The data centre industry might be quite the rage in Asia Pacific and elsewhere, but it is proving to be a tough pill to swallow for Taiwanese banks.

A NT$10.35bn (US$331m) five-year loan backing the development of a greenfield data centre campus in Taoyuan City, close to Taipei, is testing lender appetite with the first syndicated loan – and largest project financing – for the data centre sector in Taiwan.

Bank SinoPac and CTBC Bank are mandated lead arrangers, bookrunners and underwriters of the loan for the Project Westwood campus. Shanghoya International, a 50:50 joint venture of Keppel Data Centre Fund II, part of Singaporean conglomerate Keppel, and Luxembourg and Singapore-headquartered digital infrastructure startup Digital Decarbonisation Solutions Platform, is the developer of the 21MW IT load project. Keppel said in October last year that the project had the potential to scale up to 80MW.

Bank SinoPac, CTBC and EnTie Commercial Bank have prefunded the loan for Project Westwood, which was launched in September and is slated for close by the end of the year.

“As more AI applications get engrained in our lives, data centres will become a necessary part of the ecosystem,” said a senior banker at a state-owned bank who is keen to lend to the sector.

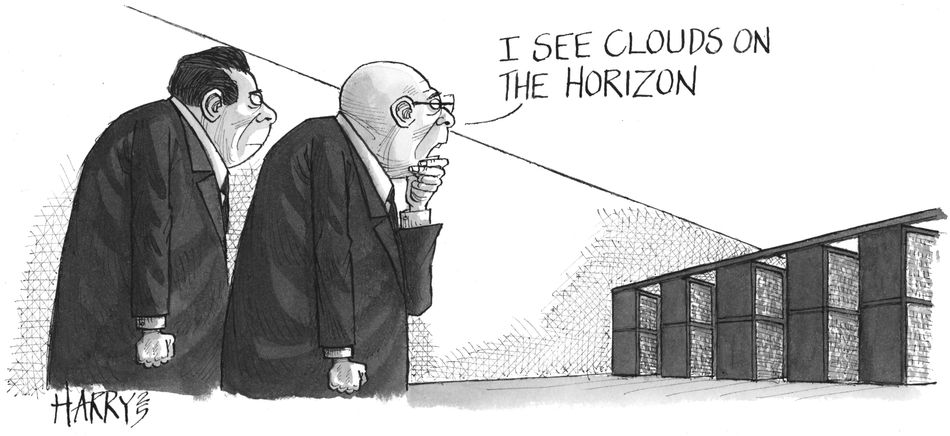

However, the industry faces specific challenges in Taiwan.

“There will always be new entrants to the Taiwan market, but on the financing part it seems that the response from lenders for now is not as strong as initially anticipated,” said a banker at a private sector commercial bank in Taipei. “Taiwan is confronting more variables than other markets in the region.”

Electricity crunch

Given the cluster of data centres in the northern region, state-owned Taipower has reportedly stopped approving electricity usage plans since 2024 for new data centres with contracted capacity at 5MW and above north of Taoyuan because of insufficient power supply in those regions.

Developers must obtain approval for their projects’ electricity usage plans and grid connection requirements from Taipower, the sole electricity supplier and grid operator.

“Over the near term we see power supply as a limitation for data centre bank financing. Getting renewable energy from private power producers is also not easy,” said another senior banker in Taipei.

While Taiwan has seen a massive buildup of renewable energy such as offshore wind, it still relies heavily on fossil fuels. The island imported as much as 96% of its energy in 2024, primarily in the form of oil, coal and gas, according to government figures. Power-hungry data centres would only compound Taiwan’s energy crunch.

According to government data, renewable energy accounted for just 12% of the total electricity generated in the first nine months of this year, with coal and LNG making up the bulk of the remainder. Within renewables, onshore and offshore wind power contributed just 0.7% of the energy supply for the period.

Power grab

While offshore wind farms have raised multibillion dollar loans from banks in Taiwan, the prospects for data centre developers signing electricity offtake contracts with these power producers are slim as they compete with stronger, well-established corporates such as TSMC, Google and MediaTek, bankers said. Offshore wind developers would typically prefer to sign offtake agreements with customers with stronger financial profiles than with unrated or lesser-rated data centres, said the second banker.

Equally, the type of tenants that data centre operators sign up are also coming under close scrutiny from lenders.

“While some of these projects have signed up hyperscalers, they will also have other small and medium enterprises as tenants. We would look at the type of clients, the maturity of the leasing agreements, the lease rates contracted. Then we would see how the data centre operators would match the cashflow from their tenants with the loan repayment profile,” said a third banker focusing on project finance.

For Project Westwood, Microsoft Operations Taiwan has signed a 15-year co-location and data centre lease with Shanghoya International.

Bankers said such an anchor tenant is a positive for lenders. However, this is mitigated by the lack of details about the tenancy pipeline or developing plans for the second phase of the project.

Another key factor is the government’s restrictions on banks for exposure to real estate risks. According to the Banking Act, such exposure in a bank’s loan book is capped at 30% of its total local and foreign deposits and issued bonds.

Loans funding the costs of construction and land acquisition for data centre facilities are categorised as part of a bank’s exposure to the property sector.

With the average ratio of real estate exposure at about 26% for the first nine months of this year, lending to data centres for construction or land acquisition faces capacity constraints, according to data from the Banking Bureau under Taiwan’s Financial Supervisory Commission.

“In terms of economic sector classifications, the treatment of data centres as construction, property-related lending in Taiwan is probably the biggest difference compared to other markets where lenders would view it as telecom or technology-related. This weighs on the ability of local banks to take such risks,” said another banker in Taipei.

On the bright side, some lenders are anticipating potential refinancings down the line for club or bilateral loans that have financed some of the data centres in Taiwan. One likely refinancing could be for an unsecured financing of about NT$2bn completed in 2024 for a 16MW IT capacity project for Vantage Data Centers, also in Taoyuan. CTBC and Cathay United Bank are likely to be involved in the refinancing.

Vantage, a Denver-headquartered global provider of hyperscale data centres, has signed Taiwan Fixed Network, a subsidiary of Taiwan Mobile, as its tenant on a 10-year lease, according to reports.