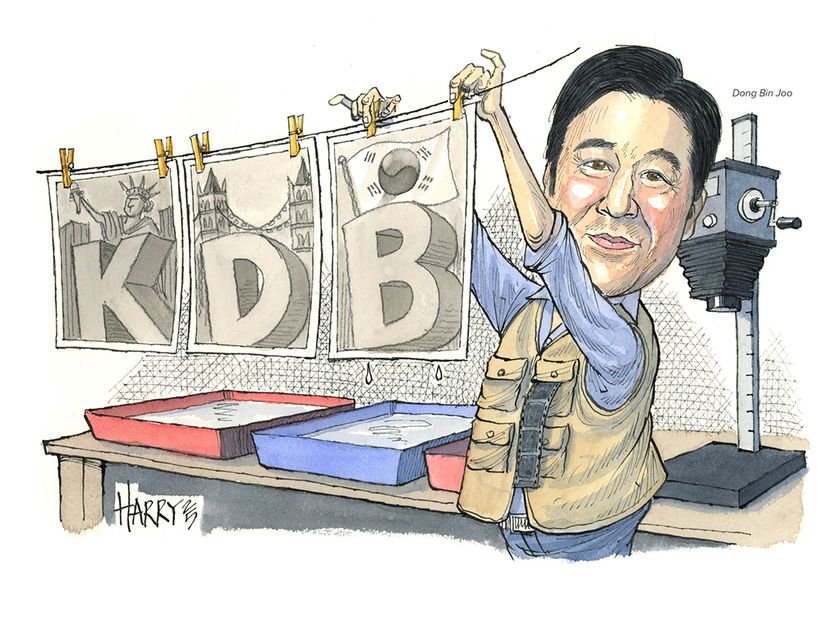

Issuer of the year: Korea Development Bank

Master developer

Korea Development Bank took the lead in persuading international investors to treat Korean credits as developed market issuers by becoming more transparent in its approach to bond pricing and execution. For attracting increased demand from high-quality accounts and setting the groundwork for its peers to follow it is IFR Asia’s Issuer of the Year.

South Korea’s largest policy bank, Korea Development Bank, staked the country’s claim to developed market status in 2024 by changing the way it approached the international bond market, winning over new investors and setting a template for the sovereign to follow.

The high ratings and tight spreads of Korean sovereign, supranational and agency credits make them an outlier in emerging market portfolios, but the process for Korean issuers to earn acceptance as developed market credits involves more than just index inclusion. As was the case for Japan decades earlier, the transition requires a change in the way institutions access capital markets, even before developed market status is officially bestowed.

Having cultivated relationships with high-quality international investors over the years, KDB felt the time was right to switch to developed market style execution.

“This transition into SSA-styled execution is certainly something we had been deliberating and preparing for a long time,” said Dong Bin Joo, chief financial officer and executive director of the financial management division at KDB.

Market volatility caused by the Covid-19 pandemic and subsequent steep interest rate rises meant that it waited for a suitable period of calm in 2024 to try its new strategy.

“By adopting an SSA-styled execution, KDB aimed to enhance the investor experience by providing a more predictable and transparent issuance process in terms of execution timeline, bookbuilding, and pricing,” said Joo.

In addition, Asian US dollar bonds had tightened to record low spreads because of decreased primary supply. KDB’s curve was starting to look too tight for some Asia-focused investors, even though investors in the US still found pricing attractive relative to the state-owned institution’s Aa2/AA/AA– ratings.

“Recent market conditions had compressed credit spreads to historical lows,” said Hyun Soo Chun, team head of the global funding team in KDB’s treasury department. “We felt our bonds were better aligned with developed market investors’ expectations, and changing our approach would deepen liquidity and enhance relative value for all stakeholders.”

For its first transaction under the new approach, a dual-tranche US dollar offering in February 2024, that meant changing to a two-day execution from same-day pricing previously and using a different technique for price guidance.

Most international bond offerings from the region start in the Asian morning with an announcement of wide initial price guidance to build momentum, then tighten by 25bp or more to final pricing – an approach that leads to big order books but a lot of order inflation and does not guarantee high-quality demand.

KDB had previously priced its US dollar bonds against Treasuries, but changed to referencing SOFR mid-swaps, though it also explained to investors how this translated to Treasury spreads to help them cope with the change.

“We had feedback from central banks and official institutions that they would prefer us to price off SOFR and they would like to see more transparency in fair value,” said Chun.

For the February trade, KDB announced initial price thoughts during the London open on the first day, then progressed to initial guidance when London opened on the second day, before launching and pricing in New York morning hours.

IPTs for the three and five-year were set at SOFR mid-swaps plus 69bp and 81bp area, respectively, plus or minus 5bp. Telling investors that both tranches would price within those ranges gave a clear indication that KDB intended to price close to fair value.

At the London open the following day, with indications of interest exceeding US$4.1bn, KDB announced price guidance of 68bp area for the three-year and 80bp for the five-year, both plus or minus 2bp. The US$1.75bn three-year tranche priced at SOFR plus 66bp and the US$1.25bn five-year at 78bp, both tightening of 3bp from the mid-point of IPTs.

The US$3bn SEC-registered offering was KDB’s largest US dollar transaction, and attracted final orders of US$2.7bn and US$2bn for the respective tranches.

KDB listed its previous US dollar bonds on the Singapore Exchange, but for the new approach also added listings in Luxembourg and London to broaden its appeal to SSA investors.

“We were able to attract many SSA investors such as central banks and official institutions around the world,” said Joo. “We also managed to engage some investors who had not been seen in Asian transactions. In terms of geography, we garnered much higher demand out of Americas and EMEA compared to the result in previous years.”

Before changing its approach, around 40%–60% of KDB’s US dollar bonds went to agencies, central banks, official institutions, pension funds and sovereign wealth funds. For the February transaction, these investors were allocated 75% of the three-year and 68% of the five-year.

The deal also attracted stronger interest from investors in the Americas, who took 54% of the three-year and 47% of the five-year, up from 49% and 28% in KDB’s previous SEC-registered offering in October 2023.

Four months after its pioneering trade, KDB returned with a US$1bn three-year Reg S-only deal that priced at SOFR plus 56bp, unchanged from IPTs. Then in October it sold a US$1bn three-year global bond at SOFR plus 60bp, inside IPTs of 62bp area, allocating 86% of it to central banks and official institutions.

“We look at not just the sovereign, but also credit spreads against our peers such as public financial institutions in Japan and Europe,” said Jiwoong Ock, senior manager in the global funding team. “Our new execution style this year is part of the process to align ourselves with those peers.”

Notably, KDB’s first SSA-styled transaction emboldened the sovereign itself to adapt its approach, though it did not come quite as close to the developed markets style of execution.

In June, after KDB’s second deal, the Republic of Korea brought a US dollar five-year offering to market, starting at IPTs of Treasuries plus 25bp area, plus or minus 5bp, before announcing guidance the following day and landing at 24bp for a US$1bn deal size.

KDB repeated its success in October when it printed in sterling, another key market for SSAs, in its first deal in the currency for seven years. While its 2017 deal priced against Gilts, the latest £250m (US$318m) offering referenced Sonia mid-swaps.

It announced guidance for a four-year deal at 60bp area, close to fair value, and priced at Sonia plus 59bp. Bankers noted that the final pricing showed KDB had tightened relative to its Japanese peers.

Joo said that while KDB’s transactions under its new approach have been successful, it still has a long journey ahead. “We will continue to search for areas to improve by actively communicating with investor communities and JLMs,” he said.

The week prior to bookbuilding, KDB held an online presentation for investors to explain its transition to developed market execution. It has committed to continuing its investor engagement efforts, both in-person and virtually, and continuing to print large benchmark deals to maintain secondary market liquidity.

That rapport with investors has helped KDB’s bonds maintain stability in the midst of volatile conditions.

Even when markets were rocked on December 3 when president Suk Yeol Yoon briefly declared martial law, foreign investors maintained confidence in Korean institutions like KDB. Its bonds widened 5bp–10bp the morning after the martial law announcement, but were back to their previous levels by the end of the day.

To see the digital version of this report, please click here

To purchase printed copies or a PDF, please email shahid.hamid@lseg.com