Asia Pacific Sustainable Finance House: Credit Agricole CIB

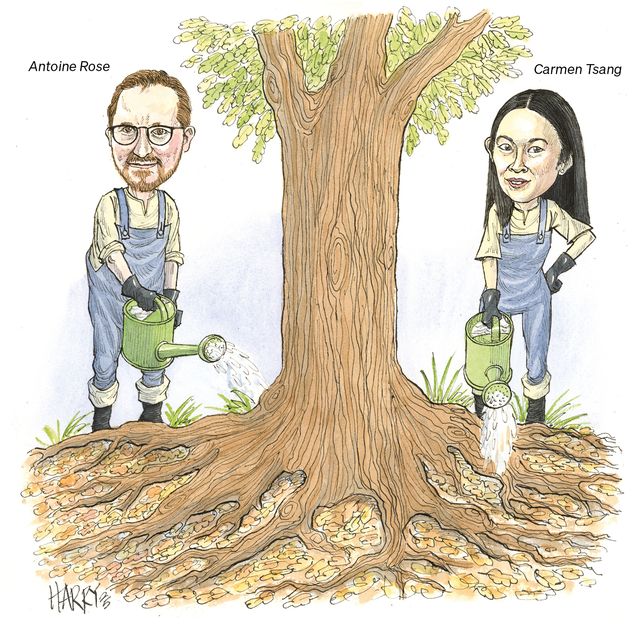

Strengthening roots

As many international banks pulled back from ESG financing, Credit Agricole CIB stayed true to its principles and strengthened its leadership position, making it IFR's Asia Pacific Sustainable Finance House of the Year.

Credit Agricole CIB structured Asia Pacific’s most significant ESG deals in 2025, breaking new ground and showing continued leadership as some banks faded away.

“This has been a year of discussion about the future of ESG,” said Antoine Rose, CACIB's head of sustainable banking for Asia Pacific and the Middle East. “We have been able to grow our market share and positioning thanks to the bank’s persistent strategy to put sustainability as a core pillar as well as the commitment and stability of the team.”

When China’s finance ministry made its offshore green bond debut, a Rmb6bn (US$846m) dual-tranche deal in April, CACIB was the only foreign bank to be picked as green structuring adviser. It was also joint green and sustainable structuring adviser for the Hong Kong government’s simultaneous green US dollar, euro and Dim Sum offering in June.

While some companies in the region have downplayed green angles in recent issues, due to the pushback in the US, CACIB's deals have continued to use ESG as a selling point.

“Our clients still value ESG labels,” said Carmen Tsang, the bank's head of sustainable investment banking for Greater China. “They see the intrinsic value of going through this reality check. It can also help them see how ready they are for global regulations.”

That was true even when some deals pushed the boundaries of the usual ESG categories. In March, CACIB was dealer for Korea Hydro & Nuclear Power’s HK$1.166bn (US$144m) three-year green nuclear bond, the first international deal with that label in Asia Pacific. By testing market appetite with a relatively small group of investors, KHNP gained the confidence to bring a larger US$500m green nuclear deal in Taiwan’s Formosa market in July, again helped by CACIB.

Then in October, the French bank brought Tokyo Metropolitan Government to the euro market for the world’s first internationally certified resilience bond, with proceeds earmarked for uses like managing rivers to avoid floods, strengthening levees to resist earthquake damage and preventing landslides.

“The competitive landscape has changed, but we have stayed consistent,” said Tsang. “We have supported some of our clients to reconfigure as they expand in the green economy.”

That includes companies in carbon-intensive industries like shipping, aviation and cement production. ESG ship finance has been slow to develop in Asia, but CACIB structured an US$80m green loan for Taiwan’s Evergreen Marine to finance methanol dual-fuel containerships. A €500m green loan for a subsidiary of Taiwanese cement company TCC Group Holdings funded reductions in carbon emissions and the development of clean energy, while the bank arranged a sustainability-linked aircraft financing for the Philippines’ Cebu Pacific, the first for a low-cost airline in South-East Asia, and a sustainability-linked loan for CDB Aviation.

CACIB was at the forefront of the ESG financing trend for data centres, working as sustainability structuring agent for AirTrunk’s S$2.248bn (US$1.74bn) green loan, one of the first to align with the industry-specific criteria of the Singapore-Asia taxonomy for sustainable finance.

The bank structured deals to match the latest regional and international taxonomies to maximise investor interest and make deals easier to market – not easy in a fragmented region like Asia Pacific. It was sole green structuring adviser when Industrial and Commercial Bank of China’s Singapore branch raised a Rmb3.5bn carbon neutrality-themed Dim Sum in August, the first international green bond from a Chinese bank to align with the multi-jurisdiction common ground taxonomy.

This ESG expertise also helped the bank win business in new markets. Its green structuring adviser role on Victoria Power Network’s debut green bond in October marked the first time CACIB had been hired for an onshore corporate bond deal in Australia.

“Our continuous engagement with clients has never stopped,” said Rose. “Asian issuers are taking a long-term view towards ESG and they know they need an experienced partner like us.”