Vietnamese brokers head offshore

A number of Vietnamese securities firms are ramping up fundraising in the offshore loan market as the country’s booming stock market and strong economic performance attract lenders starved of deals.

Viet Capital Securities is in the market for a US$150m one-year loan, while Techcom Securities is set to launch a financing. They follow Vietnam’s biggest securities firms including SSI Securities, VNDirect Securities and Ho Chi Minh City Securities that have raised a combined US$249m from loans in recent months.

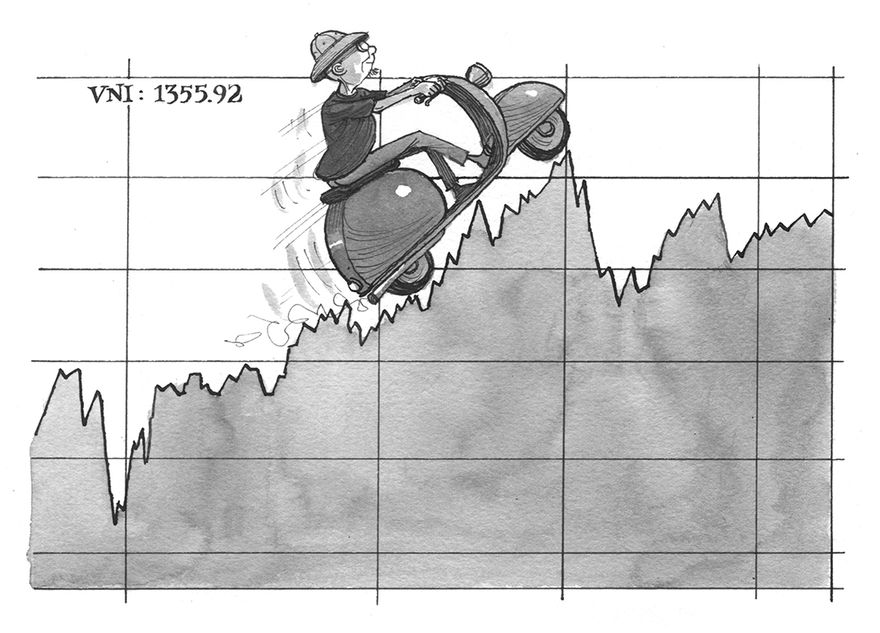

Vietnam’s stock market has been on a tear since last year with stock indices at 20-year highs. The country’s benchmark VN-Index on the Ho Chi Minh Stock Exchange has gained around 22% since the beginning of 2021, hitting a historic high of 1,424 points in July, making Vietnam the top-performing stock market in Asia Pacific.

“We believe Vietnam’s securities sector is a promising one as the country’s stock market has continuously recorded new historical highs this year, and there is still huge growth potential, driven by the strength of corporate earnings, as well as rising demand and liquidity,” said a senior banker at a Taiwanese bank.

Vietnamese securities firms are venturing offshore for funding after tapping onshore resources such as domestic banks, some of which are now close to their single-borrower limits and unable to lend more.

Liquidity in offshore markets is abundant as international lenders remain hungry for assets. This is evident from the reception for Vietnamese bank borrowers, which are poised to set a new annual record for offshore loan volumes for the country’s financial institutions.

Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank) is in the market with a US$1bn one-year loan, barely a month after wrapping up one of Vietnam’s largest loans for a bank borrower. (See Vietnam Syndicated loans.)

The booming stock market is increasing the need for capital at securities firms.

“There has been a huge demand for brokerage and specifically margin lending services, so if you see the numbers for margin lending, it has really jumped percentage-wise over the last 12 months,” said a Singapore-based loan banker.

Short tenors

The securities firms borrow in short tenors, typically one year or less, which suits the international lenders as this limits risk in an uncertain environment marked by rising numbers of Covid-19 infections.

One-year loans for SSI Securities and VNDirect Securities are good examples. Earlier this month, both increased US$50m loans to US$118m and US$87m, respectively, after attracting 10 lenders each. VNDirect’s deal was its offshore syndicated loan market debut.

In contrast, Ho Chi Minh City Securities was forced to cut the size of a three-year loan to US$44m from US$50m in May after struggling to attract lenders during a six-month syndication process.

“The rationale for not pushing anything longer than one year is the purpose for which they want the loans. The nature of their business in general is very short-term, for investments in bonds, shares, and margin lending,” said the Singapore-based loan banker.

For Vietnamese borrowers, raising a one-year loan offshore is also less cumbersome as they do not need to spend time on registering with and obtaining approval from the State Bank of Vietnam, which regulates offshore borrowings.

Future prospects

This year Vietnamese borrowers have been raising offshore loans at pace, clocking up US$4.37bn in loan volumes so far, which is a 158.5% jump year on year, according to Refinitiv LPC data.

The heavy deal flow is taking a toll on some lenders, which have been supportive of Vietnamese credits in the past few years, but are now turning selective as they risk breaching country limits, according to another Taiwanese banker.

Some lenders are also concerned about the recent rise in Covid-19 cases in Vietnam and worry that extended lockdowns may weaken consumption and investment, hampering growth prospects.

Last week, the Asian Development Bank issued a report revising down Vietnam's 2021 GDP growth forecast from 6.7% to 3.8% due to a resurgence of the pandemic that has tightened the labour market, lowered industrial output, and disrupted agricultural value chains.

“Our risk appetite for securities firms is changing very quickly as the latest wave of the Covid-19 on a large scale has been raising concerns among investors about difficulties in production and business activities, which would harm stock market and economic development,” said a third loan banker in Taiwan.