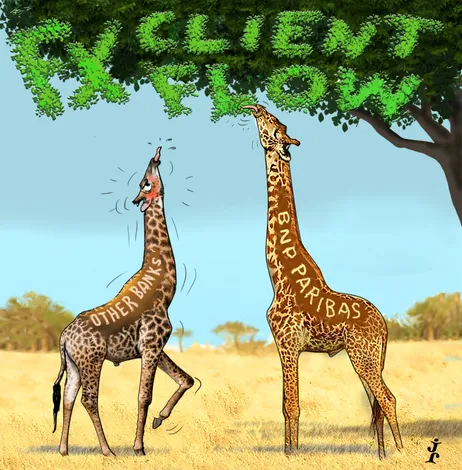

Foreign Exchange Derivatives House: BNP Paribas

Adapt and thrive

Currency desks had a challenging 2024 as low market volatility fuelled fierce competition for flow, resulting in tighter bid-offer spreads and compressed margins. For strategically growing its business and developing innovative solutions for clients, BNP Paribas is IFR’s Foreign Exchange Derivatives House of the Year.

The outlook for 2024 didn’t bode well for foreign exchange traders as central banks took a breather following a historic interest rate hiking cycle. Even as carry trades returned to favour amid the low volatility, fierce competition for client flow squeezed bid-offer spreads ever tighter and dented profitability.

BNPP was well prepared for the market calm having revamped parts of its FX options and forwards businesses in late 2023 to improve client services and tap into demand for more complex products. That included expanding its offering of exotics such as volatility knock-out options, which are typically less susceptible to spread compression.

BNPP’s exotic options book grew by a factor of 20 in the first six months of 2024 as clients piled into these products to hedge against a host of political risks. The French bank also registered impressive growth in other parts of its FX business after streamlining its cross-currency swap operations in a move that also boosted its FX forward and swap activities.

In a low volatility environment “spreads compress [and] competition becomes much tougher”, said Neehal Shah, global head of G10 FX trading and EMEA head of FX institutional sales at BNPP.

“At the end of 2023, we started embarking on slight change[s] to our businesses, both in the options and forward space, to make sure that we could 1) be competitive and offer clients some interesting products in this environment and 2) be able to generate revenue.”

BNPP’s exotics expansion proved timely in a year with a busy calendar of political events. Clients were casting around for ways to take a view on FX volatility around elections across the globe without having to pay a hefty premium. BNPP sold a significant amount of forward volatility agreements with double knockouts to cater to this demand, providing clients with a cheaper way to get long volatility, particularly in US dollar-yen, ahead of these events.

The bank also updated its risk management systems and overhauled risk limits to handle these complex positions. Here, BNPP took advantage of its diverse franchise to recycle some of these risks with private banking clients via structured notes.

“We've really focused on building out our volatility option products … to provide slightly more exotic payout structures that can take advantage of the low vol environment and still offer investors some decent returns,” said Shah.

The year's low volatility also spurred interest in carry trades, with clients looking to borrow in low-yielding currencies to invest in higher-yielding markets. Anticipating that the yen would provide the most attractive carry opportunity for clients, BNPP shifted its short-term yen cross-currency business from the interest rate trading desk in Tokyo to the FX forwards desk in London, which historically sees more of these kinds of flow.

That change – coupled with the decision to merge short-term euro, sterling and yen cross-currency trades into the same risk book – enabled BNPP to quote tighter prices for clients across forwards and swaps as well, while more efficiently recycling risk with offsetting flows.

Moving to a global book “really helped” in an environment “where everyone is looking for carry”, said Sam Smith, EMEA head of G3 FX swaps and cross-currency trading. “By merging everything into one, we're able to generally have a more streamlined headcount but also generally have a better positioning of the book within [our] risk limits.”

Continued progress on electronic trading of forwards and swaps, meanwhile, has seen BNPP increase volumes across all tenors over the past 12 months, including a doubling in its yen book. The French bank said its enhanced electronic capabilities in this space mean it can now internalise more than 90% of its flows.

Elsewhere, BNPP succeeded in growing its FX solutions business with both institutional and corporate clients over the course of the year. In one notable push, the bank significantly expanded its FX hedging business related to M&A transactions to register a record year in so-called deal-contingent trades with more than 30 transactions across the globe.

“We have gone much deeper this year in terms of the discussions … and strategic transactions that we have been able to do with [our corporate clients],” said Frederic Han, EMEA deputy head of FX structuring at BNP Paribas.

To see the digital version of this report, please click here.

To purchase printed copies or a PDF of this report, please email leonie.welss@lseg.com