Interest Rate Derivatives House: JP Morgan

Standing firm

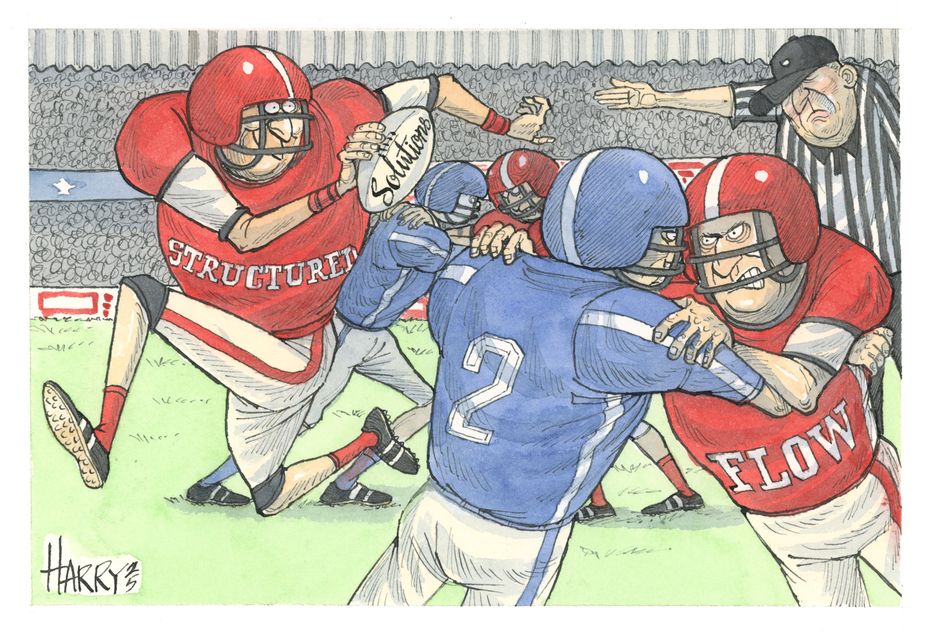

Strong competition for flow eroded margins for macro trading businesses in 2024, presenting a challenge for rates traders after a bumper few years. For leveraging its diverse franchise to maintain its position while continuing to innovate across products, JP Morgan is IFR’s Interest Rate Derivatives House of the Year.

Interest rate traders faced a reality check in 2024 after a heady few years. Central banks pausing after their aggressive rate-hiking cycles sapped volatility from markets and bid-offer spreads narrowed sharply. Competition for flow intensified, compressing margins for dealers and making it harder to turn a profit while keeping risk in check.

JP Morgan’s strength in interest rate derivatives came to the fore in this challenging environment. The bank didn’t cede an inch in flow trading, leveraging its extensive network of global clients to source and recycle risk while deploying resources to areas with better growth prospects.

That included a concerted push in structured rates and more episodic transactions as the bank kept a relentless focus on developing hedging strategies and unearthing investment opportunities for its corporate and institutional clients.

“Rates are the bedrock of global markets so we’re always looking one way: to invest and double down," said Matthew Franklin-Lyons, global head of rates trading. "Our focus on diversification and innovation has really benefited us. The breadth of franchise, breadth of trading talent and being there for clients when they need us through periods of heightened volatility remain our core competencies and our edge.”

Flow trading desks came under threat in 2024 as record interest rate derivative volumes proved insufficient to offset the decline in margins from lower volatility and heightened competition. JP Morgan met those challenges head on: sharpening its pricing to win business, while retaining senior traders to recycle its risk efficiently across its vast client base but causing barely a ripple in the wider market.

The consistent investments JP Morgan has made in the rates business over the past decade or so – including during the 2010s when other banks headed for the exits – meant it was starting from an enviable position of strength.

Europe has been a particular area of focus in recent years. Overall, JP Morgan has nearly tripled its headcount in continental Europe since the UK’s Brexit vote to give it roughly 1,700 staff across its two hubs in Paris and Frankfurt. Those additional boots on the ground have brought it closer to European clients, helping it increase market share.

“Hedging flow at very tight margins can only be done with a very broad franchise that you can rely on to exit risks,” said Tom Prickett, head of EMEA rates trading. “We recognised that the breadth of our franchise is our core strength. When we see a challenge like an aggressive tightening of spreads ... we meet it with a doubling down on the franchise.”

JP Morgan’s client-centric approach has paid dividends in securing large, episodic hedging transactions. In one notable example, it won six of the 13 hedging mandates last year from UK companies that issued bonds underwritten by JP Morgan’s debt capital markets team.

It also pioneered the development of the so-called deferred settlement rate lock for a European corporate client – a twist on the traditional playbook of pre-hedging bond issuance – which has been replicated by several companies and resulted in billions of dollars of traded notional.

This focus on innovation extends across JP Morgan’s global operations. In Japan, where bond markets sprang back to life after years of low inflation and negative interest rates, the bank stood ready to help clients adjust to the new environment. That included helping a major Japanese financial institution to think about an asset-liability framework better suited to the new interest rate regime.

JP Morgan also continued to develop its structured rates business, which formed another pillar in the bank’s diversification strategy. In Europe, JP Morgan maintained its position as a prominent issuer on Spire – the multi-dealer platform for repackaged notes – to provide European investors with access to US and other fixed-income assets. The bank said it held a 15.8% market share on Spire in euro notes with maturities of five years and more in 2024 after securing a 17.5% market share in 2023.

“The advantage of a franchise like ours is that the breadth allows us to refocus in areas that can be more profitable,” said Jorge Gallardo, head of global rate sales for developed markets. “In 2024, as compression was a key theme, we decided to focus more on developing strong trade ideas and finding solutions for clients, and so we saw an increase in structured and episodic trades.”

To see the digital version of this report, please click here.

To purchase printed copies or a PDF of this report, please email leonie.welss@lseg.com