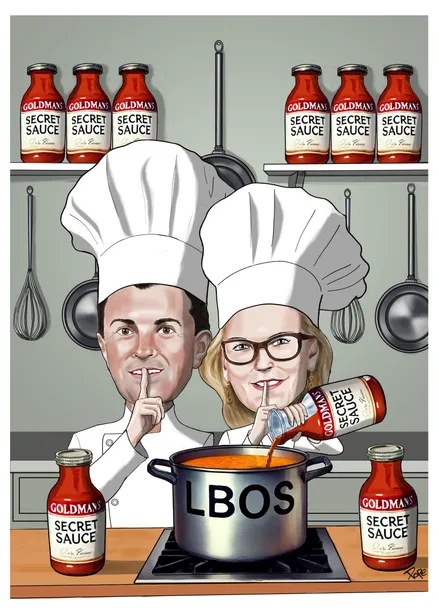

Leveraged Finance House: Goldman Sachs

Secret sauce

Creativity and expertise allowed Goldman Sachs to dominate the leveraged finance market despite a smaller balance sheet compared to its larger peers. For going toe to toe with the world’s largest money-centre banks and using best-in-class expertise, top-tier bankers and a formidable franchise, Goldman Sachs is IFR’s Leveraged Finance House of the Year.

Dominating the global leveraged finance business with a tighter balance sheet than Wall Street’s largest institutions requires a special kind of firm. Goldman Sachs managed that by providing world-class advice, delivering bespoke and creative deals, hiring some of the sharpest talent in the industry and benefiting from one of the world’s most powerful banking franchises.

“The secret sauce of our firm is we have great product expertise and really superb bankers. So when we go and sell a deal to Venture Global or a mining deal in Panama, we have incredible banking franchises that come alongside,” said Christina Minnis, head of global credit finance and head of global acquisition finance.

Whether through the ability to move quickly to create bespoke structures, provide deal-specific commitments, or execute dividend recaps and refinancings, Goldman consistently delivered for its clients in 2024. By using its merchant banking division, the firm also supported borrowers outside the broadly syndicated market.

As the lender of choice for tougher credits, Goldman executed a refinancing for J Crew despite the retailer’s controversial 2016 use of a backdoor provision to move collateral away from existing lenders and its subsequent bankruptcy filing in 2020. With cybersecurity software firm Darktrace, Goldman led one of the largest TMT buyouts in 2024 for Thoma Bravo, a deal that might otherwise have gone to the private credit market.

“Our banking franchise and the way we communicate across products – we’re not siloed. We run the business in a very integrated way, both with banking and with our products. I do think it’s the secret sauce to how we can be top of the league tables in a balance sheet-heavy business,” Minnis said.

The bank also participated in the refinancing frenzy, arranging more than US$6.6bn-equivalent across US dollars and euros in first and second-lien loans to extend the maturity of BMC Software’s (B2/B) loans and bonds. Goldman was lead-left arranger on the US$4.31bn first-lien term loan and €1.475bn first-lien term loan, which launched over summer.

“These are the deals we serve. [These deals] are fun to do, but also really important outcomes for issuers and investors. And those are the ones we get tasked with, not the Double B, US$2bn repricings to take 25bp out,” said Chris Bonner, head of the leveraged finance capital markets desk.

Goldman also expanded its efforts globally. “We’re consistently punching above our weight, versus just using relationship lending as a way to get access to capital markets transactions,” Minnis said.

Sponsor support

In 2024, Goldman remained at the forefront of sponsor dialogue, leading in both dividend and buyout financings.

“We focus on the sponsor business that’s just harder to get,” Bonner said.

Goldman led 12 of the 61 dividend recapitalisations tracked in 2024, approximately 20% of the market. The firm also arranged one of the most impactful transactions of the year – the US$5bn first-lien term loan backing KKR’s partial buyout of private healthcare technology company Cotiviti.

The bank was lead-left physical bookrunner on the US$750m fixed-rate term loan accompanying a US$4.25bn floating-rate term loan led by JP Morgan. By incorporating the fixed-rate portion, the banks tapped the high-yield bond market while maintaining the flexibility of a term loan.

In terms of sponsored business, Goldman doubled its deal count from the year before, completing 224 deals worth approximately US$64.4bn, for a 6.59% market share.

“Clearly, there was not a lot of M&A. Sponsors are designed to buy and sell companies. Over the last couple of years, they’ve been able to buy but have struggled to sell. So dividend recaps have become the flavour du jour,” Bonner said.

“This year, we were number one in terms of dividends globally. We’re lead-left on 20% of all the distributions. Getting back to our sponsor business, that’s where most of it goes. This is something that differentiates us.”

In Europe, UK cargo rental provider OEG made its debut in the high-yield market to fund a dividend to shareholders and refinance debt. The Goldman-coordinated €465m five-year non-call two fixed-rate senior secured note issued at 7.25%. The size was increased from an original €440m while the price was tightened from initial price talk of mid-to-high sevens.

European force

Goldman managed the euro tranche of a hefty US$2.3bn-equivalent bond component for a multi-billion US dollar refinancing for insurance firm Ardonagh Group that was seen as a coup for Wall Street banks clawing back business from incumbent private lenders.

The acquisitive UK insurance broker had previously leaned on private credit markets but rejigged its debt stack with the bond offering comprising two seven-year non-call three senior secured notes – one for US$500m that was upsized by US$250m and the other for €500m – plus an unsecured US$1bn eight-year non-call three.

The fact that Ardonagh took out private debt – including a record unitranche done through Ares Management in 2020 – with syndicated bonds underscored how the funding environment shifted in 2024 in favour of public transactions that investment bankers so love.

Goldman helped lead the charge for such deals in Europe. The bank was one of the global coordinators and physical bookrunners for Italian food ingredient maker Irca Group's bond that took out private unitranche debt.

The company originally proposed a deal of around €1bn, with new senior secured notes split between a €700m five-year non-call one floating-rate tranche and a €400m five-year non-call 1.5 fixed-rate note.

The fixed tranche was dropped to match the sponsor's preference for an FRN and minimum call protection, printing an upsized €1.115bn five-year non-call one FRN at Euribor plus 375bp at par.

The book was greatly oversubscribed, leading to a successful pricing outcome for the issuer. Pricing landed at the tight end of final price talk of Euribor plus 375bp–400bp, which in turn tightened from initial price thoughts in the low 400s.

Goldman also dusted off an old playbook as global coordinator and sole physical bookrunner for Italian paper company Fedrigoni, which brought to market a rare senior holdco pay-if-you-can toggle note as part of a €730m two-tranche offering.

The subordinated five-year non-call one bond raised €300m. It was the first PIK toggle since 2021, and the first distributed PIK from an Italian borrower since the global financial crisis.

Fedrigoni opted for the PIK toggle so cash that could have gone on interest payments could instead be reinvested. The notes were also structured to negate issues around tax and PIKs in Italy.

On acquisition financing, Goldman worked to help German metering firm Techem gain consent from the majority of the lenders behind its €1.85bn TLB on a change of control amendment after agreeing to be acquired by private equity firm TPG for €6.7bn from Partners Group.

That allowed Techem to amend the facility documentation so its buyout by TPG would not trigger a change-of-control clause.

Techem later visited the bond market with a €750m tap of its €500m 5.375% July 2029 senior secured note. Techem chose a tap rather than a new issue to create one large, liquid note at a suitable maturity.

To see the digital version of this report, please click here.

To purchase printed copies or a PDF of this report, please email leonie.welss@lseg.com