow” scarcely did justice to the effort involved in bringing successful deals.

Key to HSBC’s success this year was its coverage of individual jurisdictions. “Being able to call up a dedicated Nordic guy, for example, makes a big difference,” said Adam Bothamley, a director in the debt syndicate. His team’s distribution capabilities are reflected in the currency mix on offer to clients: in addition to the major markets they are firmly embedded in niche areas, having brought deals in less familiar currencies including Singapore dollars and Thai baht.

The market got off to a good start in the first quarter of 2010, with volumes flat to 2009 amid the general trend away from government-guaranteed issuance back to the more traditional funding sources of covered bonds and senior. But in April the sovereign crisis really began to bite in financials, closing the market for almost two months.

“We were talking to issuers while the market was closed,” said Bothamley. Identifying a lot of secondary flow during the period of closure in three-year floaters, he suggested a transaction in that format to Nordea. The issuer proceeded to price the first new senior deal for almost two months, paving the way for a number of other well-rated issuers to bring their own defensive instruments and set the primary market back on track.

“Nordea are proud of their ability to be the first out and our advice that a transaction was possible was right – they didn’t have to pay a big premium over what it would have cost in Q1,” said Bothamley.

Other stand-out trades for HSBC in senior format include the Santander four-year that followed European bank stress tests. With €1.5bn printed and 91% offshore distribution, the deal was an important endorsement of the better Spanish credits.

But while covering the big issuers is a clear strength, HSBC has established its credentials among lesser known players. Leaseplan selected the bank to co-run its five-year deal in September, the issuer’s longest outstanding senior deal. Continuing the theme in November, HSBC was on the two-year floater for Iccrea Bank, the central institution for Italian cooperatives.

“They’re a pretty much unknown commodity outside of Italy,” said Christoph Hittmair, head of EMEA FIG. “That’s where the work between sales, syndicate and coverage people in terms of getting the story out is so important. On that deal, our strong team in Milan really added value. Those trades are often far more difficult to do than the big liquid benchmarks.”

A capital idea

Capital was one of the year’s biggest themes, even though continuing regulatory uncertainty kept issuance to a minimum. For this reason, the ability to provide advice to issuers on a non-deal basis was essential for any bank hoping to be a contender in this area. “You can’t be relevant to clients without talking to the regulators,” said Hugo Moore, a director covering frequent borrowers.

That view was echoed by Roger Thomson, head of DCM for Europe: “Before you even think of a deal, banks want to know about things like amortising capital and the effect on their overall capital position. Our clients go to their regulators on an infrequent basis but we speak to them all the time and regulatory coverage is a strategy we’ve had for years.”

But it is not just a question of providing academic advice: the financial solutions group headed by John Peachey works closely with the syndicate to keep on top of developments in the capital arena. HSBC has been on some of the year’s most important transactions, from the first contingent capital instrument – the Lloyds ECN – at the beginning of the awards year, to the latest crop of Lower Tier 2 transactions.

In September, HSBC was on the first hybrid Tier 1 after a landmark announcement from the Basel Committee on calibration and grandfathering. The non-step deal for Intesa Sanpaolo was compliant with CRD2 and also looked towards Basel III, complying with what was known at the time about the requirements of that regime.

Sterling is one of HSBC’s traditional strengths and it continued to impress in 2010. While it was a relatively quiet year for financial issuance in the currency, issuers achieved some noteworthy transactions that would have stood out even in much busier years. Rabobank’s 50-year £300m transaction in July was perhaps the highlight for HSBC, which was sole lead.

“The worst thing you can do is screw up a muscle-flexing exercise like this but they trusted us to deliver it,” said Bothamley. “The ultra long-end is driven by a small number of players with very specific requirements. On the back of the idea we began a discussion about 50-year paper in general and thanks to the quality of our dialogue with key accounts we were able to bring it together quite quickly. Statement trades like this need an extra level of discussion to ensure they work.”

Lloyds’ 30-year transaction in September, at £1bn, was one of the largest bank offerings with this maturity ever. Nordea placed a long five-year of £500m capitalising on its rarity value. And Abbey, another rarity in the market, issued a seven-year of £400m in September. The bank initially targeted a minimum of £300m but amassed a book of almost £600m, an admirable achievement.

Not a liability

Liability management was another important area this year. It evolved from a means of mitigating adverse situations to an option issuers might choose of their own accord to proactively manage their refinancing needs. Aside from the various covered bond LM exercises, HSBC also acted on trades involving senior and capital for issuers including EFG Eurobank, Sabadell and RBS.

“Most banks can ring large accounts and find out what they’re holding – that’s the low-hanging fruit,” said Bothamley. “The difficulty is in locating the smaller tickets, the regionally distributed deals. That’s where our local expertise comes into its own, from the Trinkhaus franchise in Germany, which has got great reach into the mid-tier banks and second and third-tier insurers and fund managers there, to our presence in Asia. Accounts there might not be massive buyers of capital or senior now, but they were in the past.”

HSBC’s ability to access all markets is a crucial strength. It has had a successful year in dollars, from its own mammoth US$3.8bn Tier 1 in June, to the Australian component of the Yankee market: the bank was on deals this year for CBA, Macquarie, NAB and Westpac.

“We deliver both onshore distribution and international demand, from Asia in particular, on dollar deals,” said Moore. “On the CBA triple-tranche of threes, fives and 10s we took them on an Asian roadshow and used that bid to drive the deal in the US, obtaining price tension, global distribution and size.”

A common refrain among banks this year has been that they are product agnostic. HSBC makes the claim with justification. “We do a dollar trade because it works best, not because we have to execute in dollars,” said Thomson. “Bringing together a global platform for use by issuers is a significant tool as we can deal in many currencies that other banks have no access to.”

This year of all years, the team at HSBC is keen to emphasise that while its priority has been the bank’s individual clients, it has always been conscious of the wider market.

“With a new structure on the capital side, if you get it wrong you’ve closed the market,” said Moore. “With Poland in euros, we reopened that segment with a high-profile trade for the right name, PKO Polski, just as a Scandinavian name was the right one to reopen the euro market when it was closed by the sovereign crisis. Each successful deal was positive for future borrowers.”

Matthew Attwood