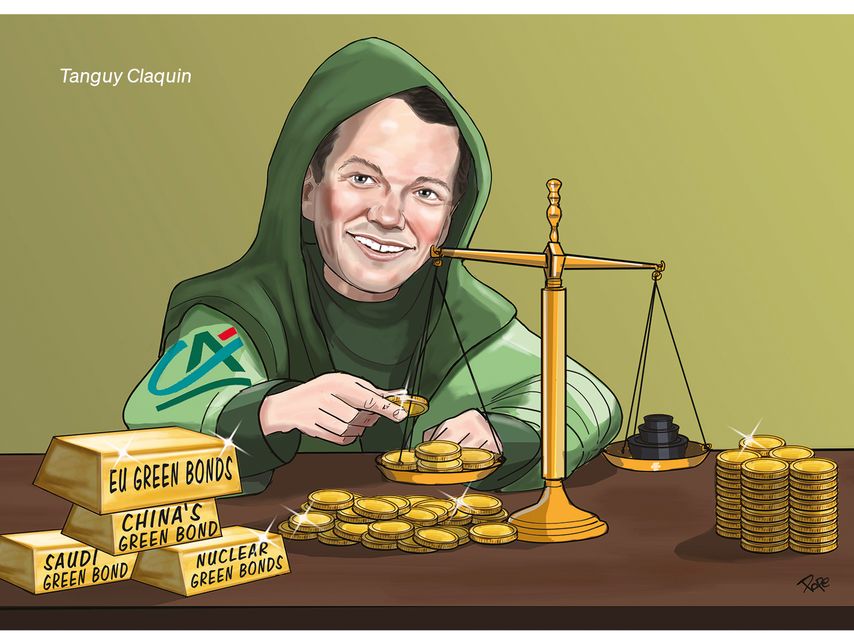

EMEA Sustainable Finance House: Credit Agricole CIB

Gold standard

For its notable market share gains in 2025, its leading role in establishing the new dark green European Green Bond, the first statutory ESG bond, and a host of nuclear green and biodiversity landmarks, Credit Agricole CIB is IFR’s EMEA Sustainable Finance House of the Year.

Credit Agricole CIB closed the gap strikingly on its ESG financing arch-rival in 2025. By the time the IFR Awards year concluded in early November, the French bank was just US$2.2bn-equivalent behind its compatriot BNP Paribas in ESG bond issues in Europe, Middle East and Africa, according to LSEG data – compared to the US$9.7bn disparity between them at the end of 2024.

This striking performance saw CACIB add as much as US$3bn to its EMEA ESG bond sales in the first 10 months of the year versus its full-year 2024 performance. This translated into a hefty 1.5 percentage point year-on-year gain in market share when every other member of the region’s 2024 top five lost ground on this measure.

Indeed, so close were the top two on LSEG's numbers that other data providers actually put CACIB in top spot – for the first half of the year at least. “This year we are back on the number one position as a global arranger of green, social and sustainability bonds. That's something that we have not seen for [several] years,” said Tanguy Claquin, global head of sustainability.

He also lauded the bank’s four consecutive years of being the top-ranked agent for green and sustainability-linked loans.

CACIB’s leadership was on display at the start of the year as the first issues emerged under the European Union’s new European Green Bond legislation, which had come into force in the market doldrums of late December 2024. The bank was sustainability adviser to the two inaugural EuGBs in January – for Italian utility A2A and French public sector agency Ile de France Mobilites.

“Whenever you have a new product to be brought to the market, clients turn relatively naturally to the banks they believe are the real experts in terms of sustainable finance for their inaugural transactions. They want to make sure that they have the best advice possible,” said Laurent Adoult, head of sustainable banking for FI & SSA Europe.

The assignments’ “extensive work and dialogue” included ensuring that the pioneering deals’ fact sheets were “really in line” with regulators’ expectations.

CACIB was lead manager on nine of the first 10 EuGBs – all the new format’s substantial deals, only missing out on the sixth, a €20m microbond for Latvian utility Rigas udens.

Its deals included the first financial institution EuGB, for ABN AMRO; the largest in any sector, for the European Investment Bank; and the first for a non-EU issuer, Norway’s Hydro.

CACIB also introduced a notable innovation on the ninth EuGB, for Covivio. To reassure buyers with investment mandates requiring them to hold bonds meeting the voluntary Green Bond Principles administered by the International Capital Market Association, it added an audit report by KPMG as a side letter to the French real estate credit’s deal. This confirmed its alignment with the GBPs.

The emerging nuclear green sector was one of the bank’s other cutting-edge areas of focus. Its breakthroughs included structuring adviser roles for the first nuclear green bond from a financial institution, First Abu Dhabi Bank’s US$750m “low-carbon energy” issue, and the first to include UK nuclear assets, EDF’s €500m note in a €2.25bn triple-trancher, as well as the first in Asia, a HK$1.166bn (US$150m) offering for Korea Hydro & Nuclear Power.

CACIB also led the first nuclear EuGB, for Finland's TVO in September.

“We keep on trying to bring new ideas and new solutions,” said Claquin.

Other innovations included the introduction of biodiversity key performance indicators such as fish health/welfare on a green/blue financing framework and €2.6bn sustainability-linked revolving credit for Norwegian fish producer Mowi; regenerative agriculture sourcing on a sustainability-linked financing framework and €500m RCF conversion for Italian food company Barilla; and protected areas in terrestrial ecosystems for Chile’s sustainability-linked bond framework.

Bookrunner roles on Saudi Arabia’s €1.5bn debut green bond and Slovenia’s landmark €1bn sustainability-linked bond – IFR’s Sustainable Bond of the Year – led the bank's other sovereign highlights.

CACIB maintained its streak of having participated in all green bonds issued by both France and Italy, according to Adoult.