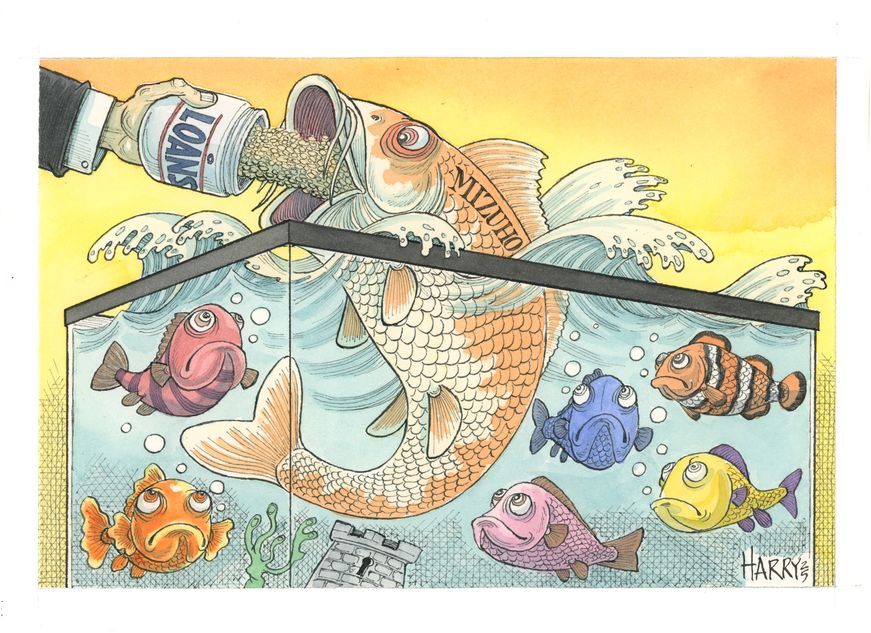

Americas Loan House: Mizuho Bank

A growing presence

An international bank seeking to become a leader in the US loan market needs to be creative, consistent and willing to put its balance sheet to work. For the development of its loans business and its influential financing structures, Mizuho Bank is IFR’s Americas Loan House of the Year.

Mizuho Bank's loans business has grown impressively since Michal Katz, head of investment and corporate banking, took the reins five years ago, gradually increasing its share of the US market to 2.69% in 2024 from 1.98% in 2020.

In US investment-grade loans, the bank’s increased presence is even more pronounced. Outgunned only by the four American money-centre banks, Mizuho’s market share has grown to 4.03% from 2.87% in 2020 and it has established itself among the top global banks for investment-grade loans.

Mizuho has also developed its presence further down the credit curve, boosting its market share in US leveraged loans to 1.93% from 1.17% over the period.

"When Michal came in five years ago, we were a bank that relied almost solely on investment-grade capital markets. She had a revisioning of the bank and got to work on all the parts of the bank that were not keeping up with the investment-grade capital markets," said Victor Forte, head of investment-grade capital markets and syndicate at Mizuho.

In conjunction with its strides into leveraged loans, Mizuho debuted its first Term Loan B as lead-left arranger. That US$1.051bn repricing term loan for payment processor North American Bancard saved the company US$3m in annual interest.

To build confidence in its leveraged operations among issuers, Mizuho has completed several hires to bolster its levfin business, including Jeb Slowik in 2023 to lead the team. It has established itself with both corporate and sponsor clients as a bank willing to offer M&A and LBO financings in size.

In 2024, Mizuho made its most significant impact in investment-grade M&A financing. Its proposal for computing and cloud services firm Hewlett Packard Enterprise to support its acquisition of computer networking firm Juniper Networks with delayed draw term loans in place of a traditional bridge loan was mimicked by other borrowers.

In January, HPE put US$14bn of delayed draw term loans in place to back the transaction.

Bridge loans have been the preference from the advisory banks' perspective. “It's easy to do, it's easy to get off risk, and it maximises their own revenue," said Seth Mair, managing director, IG capital markets and syndicate.

The term loan provides flexibility in a volatile marketplace to borrow under more forgiving conditions than would have been available under a typically structured bridge loan with funding fees, duration fees, margin step-ups and other terms to encourage corporates to take out the bridge loan in the bond market as swiftly as possible.

“We saved HPE a significant amount of money. I believe this will be the new strategy going forward for corporate America," said Mair.

Mizuho was the initial underwriter, joint lead arranger, and joint bookrunner. Citigroup and JP Morgan also led the financing.

Following HPE's example, other investment-grade corporations in the US have since opted to support their acquisitions with delayed draw term loans instead of bridges, and other lenders agree that the practice is likely to remain.

Mizuho has taken a client-centric approach to financing corporates and sponsors, using a product-agnostic view to find the best solutions across investment-grade loans, project finance and leveraged finance to fund business operations, investment and acquisitions. It views its loans business as part of an overall growth strategy.

"The loans are the tip of the spear. They're what gets you the ticket in the door, they get you dialogue with the company," said Forte.

Project finance is also a significant pillar in Mizuho's strategy, leveraging its international loan sales capabilities.

"Our distribution platform has changed significantly. We now have very integrated teams that we work with out of London, Hong Kong and Singapore. Project finance attracts a lot of global banks that are not in the US looking for ancillary business from investment-grade corporates … we're bringing in a lot of dollars from overseas," said Mair.

To see the digital version of this report, please click here.

To purchase printed copies or a PDF of this report, please email leonie.welss@lseg.com