Missing seal thwarts lenders to Chinese property developer

Four overseas lenders are facing an uphill battle to recover more than US$600m from a Chinese company that was once part of property developer Guangzhou R&F Properties, after the latter's chairman withheld the company's seal to prevent the lenders from removing him as legal representative.

Even though the debtor entered receivership a year ago, the lenders have been thwarted in their attempt to take control of pledged onshore assets because they need access to the seal, or chop as it is known in China and much of East Asia, and other documents in order to remove the chairman as legal representative of the onshore holding company.

The quarrel, which has not been reported before, highlights once again the challenges that offshore creditors face to assert their claims in mainland China. It could also prove a test case for company registration regulations introduced in December on a one-year trial basis by the Guangzhou municipality to simplify ownership transfers.

The dispute stems from a loan of originally US$540m that Hong Kong-listed Guangzhou R&F borrowed in 2023 to refinance private placement bonds that backed its Rmb18.96bn (US$2.67bn) acquisition of 73 hotels and a commercial building from Dalian Wanda Group in 2017.

As a result of the pandemic and the economic downturn in China, the loss-making property developer had to sell some of the hotels and missed several interest payments and officially defaulted on the loan in May 2024. In September last year, the lenders – Hammer Capital Opportunities Investment, Seatown Private Credit Master Fund, Knight Prosper and CC Land’s chairman Cheung Chung Kiu – appointed receivers to take over the assets pledged against the loan, which then had US$613.66m outstanding.

Guangzhou Trillion Glory Investment, a foreign-owned enterprise incorporated in China in which Guangzhou R&F held an indirect stake, was the owner of the collateral comprising 68 hotels and the commercial building in Dalian.

To take control of the assets, the receivers passed a shareholder resolution last October to remove Guangzhou R&F’s chairman and founder Li Sze Lim as the legal representative of Guangzhou Trillion Glory and replaced him with an executive who reports to them, according to two sources with knowledge of the matter who preferred to remain anonymous as the information is private.

According to Chinese regulations, the change of legal representatives needed to be registered with the State Administration for Market Regulation, with the company seal stamped on the application form, to bind third parties that are dealing with the company.

However, Li did not hand over various company items, including the seal, despite numerous requests from the receivers, leaving the creditors with no choice but to publish a notice in newspapers regarding the loss of the stamp and engaging an official vendor to engrave a new seal, according to the sources.

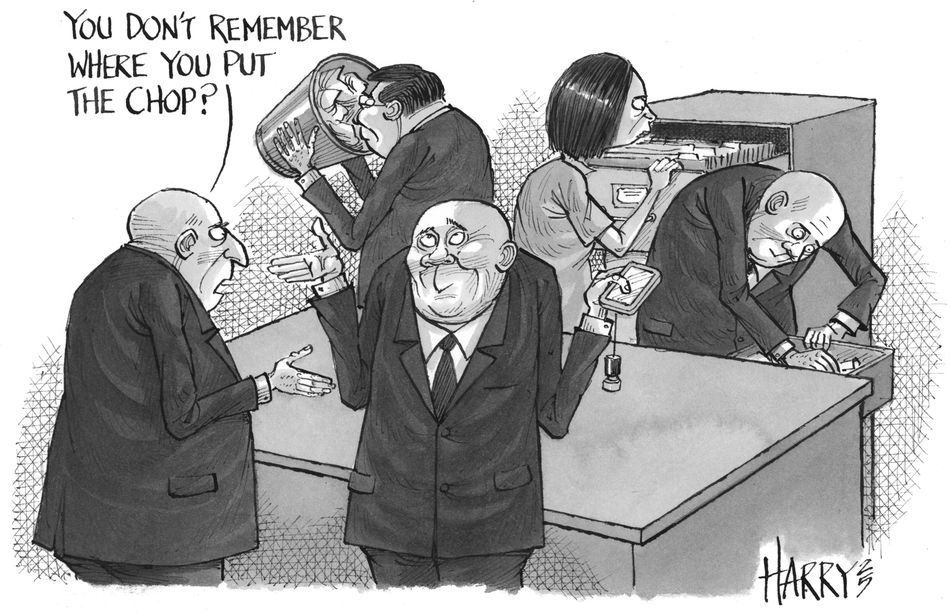

Withhold the chop

But when the creditors tried to register the change of legal representative using the new seal, SAMR rejected their application because it had already received from someone else a declaration that bore the original company stamp and claimed that Li, who was still the company’s legal representative, according to SAMR’s records, was in possession of the seal. Therefore, SAMR deemed the new stamp from the receivers to be a duplicate and therefore invalid.

“It seems that by withholding the company chop, onshore managers can easily defeat the legal rights of offshore creditors using administrative means,” said one of the sources.

The creditors also found out on the website of the courts in China that Guangzhou R&F had initiated a series of asset preservation proceedings onshore to seize control of assets of Guangzhou Trillion Glory Investment, which had also borrowed inter-company loans from the Hong Kong-listed parent and its subsidiaries.

Those proceedings run contrary to the terms of the 2023 loan, in which Guangzhou R&F had agreed to subordinate all inter-company loans to the US$540m financing from the four private credit lenders.

Furthermore, the listed company had also provided a keepwell deed for the 2023 loan, undertaking to assist the borrower to meet its obligation under the agreement.

Surprisingly, in a letter in February sent by law firm Sidley Austin on behalf of the listed company to the creditors, Guangzhou R&F admitted it had initiated the proceedings.

The letter also stated that the listed company “considers the asset preservation proceedings to be in the best interest of all creditors” and that the proceedings are “part of its efforts to preserve and maximise the value of the onshore assets for the benefits of all stakeholders”.

Enforcement proceedings

Domestic banks in China have initiated onshore enforcement proceedings against Guangzhou Trillion Glory Investment for defaulting on some bank debts that carry the same security as that pledged for the private credit loan, according to one of the sources.

The onshore lenders are superior to the private credit financiers and have called for auctions of the pledged assets. The Guangzhou Intermediate People's Court overseeing the proceedings has already sold one of the 68 hotels, in Changsha in Hunan, for Rmb513m while two more properties – one each in Fujian and Hebei – were scheduled to be auctioned in late September.

Guangzhou R&F has previously thwarted any potential sale by refusing to provide updated operational data of the hotels, said the second source with direct knowledge of the matter. At least two international investors had shown interest in buying the assets in early 2025 but were not able to propose an offer price as a result of Guangzhou R&F’s stonewalling tactics.

“The creditors only have operational data from 2023 to present to the potential buyers,” the second source said. “Because of the uncooperative attitude of Guangzhou R&F, the creditors have missed the opportunity to sell those assets to international investors who are bullish on China’s hotel market.”

Guangzhou R&F generated revenues of Rmb2.8bn from the 90 hotels it was operating in the first half of 2024, according to its interim report. Those properties were managed on behalf of global chains such as Accor Hotels, Hilton Worldwide Holdings, Hyatt Hotels, InterContinental Hotels Group and Marriott International, among others.

Guangzhou R&F’s founder Li controls 26.31% of the listed company, according to its 2025 interim report.

Legal recourse

While the creditors face resistance from Li, a lawyer in Hong Kong suggested they could take legal action in China and Hong Kong seeking court orders to stop him from staying on as Guangzhou Trillion Glory’s legal representative, request him to hand over the company chop or reveal its whereabouts.

“The new rules should be able to help the creditors in the Guangzhou R&F case to register the change of legal representative at SAMR,” said a Guangzhou-based lawyer who is not representing the creditors.

Under the rules introduced on December 5, which are being tested on a case-by-case basis, companies may register changes of legal representatives despite not possessing the company seal or the business licence.

That can be done as long as the companies can obtain consent from two-thirds of shareholders, prove that the intention to change the legal representative is real and promise to submit the required documents or company stamp within a certain period of time.

While Li’s stance is affecting Guangzhou R&F’s creditors, they are not the first to have suffered from the vagaries of China’s regulations relating to company seals.

Earlier this month, Chinese juice maker Huiyuan Group, which has gone through a series of restructurings after being delisted from the Hong Kong stock exchange in 2021, said one of its shareholders had illegally made a duplicate company seal and had applied to end court proceedings between the company and the shareholder with the fake seal.

Also in September, state-owned conglomerate China Poly Group listed 14 companies that had registered as its subsidiaries using fake company seals and forged documents.

Guangzhou R&F Properties and Li declined to comment. Sidley Austin did not respond to a request for comment.