China is preparing a sweeping overhaul of its lending framework for mergers and acquisitions in a move that could reshape how deals are funded and likely lead to a surge in activity.

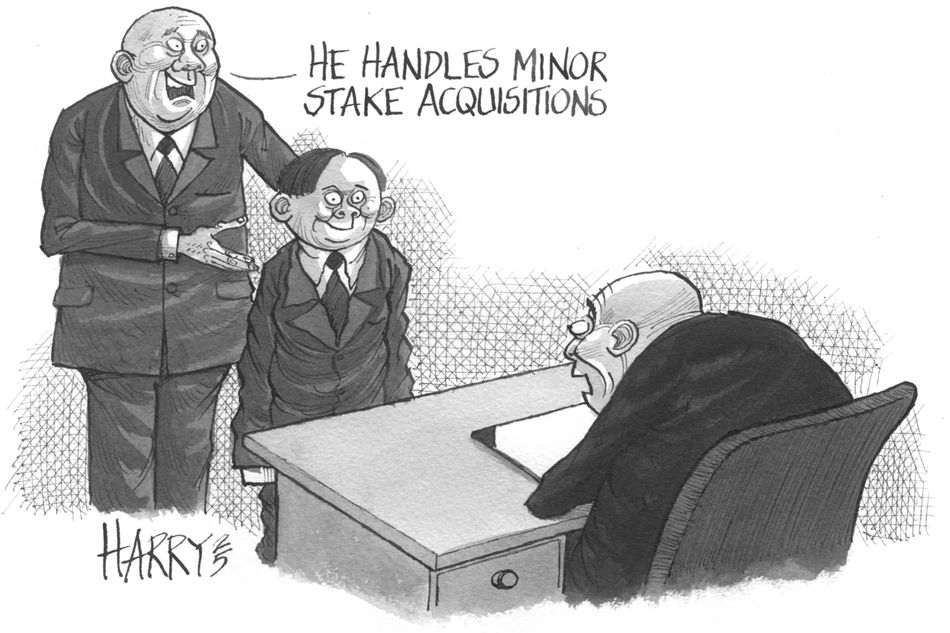

On August 20, the National Financial Regulatory Administration announced draft rules for M&A lending that, for the first time, would allow commercial banks in China to finance acquisitions of minority stakes. This marks a sharp shift from the past when only purchases of controlling stakes in takeover deals qualified for lending support.

Under the proposals, lenders could provide onshore loans to acquirers purchasing stakes of at least 20% in target firms without taking control. Existing shareholders with stakes of 20% or more would be eligible for loans to increase their holdings, provided each deal adds at least 5%.

For loans backing purchases of minority stakes, the maximum loan-to-value ratio will be 60% and the tenor restricted to seven years. For financings supporting acquisitions of majority or controlling stakes, the LTV cap is being increased to 70% from 60%, while maturities can go up to 10 years from the maximum seven years currently permissible.

“This policy shift could trigger a surge in M&A activity in China, especially minority stake acquisitions,” said a Beijing-based senior M&A loan banker at a Chinese bank. “It opens the door for mid-sized companies and private equity firms to pursue strategic investments, joint ventures and partial acquisitions that could only be funded by cash previously.”

The proposed changes would apply to all domestically licensed commercial banks in China and are open to public feedback until September 20.

The banker said the changes align China’s rules more closely with international practice. “In the US and Europe, minority stake financings are common, and international PE firms and investors will now have more flexible tools to structure their investments in China.”

Other bankers pointed out that the banking sector could drive market-based corporate restructurings. Fast-growing and capital-intensive sectors, such as technology, healthcare, renewable energy and advanced manufacturing, are positioned to be among the primary beneficiaries.

This year, M&A in China has already recorded strong activity. Completed domestic M&A deals totalled US$117bn in the first half, double the year earlier, according to LSEG data.

In a report on August 25, PwC projected strong growth in Chinese M&A for 2025, driven by reforms at state-owned enterprises, reshuffling of assets of multinational companies and exits by PE firms.

Opportunities

For banks, the draft rules offer opportunities to tap a potentially lucrative revenue stream but they also carry greater credit and operational challenges.

“This is good news for lenders as it opens an untapped market that can generate significant fees and interest income,” said a Shanghai-based loan banker. “However, financing minority stakes where buyers lack control introduces far more complex credit risks, demanding stricter due diligence and more stringent and customised covenants.

“Lenders rely more on financial covenants and shareholder agreements in such cases, which is riskier than financing controlling stakes where acquirers can pledge the target’s assets."

Stricter limits

The draft changes also impose stricter limits on refinancing M&A loans. Banks would be permitted to provide loans reimbursing buyers for acquisition costs already paid out but any refinancing of such loans must occur within one year of the original transaction.

The changes would also explicitly prohibit the use of such financings to refinance M&A debt, including bridge loans.

This restriction could complicate common practice in large-scale take-private loans and some cross-border M&A, where banks often provide short-term offshore bridge loans – either on a sole or club basis – to ensure speed and confidentiality. The bridge financings are then refinanced with cheaper longer-term syndicated onshore renminbi facilities.

One deal in focus is the proposed take-private of Hong Kong-listed ENN Energy Holdings. In July, parent ENN Natural Gas closed an HK$18.5bn (US$2.4bn) one-year bridge loan to take its unit private.

Bank of China (Hong Kong) was sole mandated lead arranger and bookrunner of the bridge loan, while China Citic Bank International joined as lead arranger in limited syndication.

The natural gas distributor had been expected to refinance the bridge facility with a seven-year onshore renminbi loan in the fourth quarter. But it is now unclear whether that will be possible if the proposed restrictions are introduced.

Bankers said the new rules aim to address excessive use of debt for M&A situations but could lead to longer-term financings upfront or push the refinancings of bridge loans to the offshore market.

“It was a grey area previously because there were no explicit rules on refinancing for M&As. The new rule provides clarity to curb evergreening of debt and excessive leverage, but they also limit common market practice by banks,” said a second Beijing-based loan banker at a Chinese bank.

“We plan to provide feedback requesting potential modifications to this rule. The curbs on bridge loan refinancings limit the ability of banks to compete for cross-border mandates, and it also forces lenders to structure initial loans for the long term, demanding more rigorous upfront underwriting,” the banker said.

Bankers also pointed out that the rule changes could affect banks differently. The Big Four domestic commercial banks – Agricultural Bank of China, Bank of China, China Construction Bank and Industrial and Commercial Bank of China – benefit from cheap and abundant offshore renminbi liquidity and may still find it feasible to provide offshore renminbi loans to refinance M&A bridge loans.

However, smaller commercial banks could find such offshore refinancings too expensive, and not all acquirers will be able to tap the offshore renminbi loan market. Onshore companies, especially those with substantial domestic operations, may face restrictions on capital inflows when using the proceeds of offshore financings to refinance onshore bridge loans.

The latest draft measures follow earlier reforms aimed at facilitating M&A activity in China. In March, the NFRA launched a pilot programme that relaxed lending rules for technology companies, raising the maximum LTV ratios to 80% from 60% and extending maximum maturities to 10 years from seven, in a bid to channel more capital into the sector and strengthen China’s technological edge.