Credit Derivatives House

Cementing its position: While other derivative classes saw increased competition in 2010, credit derivatives aspirants were forced to the sidelines, leaving a handful of established players. But as volatility soared on sovereign risk concerns, one bank cemented its recent bid to become a leading global force. For furthering its market share under extreme conditions while leading the regulatory dialogue, Barclays Capital is IFR’s Credit Derivatives House of the Year.

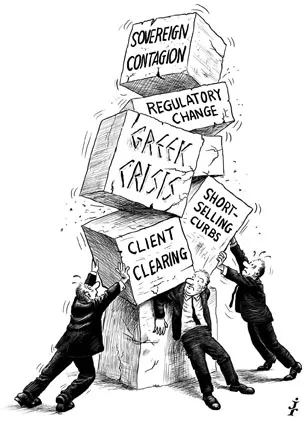

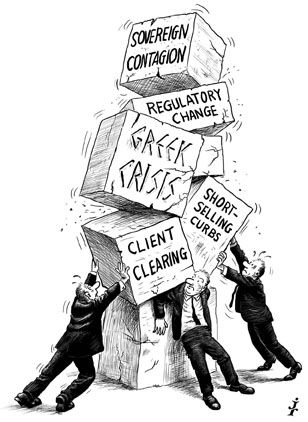

Following the credit market turbulence of the previous two years, most banks were prepared for another bumpy ride in 2010. But none could have predicted the extent of the volatility that ravaged markets in the second quarter. Already struggling to second-guess the impact of a new regulatory regime for over-the-counter derivatives, credit traders faced yet another crisis as concerns surrounding debt-laden eurozone sovereigns escalated. Credit spreads reached new highs and liquidity new lows.

Against this backdrop, 2010 threatened to derail some of those houses determined to stand their ground through thick and thin, in a market that has seen much of the competition already fall by the wayside.

Barclays Capital had only realised its global ambitions in the credit derivatives arena a year previously, following the acquisition of Lehman Brothers’ US operations. In the extreme volatility that might have threatened its growing global credit derivatives franchise, it saw opportunities to reach out to existing and new clients to demonstrate its expertise in research, flow trading and structured solutions.

Back in 2009, the bank made impressive inroads into credit derivatives globally, claiming top three positions in an array of client surveys. But the big question for many was whether the bank could maintain that momentum and continue to deliver in 2010 and the years ahead.

“We’ve extended gains in every region and product this year,” said Brett Tejpaul, head of European credit distribution. “We’ve built momentum and not lost it anywhere and we’re a driving force globally in regulatory discussions at all levels.”

Tejpaul said the bank remained on the course set out in 2009. “We kept our commitment to research and CDS-specific traders and continue to provide a holistic platform. Our clients reward us with a disproportionate share of the flow,” he said.

In the flow business, Barclays cemented its position as a leading dealer by market share. It is recognised by both its peers and clients as one of just a handful of truly global players.

“No one ever thinks we’re not a top three player in this market any more and that’s a change from last year,” said Conor Brown, head of European flow credit trading. “We continue to invest in the business and be consistent in the service that we offer, and clients recognise that.”

Clearing data from the Depository Trust and Clearing Corp shows Barclays to have a healthy 13% market share for CDS volume globally. According to CDS inter-dealer ranking surveys by credit data firm Markit, Barclays consistently ranked among the top three dealers in each month of 2010, hitting the number one spot in May – at the peak of the crisis. A fall to fourth place in June was short-lived, with the bank pushing back into the top three for the second half of the year.

“DTCC clearing data is the only pure CDS statistic out there, and it puts us as one of the top players in this market – and that’s with a European business that we effectively built from scratch in just a year,” said Rene Canezin, the firm’s head of high-yield trading.

Sovereigns provided a large portion of CDS trading volume throughout the year. In spite of some regulatory attempts to place stricter curbs on short-selling, Barclays remained at the forefront of the activity, making two-way markets throughout the most volatile periods. The bank was at the helm of some of the largest sovereign CDS trades, printing a US$1.5bn ticket for one client – one of the largest such trades to date.

“We knew there was going to be huge demand but we never foresaw Greece trading up to 1,000bp,” said Brown. “A lot of the first few tickets were not ones we would have liked to print, but we’re a liquidity provider and we were active throughout the volatility.”

Barclays displayed its CDS dominance in restructuring events, ranking as the number one dealer in some of the most significant settlement auctions. It bought 65% of bonds in the Hellas auction, for instance, and 35% in the Thomson auction – more than double the levels achieved by its closest rivals.

“We have kept our separation between CDS traders and cash traders in many areas where the client base demands differentiation of the product. We continue to think that CDS is a very important part of the market and are gradually pushing the separation out in Asia and the emerging markets,” said Brown.

Research commitment

Without doubt, sovereign risk was the financial markets story of 2010. Few were better placed than Barclays to step up to the table, delivering analysis of the crisis as it unfolded and providing new trading ideas around the events that played out.

“We really gave clients what they needed. The events had a huge impact for clients, and that was especially true for us given how many new clients we’ve introduced to the product,” said Brad Rogoff, co-head of US credit strategy at the bank.

“We were one of the first houses to come out with primers and trade ideas and began recommending that investors go short of sovereign credit as early as October 2009. We combined with our rates team to provide joint pieces to provide clarity on some of the really big questions, such as ‘what happens if a country leaves the EU or the single currency?’”

In October 2009, Barclays analysts published relative value trading ideas for SovX indices, proposing 5x5 forward trades as an efficient short on the market. In March 2010, two months before the Greek crisis hit its peak, analysts proposed selling credit options and buying SovX protection to position for a range-bound market, unless sovereign risk resurfaced.

In early February, Barclays published its standard corporate CDS handbook, covering basic operations, trading strategies and settlement auctions. As sovereign credit deteriorated through the early part of 2010, credit strategists received increased interest from rates investors looking to trade sovereign CDS. The bank responded by publishing its sovereign CDS trading report in February, covering all technical aspects of the product.

As part of the commitment to the research function, the bank enhanced Barclays Capital Live, a whole platform delivery suite incorporating research and analytical tools, which attracts more than 30,000 buy-side professionals each month. It added a number of new features to the platform in response to market changes through 2010, allowing users to screen global basis trades to find optimal execution points based on additional parameters such as subordination, rating and currency. This functionality was not available on rival platforms.

If sovereign volatility was the key client concern of the year, forthcoming regulatory changes ran a close second. Barclays has been a leader in regulatory discussions on both sides of the Atlantic, lobbying for improved transparency in the CDS market and pushing for central clearing.

“We’re at the forefront of product development in the clearing space and were the first to clear a client trade on the CME. The next large hurdle if CDS is to become a mainstream product and we believe that we will gain from that shift,” said Canezin.

Solutions-driven approach

Against such a turbulent backdrop, clients had no shortage of complex credit problems to address, including reduction of counterparty exposure and unwinding portfolios of illiquid assets to achieve capital efficiency.

“Our business is about helping clients manage their balance sheet issues, and for that we have a huge client solutions team,” said Tejpaul. “Clients are looking for liquid secondary market support and they increasingly need their dealers to be more creative about how to restructure assets on the balance sheet.”

Barclays devised long-term financing solutions for clients in connection with illiquid assets using a variety of structures. It eliminated one financial client’s reliance on short-term funding using applied structured credit technology to finance a portfolio of ABS securities. It was also involved in several large portfolio unwinds for other dealer firms, including a 2,000 single-name trade with a notional value of US$12bn and a CSO unwind on a portfolio in excess of US$3.5bn.

“We are a client facing business and everything we do is because it’s what the customer wants,” said Brown. “Our consistency and full service platform are what differentiates us from our peers.”

And as one of the most active market-makers for credit derivatives tranche trading, the firm has worked with clients looking to use high-yield CDX indices to apply fundamental view on near-term defaults and to take advantage of non-recourse leverage embedded in the 10%–15% risk slice.

While competition continues to build as volatility exacerbates, Barclays remains confident that it will hold on to its leading position, assisted at least in part by the new regulatory regime it has helped to shape.

“We enjoyed first-mover advantage in hiring and investing in this business and although our world is becoming much more competitive, the investment needed to run a derivatives business is higher than it was in 2005 and 2006 so it’s difficult for the rest of the pack to invest and catch up,” said Brown. “Add to that the investment required for client clearing and the barriers to entry are enormous.”

Helen Bartholomew