Flow Marketmaker: Citadel Securities

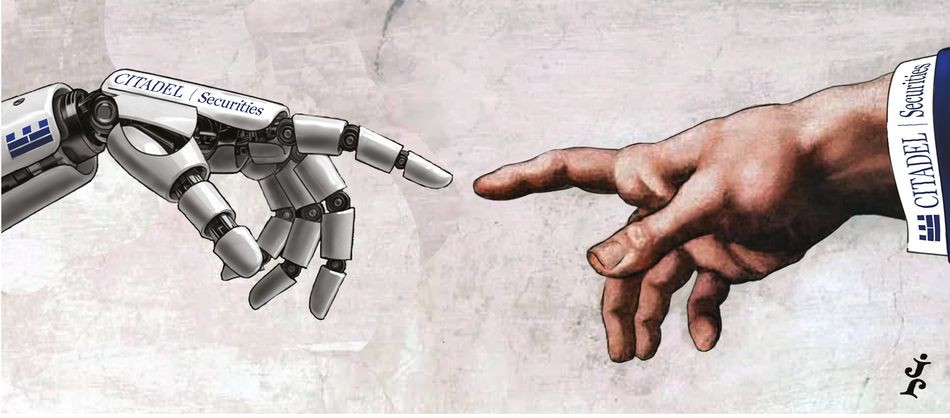

Man plus machine

Trading volumes broke records in 2025 as investors reacted to changes in US policy and the fast-moving narrative around AI. For expanding its high-touch capabilities while further strengthening its electronic trading franchise, Citadel Securities is IFR’s Flow Marketmaker of the Year.

Citadel Securities’ success in equities trading is often attributed to its pedigree in quantitative finance. After all, about a sixth of its 1,800 employees hold PhDs, including chief executive Peng Zhao.

The marketmaker’s prowess in low-touch, electronic trading came to the fore again in 2025 as clients responded to chaotic US trade policies and an acceleration in the AI boom – sending trading volumes through the roof.

Arguably, though, it was the expansion of Citadel Securities’ high-touch services – in which humans, not just machines, are needed – that made 2025 a watershed year for the firm. In a series of targeted investments, including hiring a raft of finance veterans, Citadel Securities has further strengthened its institutional franchise over the year.

From launching high-touch equities and OTC options, to bolstering fixed income and rolling out research content, the methodical buildout underscores the marketmaker’s determination to keep evolving – and become an even more formidable competitor in global markets.

“This was a transformational year for Citadel Securities,” said the firm’s president, Jim Esposito. “Historically, we've been dominant in low-touch electronic channels. This year was all about investing in the high-touch voice channels to build deeper client relationships and to help solve their most important problems.”

The Miami-based firm certainly has the financial heft to back its ambitions. Citadel Securities generated US$8.4bn of net trading revenues in the first nine months of 2025, according to investor documents, putting it on track to break last year’s record haul of US$9.7bn. That’s comfortably above banking giants Societe Generale, UBS and Wells Fargo – and roughly level with BNP Paribas and Deutsche Bank.

It’s also done that without resorting to the kind of high-stakes, proprietary trading that has contributed to the rapid growth of nonbank rivals Jane Street and Hudson River Trading. Since Ken Griffin founded the marketmaker in 2002, Citadel Securities has always operated independently from the eponymous hedge fund – a point Esposito is keen to drive home.

“We are in a category of one – there’s no one else out there doing what we’re doing,” he said.

Trade relations

While the firm’s technological backbone remains central to its success, there’s no doubt that Citadel Securities has taken a leaf out of banks’ books lately when it comes to deepening its relationships with institutional clients. That has started with staff.

Esposito, a 29-year Goldman Sachs veteran, joined in August 2024 to lead the charge. He’s one of around a dozen senior bank hires over the past 12 to 18 months from the likes of Goldman, JP Morgan and Morgan Stanley.

These additions have reinforced Citadel Securities’ salesforce and helped it enter new markets. They’ve also allowed the firm to produce more content to share with clients. That includes its own spin on the age-old bank practice of publishing regular research notes, such as unpacking the huge trading flows Citadel Securities processes on its platform.

The marketmaker also hosted a landmark conference in November with speakers including ex-ECB head Mario Draghi and Nvidia’s Jensen Huang – again showing its drive to increase its profile.

“On the content side, we’re more closely aligned to the traditional bank marketmakers than our nonbank peers,” said Esposito. “We provide a very different client experience.”

Amazon of finance

Despite these mainstream moves, there remain crucial differences between the trading operations of Citadel Securities and those of traditional banks, giving it a considerable edge in some of the world’s biggest financial markets. Nowhere is this more obvious than in its flagship equities franchise.

“We like to think we are the Amazon of finance. We trade more equity flow than anyone on the planet,” said Esposito.

Citadel Securities’ acquisition earlier this year of Morgan Stanley’s exchange-traded US equity options business cemented its dominance in these markets. It also marked the exit of the last major bank that was active in the space. Citadel Securities says it now provides 45 billion US option quotes daily – a feat that forced it to manufacture its own bespoke microchips to keep pace. The result, it says, is a more than 30% share of all volumes, making it the top player in listed US options.

Banks are also largely absent from the business of taking stock trades off the prominent retail platforms such as Robinhood. Citadel Securities again has a towering presence here, handling about 35% of all retail trading in US equities and options – and around a quarter of all equities trading across the entire market.

“The story of the year in equities is the dominant participation of retail investors – they’ve been active and … helping drive valuations higher,” said Esposito. “No one is more dominant in servicing retail client flows than Citadel Securities.”

Its push into equity block trades further burnishes its credentials in institutional equities, building on its presence in ETFs and electronic trading. Other notable initiatives this year include launching 24-hour equities trading five days a week, going live with OTC options trading and fleshing out its institutional e-trading offering.

“We want to be as successful in high-touch voice execution as we are electronically,” said Esposito. “The objective is to seamlessly meet our clients wherever they want to transact.”

Top 10

In fixed income, where Citadel Securities has long been a top marketmaker in Treasuries and swaps, the firm is now one of the top 10 primary dealers in Germany’s Bund issues auction group and plans to enter France too. That has run alongside a rollout of euro and sterling interest rate derivatives trading.

Elsewhere, Citadel Securities says it has gained ground with its biggest clients in US corporate credit and estimates it has a 15% market share in block trades larger than US$5m and longer than seven years' maturity. It has also started offering “grey market” trading for newly issued bonds.

“We don’t have a strategic plan to be all things to all people,” said Esposito. “How do we decide to enter a new market? We’re always guided by a client need, a client problem, a client constraint. If a client need isn’t being met and we have something differentiated to offer, we enter. And when we enter, we play to win.”

All the while, Citadel Securities’ meticulous development of systems, technology and infrastructure has provided the foundations to process the deluge of client flows that have arrived during the various bouts of volatility that have erupted in recent years.

In April, at the height of the “liberation day” tariff turmoil, Citadel Securities absorbed a record of roughly US$1.4trn of gross trade volume in Treasuries on one day – nearly double the previous peak of activity it handled in 2023 around the collapse of Silicon Valley Bank. Overall, its rates trading desk executed double the trading volume in April than its previous monthly record – and with a much higher trade hit ratio.

“Whether it's 'liberation day' or Silicon Valley Bank in 2023 or Covid in 2020, whenever we see these giant spikes in client volume, setting new records each time, we’ve been able to handle those seamlessly and ensure our clients get the same level of service when markets are choppy as when markets are calm,” said Matt Culek, chief operating officer.

He said the firm builds its systems to handle three times the previous record in volumes as a minimum standard. “We built the platform to naturally scale as the market moves and volumes increase exponentially, as we’ve seen over the past five years,” he said.