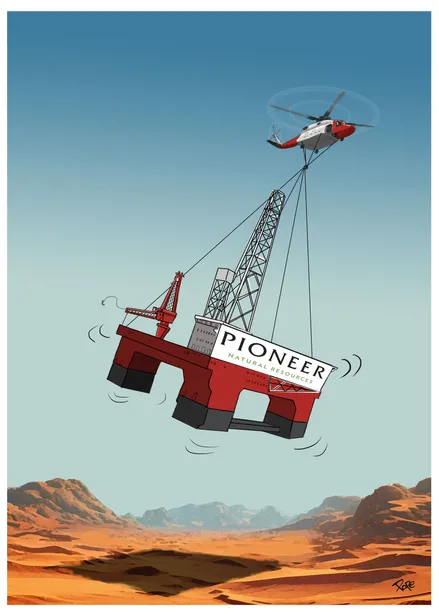

M&A Deal: ExxonMobil’s US$65bn acquisition of Pioneer Resources

Permian push

ExxonMobil brushed off its activist critics and made the most of the oil price recovery to press ahead with expanding its domestic US presence through the all-share acquisition of Pioneer Resources. This landmark transaction is IFR’s M&A Deal of the Year.

The biggest completed acquisition of 2024 saw the leading US oil and gas producer ExxonMobil cast criticism aside and double down on its core business, buying Pioneer Resources in an all-share deal valuing the biggest independent operator in the Permian Basin at US$65bn.

The merger combined Pioneer’s more than 850,000 net acres in the Midland Basin with ExxonMobil’s 570,000 net acres in the Delaware and Midland Basins, creating what the oil producer called the “leading high-quality undeveloped US unconventional inventory position”.

The deal fits with Exxon’s strategy of creating large continuous tracks in the Permian Basin to create efficiencies from fracking. “Pioneer is a clear leader in the Permian with a unique asset base,” said ExxonMobil chairman and CEO Darren Woods announcing the transaction.

“Their tier-one acreage is highly contiguous, allowing for greater opportunities to deploy our technologies, delivering operating and capital efficiency as well as significantly increasing production."

Initially, ExxonMobil envisaged US$2bn of annual synergies from the combination but now anticipates more than US$3bn.

The transaction sparked a frenzy of dealmaking across the energy complex. Indeed, US oil and gas was by far the most active sector in 2024. The year saw 14 energy deals of more than US$5bn completed, of which half were more than US$10bn, all US domestic deals.

The largest by far saw ExxonMobil agree to buy Pioneer Resources in October 2023 at an 18% premium to its pre-deal share price. It was Exxon’s biggest transaction since agreeing to buy Mobil in 1998 for US$81bn and the fourth-biggest oil and gas deal involving a US company.

Woods said the transaction took shape rapidly. “We basically closed this deal fairly quickly,” he told reporters when it was announced. He had only approached his counterpart at Pioneer, Scott Sheffield, two weeks previously "and started talking about the complementary nature of both of our businesses".

A number of other deals followed, with Diamondback Energy buying Endeavor Energy Resources for US$25.8bn; ConocoPhillips making a US$22.5bn offer for Marathon Oil and, most notably, Chevron launching a US$59.6bn bid for Hess, a deal that has not yet completed.

At the start of 2022, ExxonMobil’s strategy seemed to be heading in a different direction after activist investor Engine No 1, despite only having a tiny shareholding, managed to win three seats on the oil giant’s board, with a push for the company to consider its transition plan during a trough for oil prices.

Instead, on the back of rising energy prices in 2022 as sanctions against Russia squeezed supplies, ExxonMobil rediscovered its roots.

It could have made the offer for Pioneer solely in cash after posting a record US$56bn profit in 2022, but instead made use of its resurgent share price to make an all-share bid.

That allowed ExxonMobil to conserve its firepower and stick to its pledge to spend US$19bn in 2024 on a share buyback, one of the largest ever announced. It also meant the Pioneer deal was less risky for the acquirer, always a consideration in a sector based on volatile commodity prices.

The execution of the transaction was impressively smooth. ExxonMobil did not have to raise its offer. By being first, competitors then had to follow its move and sensibly steered clear of trying to compete for Pioneer, the biggest prize in the Permian Basin.

One wrinkle saw Pioneer’s Sheffield blocked by regulator the Federal Trade Commission from being on the board of ExxonMobil, as originally planned. But the company took that in its stride, letting the deal complete in May, within eight months of its announcement.

By the end of 2024, ExxonMobil was head and shoulders above its nearest competitor Chevron, boasting a market capitalisation of US$467bn against Chevron’s US$257bn, with annual revenues of US$334.7bn in 2023 compared with US$196.9bn for Chevron.

Citigroup was lead financial adviser to ExxonMobil, with Centerview also advising. Goldman Sachs, Morgan Stanley, Petrie Partners and Bank of America were financial advisers to Pioneer.

Stephan Feldgoise, co-head of global M&A at Goldman, said: “Pioneer was a flagship example of the energy franchise that was so active last year.”

To see the digital version of this report, please click here.

To purchase printed copies or a PDF of this report, please email leonie.welss@lseg.com