SJM bets on loan extension

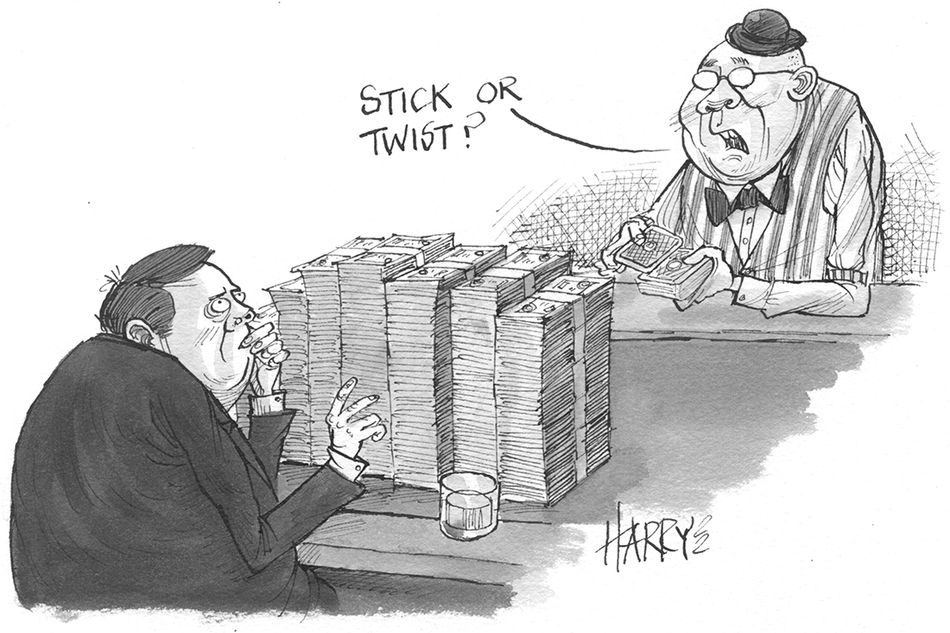

Casino operator SJM Holdings is extending a HK$25bn-equivalent (US$3.2bn) syndicated loan that matures on February 28 rather than refinancing the deal, after Macau’s government released details of a highly anticipated gaming bill that lifts the clouds of uncertainty over the sector.

SJM is seeking unanimous consent from lenders to extend the facility for one year to February 2023, after being unable to draw down on a new financing that had been in the works since the middle of last year due to pending government approvals.

Lender appetite for the extension could benefit from the biggest reform of the territory’s gaming sector in 20 years, unveiled by the Macau government on January 17.

“The proposed bill is not as rigid as the market had earlier expected,” said a Macau-based loan banker. “It addresses the market’s biggest concern over the number of gaming licences.”

The proposed changes, which need approval from legislators to become law, will retain the limit on casino licences to six, with the licence term halved to 10 years.

There will also be curbs on junkets – trips and accommodation provided to high rollers. If approved, casino operators will no longer have dedicated junket rooms, and revenue sharing arrangement between junkets and concessionaires will be banned.

The government has also proposed a formal cap on the number of casino tables and gaming machines in the local market, and a minimum annual target of gross gaming revenues that the city’s six operators will have to meet.

The licences of the six operators, Wynn Macau, Sands China, MGM China Holdings, SJM Holdings, Galaxy Entertainment Group and Melco Resorts, are all due to expire in June. All existing or potential new operators will need to apply through a new tender process.

Alleviating the pain

The proposal comes as a huge relief for market players suffering from the impact of the pandemic and fears of a broader clampdown on gambling in Macau following the arrest of junket operator Suncity Group’s chairman, Alvin Chau, last November.

“The arrest came as a huge blow as there were fears of a more heavy-handed crackdown on the entire sector,” said a second Macau-based loan banker. “Then we saw a wave of VIP gaming room closures, which means gaming revenues of some of these casino operators will be hit. At least we know we have gone through the worst times now.”

A plan to introduce government representatives to monitor the daily operations of the gaming firms is no longer part of the proposed changes, which Nomura described in a credit commentary as “positive for market sentiment, considering investors had linked the proposed government supervisions to the regulatory crackdown on the China technology sector”.

Furthermore, Nomura also said that it does not expect new entrants to replace the existing players, given the limited time for the re-tendering process and the shortened licence duration.

Moody’s said that it expects the six operators to retain their concessions as “non-renewal of any of the concessions would pose substantial risk to government finances and economic stability in Macau because of the significant amount of employment the industry generates”.

Loan extension

Industrial and Commercial Bank of China Macau branch is coordinating the extension of SJM’s HK$25bn-equivalent facility. Lenders agreeing to the company's request receive a 10bp extension fee and an additional 5bp as early-bird fee for doing so by the end of January.

“We are working on the extension of the syndicated bank loan, awaiting government approval,” SJM said in an emailed statement, without specifying the timeline.

SJM had originally planned to refinance the jumbo loan with a new HK$19bn-equivalent six-year financing. Relationship banks had committed to the facility, but SJM was unable to draw down the loan as government approvals dragged on for months.

The borrower is still pursuing the HK$19bn-equivalent borrowing and seeking a review and approval from Macau’s Gaming Inspection and Coordination Bureau on certain definitions of the gaming area in the loan agreement, since SJM is planning to relocate some table games to its Grand Lisboa Palace resort from its other casinos, according to bankers with knowledge of the situation.

The maturing HK$25bn-equivalent borrowing was signed with 17 banks in 2016 and had backed SJM's construction of the Grand Lisboa Palace, which finally opened its doors to the public last July after repeated delays.