Restructuring Adviser and EMEA Restructuring Adviser: Houlihan Lokey

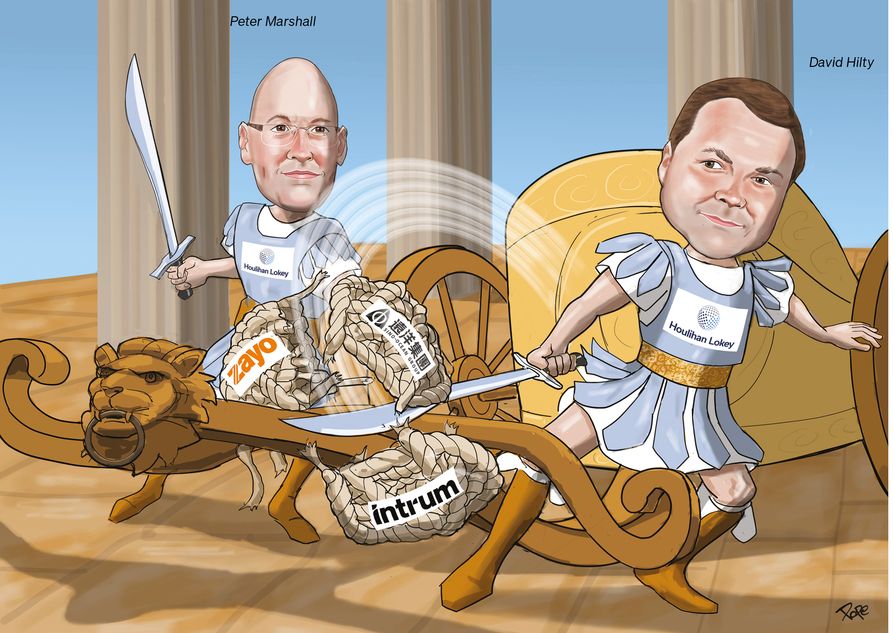

Unpicking Gordian knots

Debt restructuring often relies on making use of domestic legislation to implement deals but Houlihan Lokey’s international approach came to the fore in 2025 as it crossed boundaries to solve some of the trickiest restructuring conundrums. It is IFR’s Restructuring Adviser and EMEA Restructuring Adviser of the Year.

Houlihan Lokey led the way in addressing one of the world’s biggest debt restructuring issues: the workout of China’s real estate companies, the vast majority of which have been unable to raise fresh debt since the outbreak of the pandemic.

In 2021 it staffed its offices in Beijing and Hong Kong with 20 experts in the field so it was best positioned to advise debtors on such issues. That first-mover advantage paid off with the firm advising seven distressed Chinese property companies this year.

It had been slow work. Onshore creditors, largely state-owned banks, have been reluctant to recut their lending agreements and offshore creditors have reached only temporary arrangements to amend and extend debts owed to them.

That changed in 2025, when Houlihan Lokey advised state-owned Sino-Ocean on a comprehensive transaction that saw it make use of an English law restructuring plan, in conjunction with a Hong Kong scheme of arrangement, to impose a more lasting deal on its creditors.

The transaction targeted US$6.3bn of offshore debt. There was initial resistance from some creditors holding these liabilities. But the company had sufficient backing to be able to impose the deal across its debt stack after the English restructuring plan was approved.

Under the deal, the offshore debt was reduced by two-thirds to US$2.2bn and the maturities extended by eight years. Creditors received mandatory convertible bonds as well but crucially it left the state-linked shareholders, China Life and Dajia Life, in charge of the Hong Kong-listed company.

Brandon Gale, head of Asia restructuring at Houlihan, called it a “remarkable outcome” for the company. “It was a deal that evolved the market,” he said. And one that will help in its mandates for other distressed debtors.

Unlike other situations involving Chinese property companies, in which bondholders have obstructed more long-term solutions, banks held a larger proportion of the debt stack, enabling the English restructuring plan to be a more viable route to pursue, Gale said.

Swedish shuffle

Another situation in which Houlihan was pivotal, using its knowledge of international methods of implementing controversial restructurings, was for Swedish debt collector Intrum. Again, Houlihan was retained in the plum role advising the company.

Manuel Martinez-Fidalgo, co-head of financial restructuring for Europe, the Middle East, Africa and Asia, said the negotiations were framed by the creditor base, comprising €4bn of bonds and €1bn of bank loans, being split between longer and shorter-dated liabilities.

Holders of the debt coming due more imminently wanted to delay any transaction so they could simply receive their repayments first rather than face a uniform treatment across the creditor stack. Houlihan managed to play off both parties to impose an agreed deal.

It helped that this could be executed in a prepackaged agreement using a Chapter 11 process in the US, where Houlihan has strong experience. This happened at the same time as a restructuring plan was carried out using a new and relatively untested Swedish mechanism.

“Working as a crossborder team is second nature to us,” said Peter Marshall, co-head of financial restructuring for EMEA and Asia. “It has been a prevalent feature of deals this year. We are on track to have our busiest year outside the US and have been on all the biggest deals.”

Another landmark transaction was packaging company Ardagh’s US$4.3bn debt-for-equity swap. Founder Paul Coulson and other shareholders received US$300m in return for giving up control of the business to senior creditors, including Arini Capital.

That was a notable upending of the creditor hierarchy, which Marshall called “groundbreaking”. It took two years to complete, with the first step seeing Apollo provide a super-senior €750m facility to allow the company to repay its 2025 maturities and work out a longer-term solution.

Shareholders were given a dowry to walk away from the business. The senior secured noteholders who took control of the business also lent fresh money to refinance the Apollo loan.

“The past year has seen a lot of large deals, which are global in nature,” said David Hilty, global co-head of restructuring, who worked on the Intrum and Ardagh deals. “We are the best positioned for this. We operate as one global group in restructuring.”

Saving Zayo

Among the biggest transactions in the US, Houlihan advised an ad hoc group of lenders and noteholders with 90% of Zayo Group Holdings’ US$8.6bn debt on the company’s amend-and-extend transaction.

“As I think about liability management transitioning, from being very aggressive to consensual, Zayo is great example of a win-win transaction,” said Alex Raskin, managing director at Houlihan. “Everyone was focused on what was the right thing for the business and what was the best way to implement it without squeezing one side or the other.”

Zayo, a fibre-based communications infrastructure company, was looking to build its North American business with a US$4.25bn acquisition of Crown Castle’s fibre assets but faced a maturity wall in 2027 and 2028.

Pushing out the maturities beyond 2030 would give the company the capacity to make the acquisition without being hamstrung. While Zayo, EQT Partners and DigitalBridge ultimately entered a consensual transaction with creditors, the initial approach was punchy.

They approached lenders looking for a maturity extension and discount on the debt. “It was an aggressive opening salvo,” Raskin said.

Houlihan negotiated and structured an out-of-court transaction that included a maturity extension across all tranches of Zayo debt, with a US$2bn paydown for participating lenders, a par exchange into new securities, and enhanced economics and collateral on exchanging debt. Some 99% of lenders participated.

Creditors holding senior secured debt extended maturities by three years to March 2030. Secured lenders received pay-in-kind interest of 50bp before March 2027 that stepped up to 200bp after, ESG lenders were enticed into the primary first-lien tranches and all secured holders received a 75bp PIK fee.

Unsecured creditors were able to up-tier a portion of their debt to secured with the remainder exchanged into second-out priority first-lien with an interest rate step up of 300bp to March 2027 and 700bp after. The unsecured holders received a 50bp PIK fee.

Creditors also negotiated tighter debt documents with an anti-LME covenant. “On a blended basis we got a fairly attractive deal,” Raskin said.

Elsewhere in the US, Houlihan advised creditors on AImbridge Hospitality’s comprehensive out-of-court restructuring and Saks Global Enterprises’ capital structure revamp following its acquisition of Neiman Marcus.

For the latter, a Saks Global subsidiary issued US$600m of senior secured asset-based notes for cash, intercompany loans, including a first-in-last-out asset-based credit facility and term loan credit facility, and carried out an exchange offer, in which 98% of bondholders participated.

Houlihan advised other retailers including The Container Store Group as it restructured in Chapter 11; and Claire’s Stores. It also advised creditors of restaurant chains Hooters and TGI Fridays.

The firm also continued to act for Dish Networks after its “marquee” liability management exercise in 2024.

Jonathan Cleveland, managing director, reckons this is the third year of a super-cycle for restructuring, and Houlihan’s revenues from this area in the last 12 months to the end of September are at a record high. “We've continued to grow, continue to succeed and prosper,” he said.