Latin America Bond House: Bank of America

Mastering the complex

Bank of America combined structuring ingenuity with deep regional coverage to lead some of Latin America’s most complex transactions. With steady top-three league table presence, dominance in Mexican sovereign issuance, breakthroughs in local currency formats and debut access for difficult credits, it is IFR’s Latin America Bond House of the Year.

Latin America’s bond market surged to record volumes in 2025 as issuers leaned into strong demand and tight pricing to stay ahead of upcoming maturities, with Mexico dominating regional supply and accounting for nearly 30% of issuance.

In an environment that reopened the door to high-beta names and complex structures, Bank of America distinguished itself by steering transactions that defined the year. The bank maintained a solid presence among the region’s top-three bookrunners and global coordinators, capturing around 10% market share and executing 42 transactions through the IFR Awards period.

Yet its defining contribution lay in leading deals that demanded structural innovation, sovereign engagement and the ability to deliver technically demanding formats.

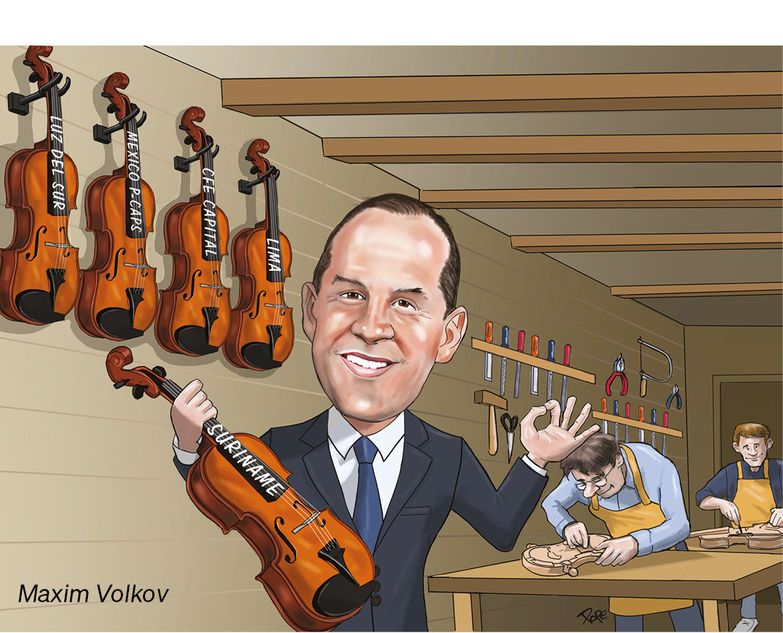

Maxim Volkov, head of Latin America debt capital markets at BofA, said that while a large portion of Latin America’s league table activity stems from balance sheet-driven corporate lending, BofA takes an alternative approach.

“Our business is different. We focus on trades that require structuring expertise, ratings expertise, innovation and many months of preparation," he said.

That philosophy defined the bank’s work on the most innovative sovereign-linked structure of the year: Mexico’s pre-capitalised securities transaction in July. The US$12bn securities-lending mechanism – the first of its kind outside the US – required adapting an insurance-sector technology to sovereign needs and crafting a multi-layered instrument with contingent risk transfer, treasury lending and Pemex-linked exposure. Investors embraced the structure with minimal handholding, producing demand in the tens of billions of US dollars and setting a template that is being studied by other sovereigns.

The bank was active bookrunner or global coordinator for a large portion of the Mexican sovereign’s crossborder issuance, guiding the country through one of its most ambitious funding programmes. That included September’s euro-denominated benchmark, the largest ever euro deal from Latin America, which broadened Mexico’s investor base and reinforced its standing among global reserve currency buyers.

“Mexico gave us more than 80% of their business this year,” said Volkov. “That speaks to trust, sophistication and our execution across every part of their funding programme.”

BofA also helped steer Mexico’s liability management agenda, supporting tender and exchange operations that collectively addressed tens of billions of US dollars in bank and bond maturities while helping stabilise Pemex’s near-term profile and affirming Mexico’s sovereign ratings.

Innovation did not stop at P-Caps. BofA also led a US$725m bond due 2040 from CFE Capital’s Fibra E, the first Mexican energy and infrastructure REIT-like vehicle backed by transmission revenues. Its inaugural international bond was anchored by the IFC as a cornerstone investor. The deal blended corporate, structured finance and sovereign-linked elements, attracting deep crossover demand and creating a replicable model for infrastructure monetisation in the region.

Similarly, the bank engineered a US$580m debut bond due 2033 for El Salvador state-owned hydro power company CEL, the country’s first non-sovereign international issuance in a decade. Using a New York law sovereign guarantee and a carefully crafted disclosure approach suitable for a government-controlled utility lacking fully internationalised financial statements, BofA unlocked 4.6 times subscription and brought a challenging credit to the market.

BofA was equally dominant in the region’s local currency international markets, particularly the Peruvian sol. It led important sol transactions for Alicorp, Municipalidad de Lima and Luz del Sur, reinforcing its role as the main intermediary between Peruvian issuers and global local currency demand.

Lima's transaction showcased BofA’s technical depth. The bank helped build a trust worth S1.545bn (around US$548m now) backed by dedicated tax revenues, creating a ringfenced structure that insulated the bonds from the city’s broader finances. That was essential for a Peruvian issuer, which would have otherwise struggled to tap offshore demand. With this structure, the 20-year sol-denominated notes drew a nearly twice subscribed order book from global investors.

“We took a purely local law Peruvian structure, flew the notes to New York, deposited them with DTC, and made them work for international investors,” said Carlos-Ivan Lopez, BofA's head of DCM Andean, South and Central America. “Nobody had ever done that before.”

Another of BofA’s notable contributions was bringing new or long-absent issuers to market. Beyond CEL, the bank helped Peru’s Luz del Sur achieve a successful debut in Peruvian sol, supported by multi-notch rating upgrades through BofA’s advisory work. It also led Suriname’s dramatic return to the market as sole bookrunner on a dual-tranche US$1.575bn deal that attracted US$4bn in orders and marked a turning point after the country’s 2023 restructuring.

“We bring ideas, structure and execution. These are not Friday-to-Monday flow trades,” Lopez said.