Chinese property developers with more than US$25bn falling due in the next 12 months are facing an uphill battle to refinance the debt as offshore lenders remain unconvinced that Beijing’s efforts to rescue the ailing sector are working.

Declining home sales as well as the steep haircuts and unfavourable restructuring terms offered to offshore creditors by some developers that have defaulted on their debt have shaken the confidence of bank lenders.

In addition, offshore lenders are concerned that unsecured lending would be subordinated to secured onshore loans.

“The unsatisfactory loan recoveries seen in some offshore debt restructurings have made offshore lenders wary of the risks,” said a Hong Kong-based loan banker. "When our credit committee asks about the repayment source for the offshore loans, there is no justifiable answer, because these loans are not backed by any cash-generating assets.”

As a result, even large developers or those with links to Chinese state-owned firms such as China Jinmao, Joy City Property and Longfor Group are facing delays in raising the funding needed to address looming debt maturities.

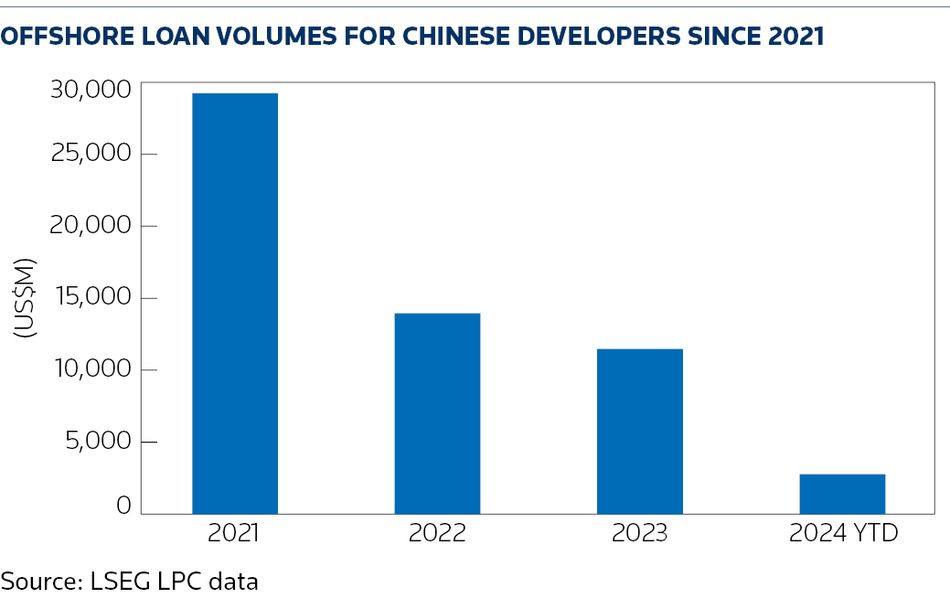

The trio is raising at least US$1.6bn-equivalent combined, while China Merchants Land and Shui On Land are also said to be in refinancing talks for offshore loans. The slew of deals will add to lacklustre activity this year that has clocked only US$2.76bn in offshore loans for China’s property sector.

Slow progress

Privately owned Longfor is raising a HK$3bn (US$384m) five-year loan to partially refinance a much larger HK$8.75bn syndicated borrowing maturing in January next year.

“Longfor has good cashflows, but some existing banks will exit the loan as they aim to reduce their overall exposure to the property sector, especially for privately owned enterprises,” said a second Hong Kong-based loan banker.

Longfor told investors in March that it would start transferring onshore funds to repay its offshore syndicated loan early.

Meanwhile, Sinochem-backed China Jinmao is seeking a three-year loan to refinance a HK$4bn borrowing due in July, offering a richer all-in pricing than originally proposed of 150bp over Hibor after facing push-back from banks.

State-owned Joy City Property is raising a US$700m three and five-year club loan to refinance a US$600m dual-tranche borrowing completed in September 2021. It is offering pricing in the low-100bp over SOFR level.

A few large Chinese banks are expected to be the main backers for the China Jinmao and Joy City deals.

“Joy City benefits from its ownership by Cofco and strong banking relationships, but even for borrowers like this, banks are taking a much longer time than before to obtain loan approvals,” said a third loan banker.

With a shrinking lender base, the property developers have to rely on internal cash balances to make up for the shortfall in refinancing. However, declining home sales are putting pressure on cash while exacerbating the concerns among lenders.

A fourth Hong Kong-based loan banker pointed out that “banks are unlikely to shift their outlook on the real estate market until the decline in home sales comes to an end.”

According to China’s National Bureau of Statistics, monthly national contracted home sales dropped 36.2% year on year in April, compared to a 28.6% decline in March.

Moody’s expects national home sales to fall 10%–15% in 2024 despite the rollout of supportive measures, as a result of lacklustre economic activity in China and concerns among homebuyers on property completion risk.

On May 17, China announced a number of support measures for the property market aimed at stimulating demand and reducing housing inventories. They include the easing of mortgage rules and a Rmb300bn (US$41.36bn) funding package that will support select state-owned enterprises to purchase unsold properties.

However, the funding package is considered “a drop in the ocean", according to a May 20 commentary by Harry Murphy Cruise, an economist at Moody's Analytics, given the scale of unsold inventory. Estimates suggest the value of outstanding housing stock has jumped by more than Rmb7.5trn since 2018, and the funding package covers just 4% of that.

Optimism at home?

One ray of hope for the property developers is the domestic loan market, which appears to be showing some signs of optimism. The recent experience of embattled state-backed developer China Vanke is a case in point. The borrower has raised at least Rmb40.32bn combined since May through a number of secured financings and managed to repay the principal and interest on a US$600m bond on June 7, its last offshore debt maturity this year.

However, Vanke was forced to pledge its real estate assets or shares of its units to obtain the recent loans. In the past, most of its financings were unsecured.

Vanke is among the very few property firms that have prompted direct intervention and support from the central government, with banks being instructed to enhance their financings for the company.

“High-quality assets are Vanke's only bargaining chip at present,” said a Shenzhen-based loan banker, who doubted the same approach could be replicated by other distressed developers.