SSAR Issuer: Mexico

On the cutting edge

Mexico has long been a trendsetter among emerging market sovereign issuers, and it elevated that role in 2025 through bold, early execution, structural innovation and record-setting deal sizes across markets. A landmark euro benchmark, pioneering P-Caps and smart market timing underscored the sovereign’s strategy in 2025. Mexico is IFR’s SSAR Issuer of the Year.

By sheer scale alone, Mexico stood head and shoulders above its emerging market sovereign peers in 2025 when it raised nearly US$44bn in global debt markets across different currencies – the equivalent of about a quarter of all Latin American corporate and government crossborder issuance during what was a record volume year for the region.

That is an impressive amount at any time, but especially so in a year that did not necessarily bode well for Mexico as the incoming administration of US president Donald Trump hiked tariffs across the globe, including its neighbouring trading partners.

Yet the country’s funding forays were not driven by blind borrowing to plug fiscal gaps – just US$12.7bn of the total was new financing. Rather, they were part of well-thought-out strategies to optimise funding costs and, perhaps most importantly, tackle state-owned oil company Pemex’s lingering debt problems, without damaging the government’s finances.

“It was a record year,” said Paula Espinosa, general director of financial operations at the Ministry of Finance. “It is only a great team that could achieve this.”

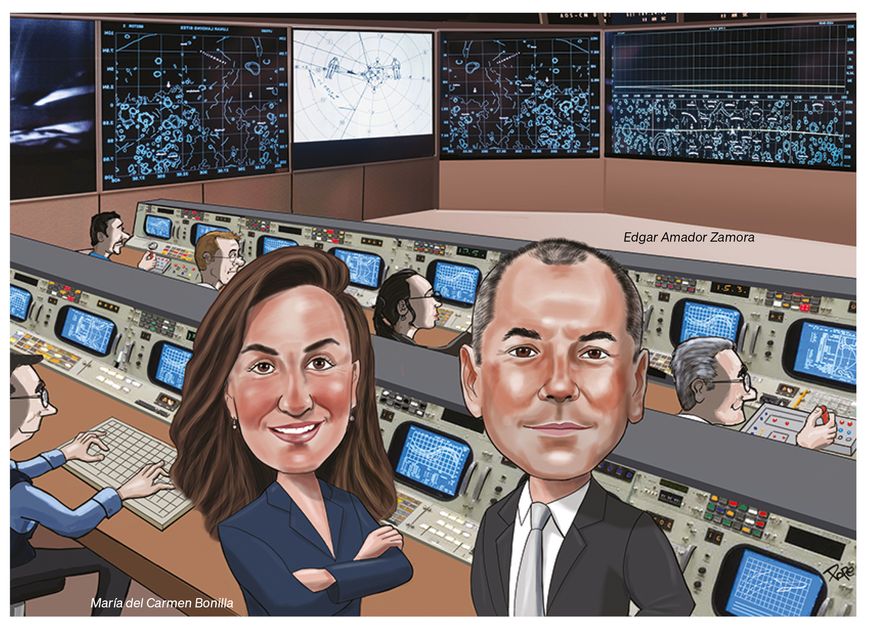

Under the leadership of secretary of finance Edgar Amador Zamora and undersecretary Maria del Carmen Bonilla, Mexico burnished its reputation as a market-savvy borrower when investors were on tenterhooks over policies coming out of Washington.

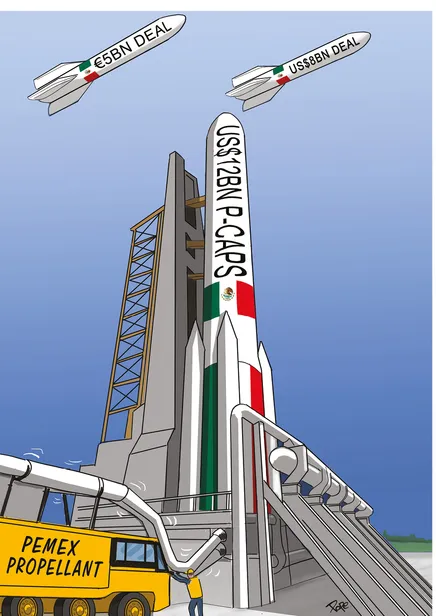

Pioneering P-Caps

The country not only brought its largest vanilla bond deal ever in January, but later in the year it sold the biggest euro trade from an EM borrower. Arguably, though, the most consequential development of 2025 was Mexico’s issuance of pre-capitalised securities, marking the first time any sovereign had used such a structure.

“Mexico is not afraid to adapt and improve upon practices existing elsewhere, such as the P-Cap concept. They are very sophisticated; they are leading the way,” said Jorge Ortiz de la Pena, head of LatAm loan syndications and Mexico DCM at Bank of America.

P-Caps are commonly used by highly rated insurance companies as a form of standby credit that stays off the balance sheet unless the borrower needs to raise cash. And Mexico cleverly extended their use to suit its needs.

The US$12bn July issuance of P-Caps – Mexico’s largest transaction on record and one of the biggest single-tranche deals ever in the dollar market – became a turning point in the government’s plans to fix Pemex’s financial profile.

Proceeds were invested in Treasury strips through an SPV, creating collateral for a Pemex liquidity facility that enabled the company to refinance bank loans and revolving credit lines. At the same time, the structure allowed Mexico to avoid recognising the debt on its books unless certain events occurred – such as Pemex failing to return the Treasuries or equivalent cash to the SPV.

After issuance, the P-Caps traded up, Pemex spreads compressed and the government completed repayment of Pemex’s 2025–26 revolving credit lines, achieving the first stage of its multi-year stabilisation plan for the debt-laden oil company.

Yet the significance of the P-Cap issue extended beyond Pemex. The precedent-setting framework now offers a template for sovereigns seeking tools to manage contingent liabilities, similar to how earlier Mexican innovations – such as collective action clauses and switch tenders – eventually became global norms.

“We are not afraid to innovate," said Espinosa, but only after careful planning and preparation.

For the P-Cap offering, which required extensive cross-government coordination, the team spent months anticipating investor questions and concerns. “If it takes a year to be ready to execute it, we do it, because if we do it, we do it right,” she said.

The ministry also made a habit of updating investors, explaining the sequencing of the Pemex strategy, the rationale for the structure and the implications for the sovereign balance sheet. That clarity contributed to the compression seen in both Pemex and sovereign curves after the P-Cap sale.

“Their level of preparation is remarkable,” said Marcelo Delmar, head of Latin America debt capital markets at SMBC.

Market setter

Public credit officials also showed their skills at market timing and deal execution during increased nervousness over how Mexico might fare under the new Trump administration.

The year began with one of Mexico’s most decisive moves: an US$8.5bn three-tranche US dollar offering on January 6 that opened the global issuance calendar. At the time, the deal was the largest single-day transaction in the country’s history, and it secured more than half its annual external funding needs in one session amid uncertainty around potential US tariffs.

“They’re on calls on December 31 at 8pm making sure every detail is ready," said Delmar. "That’s why they can move first — and why the market trusts them.”

That level of readiness allowed Mexico to seize windows of opportunity that are too narrow for most issuers.

“We always try to do things ahead when we see possible volatility that could affect us,” Espinosa said. “That gives investors confidence that we are ready and that we will do it in the best possible way.”

Weeks later, the sovereign executed a second major transaction, this time in euros. The €2.4bn dual-tranche deal, split between eight and 12-year maturities, tapped strong demand from European investors who wanted exposure to one of EM’s top sovereign names.

Together, these early operations underscored Mexico’s role as one of the few EM sovereigns capable of placing size at will across dollars and euros.

Landmark euro deal

Mexico’s final major deal came in mid-September with a €5bn three-part benchmark, its largest EM sovereign euro deal on record.

The 2029, 2034 and 2038 tranches attracted broad participation from global EM investors and selective investment-grade accounts. The size and quality of demand reaffirmed Mexico’s ability to mobilise international liquidity, even deep into the calendar year.

The following day, Mexico returned to dollars with an US$8bn three-tranche offering designed to accelerate the consolidation of Pemex liabilities.

Combined demand across euro and dollar offerings exceeded US$50bn, reinforcing the global depth of appetite for Mexico risk. Both deals helped extend maturities at Pemex, smooth its debt profile and contributed to ratings upgrades for the energy firm.

By year-end, nearly all 2026 Pemex maturities had been addressed through either the P-Caps or the September refinancing. The operations strengthened the sovereign curve, clarified the scale of remaining support and anchored expectations around Mexico’s fiscal strategy heading into 2026.

Magic mix

Mexico’s 2025 funding year did more than accumulate milestones. It delivered a blueprint for EM sovereigns seeking to combine innovation with scale while maintaining fiscal prudence. Espinosa described the strategy as rooted in long-term habits: transparency, preparation and constant dialogue with investors and rating agencies.

Officials said the results – tighter spreads, strong books, diversified buyers and effective refinancing – were the product of institutional design rather than short-term tactics. Early issuance, liability management, currency diversification and structural innovation are practices honed over decades. Investors responded accordingly, rewarding Mexico not only for what it issued but for how it issued.

“Sometimes when things are done well and they are done well consistently, people lose the notion of the difficulty, the skill and the degree of decisiveness and alacrity that Mexico has in executing these transactions,” said Delmar.