Equity House, EMEA Equity House and Asia-Pacific Equity House: Morgan Stanley

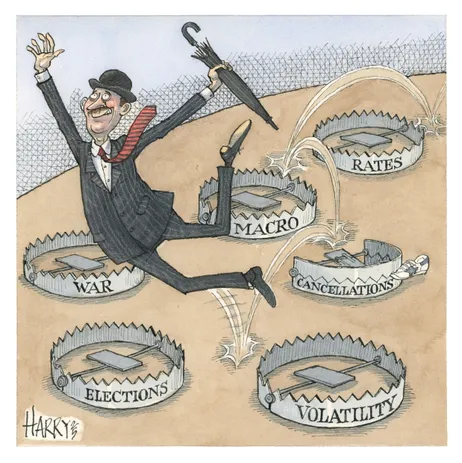

Precision steps

With equity capital markets in recovery mode, focus and care were needed to avoid missteps. The global leader in IPOs avoided the bear traps and delivered positive outcomes for clients and investors, making Morgan Stanley IFR’s Equity House, EMEA Equity House and Asia-Pacific Equity House of the Year.

Take a look at revenues of the top US banks and one might easily conclude that equity capital markets recovered in 2024. After two terrible years for issuers, bank and investors' fees are back to 2019 levels, the last year of normality before the pandemic.

Yet it was a year in which judgment and expertise were vital with plenty of poorly performing and cancelled deals. The nadir was perhaps Spanish baker Europastry cancelling its IPO twice a few months apart. Too often banks achieved oversubscribed books of demand, only to see interest evaporate when shares began trading.

Morgan Stanley has suffered in league tables over the past couple of years, with bankers at the firm saying it was due to advising clients to wait rather than pushing them into the wrong market environment.

The credibility of that excuse can only be assessed after the fact: how did the bank perform when markets reopened?

Morgan Stanley pipped JP Morgan to top the cash equity league table globally. It was streets ahead for IPOs with more than US$10bn of league table credit from 66 deals having ranked a lowly 15th in 2023, with JPM second in 2024 on US$9.8bn and 57 deals.

Perhaps most importantly after two years of poor returns, the bank's revenues grew by 80% to catch up with Goldman Sachs and JP Morgan whose revenues were up 45%–47% while issuance in the year was only up 17%.

“This was a recovery year and we have been instrumental in that recovery,” said Martin Thorneycroft, global co-head of ECM.

Stakes were high as investor sentiment was fragile, with Thorneycroft pointing to the IPO of Swiss skincare specialist Galderma as a year-defining transaction.

“This had to work, not just for us but for all private equity IPOs. It worked brilliantly for the owners and investors,” he said. The SFr2.3bn (US$2.5bn) listing, IFR's EMEA IPO of the Year, was followed by two blocks totalling SFr2.35bn due to the strong performance of the stock.

The team in EMEA had managed a record of all their IPOs trading up on the first day – or flat in the case of Poland’s Zabka Group, the bank’s only bookrunner role in the region – until Delivery Hero’s Talabat fell on debut in December, but the Dubai spinoff was still the largest tech IPO globally and largest GCC float of the year, while the same month saw OQBI shares debut in Oman and trade up.

Similarly in the US, the bank was entrusted with more stabilisation roles than its rivals and on average its deals outperformed those in which it wasn’t involved, which allowed the full greenshoe to be exercised on most deals.

The bank led and stabilised the largest IPO of the year when cold storage REIT Lineage convinced investors to pay a premium to its main peer and priced an upsized US$5.1bn Nasdaq IPO, also the largest real estate IPO ever. Morgan Stanley’s role in the July offering was no overnight success having structured and raised US$6.5bn from private placements for Lineage since 2018.

Aftermarket performance was vital to both encourage owners of companies that an IPO was the right route and reassure investors that new issues could provide alpha. Morgan Stanley’s record supported both those messages, even if that wasn’t clear from wider issuance.

Moving on and getting on

The year began with a US$249m settlement with the SEC to resolve a block trading scandal in the US that had hung over the bank for a couple of years. Resolution came in January and the velocity of issuance with a string of complex jumbo cross-border follow-on offerings in February and March showed the bank had regained clients’ trust.

In late February, the bank was sole books on a US$2.9bn selldown of European investment firm JAB’s stake in US drinks maker Keurig Dr Pepper, the largest consumer and retail block in history.

In mid-March, Morgan Stanley acted in the lead-left and stabilisation slots for tobacco company Altria’s US$2.15bn selldown of its stake in cross-listed brewer Anheuser-Busch InBev while executing three other European trades that evening.

Just five days later, Morgan Stanley led Pfizer’s US$3.1bn marketed sale of its stake in LSE/NYSE-listed consumer health company Haleon and a US$1.9bn overnight block sale by Bourse Dubai of its stake in Nasdaq.

The Haleon offering was the largest marketed secondary offering in the US since 2020.

“Those jumbo offerings demonstrate the power, expertise and seniority of our franchise,” said Arnaud Blanchard, global co-head of ECM. “Our track record on jumbo financings really speaks to the credibility we have with markets.”

Other jumbo cross-border mandates included the US$5bn convertible bond of NYSE-listed Chinese e-commerce giant Alibaba Group and South Korean Hyundai Motor’s Rs279bn (US$3.2bn) IPO of its Indian unit in the country’s largest ever IPO.

Morgan Stanley helped UK telecoms operator Vodafone Group raise Rs151bn from the sale of its shares in India’s Indus Towers and worked with China’s Ant Group and Alibaba to cash in their stakes in Indian food delivery company Zomato in two blocks raising a combined Rs75.9bn.

The signature deal came in August when US retailer Walmart sold a US$3.6bn stake in Chinese e-commerce company JD.com, the largest ever American depositary receipt selldown in a Chinese company.

While Walmart has business relationships with almost every bank on the street, it picked only Morgan Stanley to handle the sale, highlighting the bank’s ability to commit capital for the right names.

The deal was wrapped up in less than four hours before the Hong Kong counter started trading.

“We are particularly proud of these cross-border transactions because that really reflects our global and regional franchise … This is important because this trend is going to continue and we are definitely well positioned to capture it,” said Cathy Zhang, head of Asia-Pacific ECM.

Morgan Stanley almost tripled its ECM activity in Asia-Pacific and led six of the 10 largest transactions for a table-topping year.

Eddie Molloy, global co-head of ECM said: “Those types of transactions that are complex, that you can't get wrong, and you need the whole globe to do them, they are what really differentiate us relative to any other bank you talk to. They don't have the breadth of leadership globally that we do.”

Morgan Stanley’s leadership is a calling card of the firm and mid-year changes allowed for internal promotions. US-based Blanchard, Molloy and UK-based Thorneycroft stepped up as global co-heads of ECM following the appointment of Evan Damast and Henrik Gobel as co-heads of global capital markets. Those changes provided the opportunity to elevate long termers Natasha Sanders and Thomas Thurner to run EMEA ECM origination.

Running through the line

There was no tailing off as the year ended with Morgan Stanley pricing 27 deals in December, comfortably ahead of most rivals with only JPM (again) close with 25. Deals were priced across regions including for clients in Japan, India, China, Oman, Australia and Japan, while Morgan Stanley was sole bookrunner on a sale in Amsterdam-listed CVC Capital Partners, having been joint global coordinator on the IPO and first selldown in the private equity company earlier in the year.

Perhaps Morgan Stanley’s biggest coup was in December when it went from sellside M&A advisory position on insurance broker Arthur J Gallagher’s US$13.45bn acquisition of sponsor-backed AssuredPartners to leading the nearly US$9.78bn stock sale to fund the purchase.

Morgan Stanley shared bookrunning duties with Bank of America but its 62% share of fees, translating into a US$100m-plus payday, underscored its dominant role in leading a weekend wall-cross followed by a day of marketing.

To see the digital version of this report, please click here.

To purchase printed copies or a PDF of this report, please email leonie.welss@lseg.com