Derivatives House

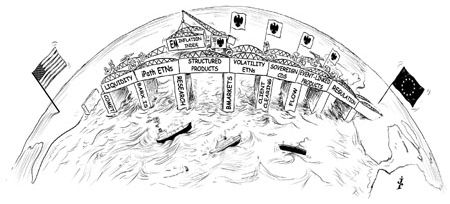

Thought leaders: In a year dominated by eurozone volatility and regulatory overhaul, banks with nimble business models proved most adept at navigating the new world. For its achievement in building a top-tier franchise in just three years and excelling through the toughest conditions, Barclays Capital is IFR’s Interest Rate Derivatives House of the Year and Derivatives House of the Year.

Barclays’ purchase of Lehman Brothers’ investment banking and trading operations in the US following the dealer’s 2008 demise proved to be a transformational event for the UK bank.

Whether the acquisition came down to good luck or good judgement, one undisputed success lies in the seamless integration of the two investment banking businesses to build a full-service derivatives franchise that competes at the highest level across every product class and geography. That breadth proved vital in navigating smoothly through subsequent chapters of the financial crisis and put the bank at the forefront of the debate on regulatory reform.

“There are some big things going on around us concerning regulation and the macro environment,” said Eric Bommensath, Barclays Capital’s head of FICC and head of EMEA trading. “The product is simpler but the world is more complex so you differentiate yourself by having a grasp on the complexity of the world from a regulatory, legal and market standpoint.”

“The ability we think we have lies in the way that we’ve been able to transform our business through the simplification of products and a shift to lower capital products, while also keeping relevant with the right market share and improving contact with clients, while at the same time navigating the dangerous waters that are this current crisis,” he added.

As capital became an increasingly scarce commodity, the bank’s Double A rating proved pivotal in the continued development of the derivatives business given its ability to commit balance sheet to clients when required.

“Risk appetite has shifted and liquidity has shifted away from duration products, but it’s no issue to us to take a big block of European government bonds or take underwriting risk on corporate deals as we know we have the sales force that can shift the paper and understand the market,” said Omar Selim, the bank’s head of distribution for Europe and EEMEA.

With those balance sheet capabilities providing a competitive edge, BarCap avoided the dangerous tactic of competing for business purely on price.

“We don’t buy market share. We’re not always the cheapest dealer out there but we’re permanent, reliable and quality-driven in our pricing. We have been acknowledged and rewarded for being there for clients even at the most difficult times,” said Selim.

BarCap’s derivatives ambitions got off to a quick start following the Lehman acquisition, but 2011 marked an important shift towards a more co-ordinated business model that allowed the bank to show greater leadership in both the US and Europe while it continued to gain market share in Asia. It also filled important gaps in areas as diverse as flow equity derivatives, European power and gas and precious metals.

“Our organisational set-up is quite different from US firms, which tend to put the regional focus ahead of the product focus, but the way we differentiate ourselves is to oversee all asset classes and offer a truly holistic approach,” said Selim.

As part of that approach, the bank hired a specialist accounting team from KPMG, offering a regulatory accounting and quantitative advisory service to manage risk on a cross-asset basis. It also put content at the heart of the business model, offering broad research on macro and regulatory matters as well as tailored product and cross-asset research for individual clients.

“We have tried to focus on what is important to our clients: simplicity, liquidity and transparency,” said Kevin Burke, head of investor solutions and Barclays Capital fund solutions distribution. “This year has been a breakout year in reaching out to clients on the back of our superior content and has also been made possible by the strength of our e-commerce platform.”

“Our biggest achievement in 2011 was that we got through the year seeing no friction with our clients,” said Selim. “We don’t mislead clients or put them into trades we don’t like. We are a steady and good quality service provider – consistent pricing is what makes us good at what we do.”

Rates leader

As a long-standing leader in the rates business, BarCap proved its mettle through the turmoil of 2011, building market share, providing continuous liquidity and generating innovative solutions for clients facing new challenges.

“Connectivity and leverage is the name of the game with clients. We couldn’t do this without our flow monster delivery or our connectivity across the client base,” said Aurelia Lamorre-Cargill, head of global rates structuring. “We now have a really strong investment bank with better connections between corporate and institutions and across geographic regions, which means we can recycle risk from a global perspective. The end product is that we are smart at defining what our client needs.”

Sovereign debt concerns dogged the year as fears raged over how far Greek contagion would spread. Across the Atlantic, the US lost its Triple A rating for the first time. Investors faced the challenge of high volatility combined with poor liquidity alongside an unprecedented low rate environment and a further build-up of inflationary pressure.

Against that backdrop BarCap worked with an Eastern European sovereign that had exhausted credit limits to convert US dollar debt into euros. With normal cross currency swaps proving a challenge due to higher regulatory capital requirements, BarCap executed a transaction that saw the client’s bonds used to satisfy ISDA obligations, allowing the bank to buy CDS on cashflows owed under the swap and be fully credit-hedged.

Concerns over future rate rises saw the bank complete a €2bn swaption trade for a client on a €4bn portfolio hedged until 2013. The interest rate swaption allows the client to enter into a seven-year swap in 2013 and was transacted over a period of time to ensure smooth execution by accessing optimal market liquidity.

Given the lengthy duration of many trades, the regulatory onslaught added new layers of complexity to the business.

“The way to deal with uncertainty is to cover all bases in terms of different possible outcomes,” said European head of rates sales Kashif Zafar. “We are thought leaders in regulatory uncertainty and make sure that we’re there to serve our clients. Our electronic platform is also a huge investment and we make sure we have the nimbleness to move ahead of the competition.”

The bank maintained a consistent approach to pricing throughout the year despite fierce competition between dealers in late 2010 and early 2011, and continued to offer liquidity as markets became increasingly choppy mid-year.

“Having the largest client franchise positions you in a way to offer the best service and prices to clients,” said Zafar. “If it’s your job to recycle that risk, you’re able to be tighter than others. Building a strong client-base reinforces that loop.”

The index business also continued to flourish with expanded offerings in inflation, including the expansion of emerging market inflation-linked bond indices, and launch of an equity inflation response index that is designed to outperform broad equity indices during period of high inflation.

Strength in credit

BarCap had another strong year in credit derivatives, continuing to build on the previous two years’ work that saw the integration of Lehman Brothers’ powerful credit trading franchise. In what was the toughest trading environment since 2008, the bank generated respectable revenues while consolidating its gains in market share.

“On average, our market share is 13%, but that increases to 20% in periods of huge market volatility,” said Brett Tejpaul, head of European credit sales.

In recognition of the increasing dominance of the European sovereign debt issues, Eric Felder, global head of credit trading, re-located to London earlier in the year to spearhead the team’s handling of the unfolding crisis.

According to Felder, BarCap’s success in this challenging year was in large part due to the breadth of its franchise, which is strong across the entire credit spectrum, from origination and high-yield to loans and secondary market trading.

“The only way you can give the best advice and commit capital is if you know where you’re going to be able to offload those risks and who will be the likely people to take them,” said Felder.

“This year, when I look at our market share, the reason why clients are coming to us across products is because lots of what is going on in the market is more macro. When things get dicey, correlation across all products go to one, so it’s important to know what’s going on,” he added.

BarCap continued to lead on content too, providing clients with thoughtful analysis through its well-respected credit research team. Brad Rogoff, head of US credit strategy, underlined how the team helped guide clients through a range of issues this year, from questions over sovereign credit default swaps, to the best way to hedge cash portfolios in the volatile market environment.

The bank was also at the forefront of regulatory change, allocating significant resources to the launch of its credit e-trading platform in February. BarCap concentrated on offering a breadth of products in both single names and indices in the US and Europe, with 70 active single-names on launch, growing to 105 single names by expanding coverage to Asia and emerging markets. Another key innovation was the launch of automated market-making on the platform in April.

“Our algorithmic pricing guarantees execution for clients. The notionals are smaller, but these go up hugely during periods of large stress,” said Sonali Das Theisen, a director in credit trading.

“E-trading is still the minority in terms of flows, but it will be huge in two to three years, and that’s why we’re making the investment today,” added Tejpaul.

Go with the flow

Some of the biggest changes in the bank’s derivatives business through 2011 were made in equity derivatives, which reaped the benefit of a relaunched European equity platform including a significant boost to the flow equity derivatives function.

“Now we have a fully functioning equities arm,” said Richard Ager, head of equity and funds structured markets. “Traditionally, a lot of our client business has been in the private investment space and that’s still a core business, but the addition of a more equity-focused business to our client-base has been a big change.”

As a result of that investment, volumes and client revenues were up 20% year on year in spite of the difficult backdrop that hit profits at many more established franchises.

“In Europe and Asia, we have the fastest growing flow derivatives business on the Street and now we’re building a top tier delta one business,” said Fergus Slinger, co-head of equities flow derivatives distribution.

The franchise brought in an additional 300 clients in Europe in the last two years and 80 of those in the last year. “In a year when the flow wallet was 50% down, our flow revenues increased by the same amount,” said Slinger.

The bank identified volatility and inflation as key themes for the year. Having already proved its leadership in the volatility space with the launch of the first exchange-traded notes linked to the VIX volatility benchmark in 2009, the iPath volatility family was expanded to include a new mid-term note linked to the VStoxx, which was also made available in UCITS fund format.

With volatility looming large throughout the year, volume in the flagship VXX hit new records despite the launch of competitor products – both exchange-traded and over-the counter – from rival firms that were critical of the value erosion associated with rolling short-term futures on VXX.

Despite its critics, volume in VXX hit a record 143m shares for a market cap of US$4.97bn in August as investors rushed to position for another volatility spike.

“These days, for most clients, when they think of volatility they think of Barclays,” said Corinne Grain, head of equities distribution.

The structured products business continued to thrive, driven largely by technology investments in Bmarkets, the automated retail structured investment platform and COMET, the bank’s automated pricing and trading tools for flow structured investments.

Commodities

In the commodities space, BarCap has secured its place in the big leagues over the years, but its attention to clients was particularly notable in 2011.

Nowhere was its full-service client focus more pronounced than with its build-out of a Barnett Shale monetisation project for Chesapeake Energy Corp. After selling the first volumetric production payment involving natural gas liquids and first publicly rated VPP last year, worth US$1.15bn, Chesapeake sold another VPP via BarCap worth US$800m that accessed both the floating rate loan market and 10-year private placement market.

BarCap also realised how important it is to further develop the physical side of its commodities business for its clients. In September, BarCap and Metalloyd took over ownership of Erus Metals warehousing on the London Metal Exchange. It also procured heating oil tanks in New York.

“The reason we got physical is to facilitate the client business, be able to do deals with our clients that we couldn’t otherwise execute,” said Roger Jones, global head of commodities. For the rest of 2011 and 2012, his team plans on building up its physical crude oil and refined products businesses as well as its North American and European gas operations.

But any expansion will not be performed in a vacuum. “We are looking at where our gaps are, being self-critical when we’re not doing something well, and addressing opportunities,” said Jones.

To see the full digital edition of the IFR Review of the Year, please click <a href="http://edition.pagesuite-professional.co.uk/Launch.aspx?EID=94eeb650-a02a-483d-9646-a7f2c0593171" onclick="window.open(this.href);return false;" onkeypress="window.open(this.href);return false;">here</a>.