Sumitomo Mitsui Banking Corporation has completed its first synthetic risk transfer in Asia Pacific, highlighting an instrument that is becoming more relevant to banks in the region.

The Japanese megabank’s transaction references a US$3.2bn portfolio of Australian and Asian project loans and was closed in September–October with strategic sponsor partners US investments firms Blackstone and Stonepeak and Singapore-based Clifford Capital.

“This inaugural SRT is a strategic step to further enable our client-centric growth in the region whilst optimising our capital returns,” said Katsufumi Uchida, head of SMBC’s Asia Pacific division, in a statement on Wednesday.

The deal follows SMBC’s inaugural SRT transaction in April, which was completed by its Americas division and was reportedly US$375m in size.

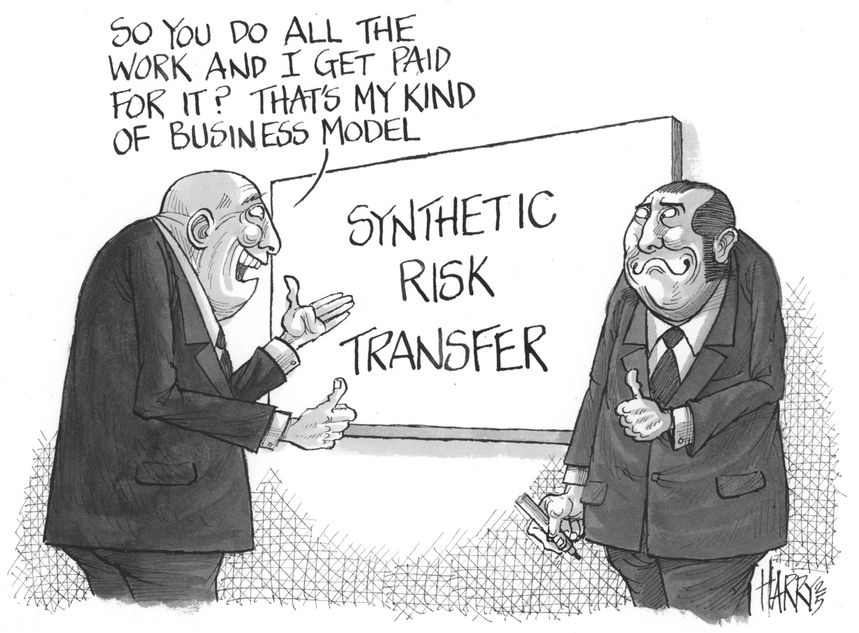

In a synthetic risk transfer, banks transfer a portion of the risk on a portfolio of loans to investors by selling credit-linked notes to them. The bank receives cash upfront equivalent to the principal amount and the investor receives interest payments during the life of the CLN.

While the bank keeps the loans on its books and maintains the customer relationships, investors in the SRT agree to take the first losses from the portfolio. That means the bank can reduce the amount of capital it needs to hold in reserve against this portion of risk under Basel banking regulations, freeing it up to provide new loans.

"With the initial implementation of the final Basel III capital rules in March 2024, SMFG’s disclosed risk-weighted assets increased and its common equity Tier 1 ratio fell," said Kaori Nishizawa, a Tokyo-based director in Fitch's financial institutions team. She said Sumitomo Mitsui Financial Group, the parent of SMBC, is likely to see its RWAs increase and its capital ratio decline further when the Basel III standards are fully phased in by March 2029.

"Implementation of final Basel III capital rules over the coming years is likely to weigh higher on the Japanese megabanks than in most other banking systems in Asia," said Jonathan Cornish, Fitch's head of Asia Pacific banks, who is based in Hong Kong. He said the use of SRTs by Japanese banks and others could expand but is likely to be just one element of their capital management strategies.

"We expect the banks to use SRTs for portfolios where risk-weight density is high and origination demand is strong (such as project finance, subscription lines, corporate or mid-market)," said Nishizawa.

First-time investor

The SMBC transaction marks the first time Clifford Capital has participated in an SRT, said Nicholas Tan, group head of markets and investor services and CEO of Clifford Capital Asset Finance (formerly known as Bayfront Infrastructure Management). It is also the first infrastructure and project finance related SRT transaction to be executed in Asia Pacific, he said.

“While SRT is not uncommon for corporate loans, it is uncommon for infrastructure/project finance loans,” said Tan. “This deal demonstrated our ability to combine our infrastructure credit capabilities with our securitisation expertise effectively and apply them to a unique SRT transaction.”

Clifford Capital has a mandate to help banks recycle capital and encourage institutional investment into infrastructure credit, which it has done through securitisation and other financings before.

The concept of significant risk transfer to benefit from capital relief has been around since 2004, and SRTs have become a popular tool in Europe in particular. There were €300bn (US$351bn) of synthetic securitisations, which includes SRTs, outstanding in the European Union at the end of 2023, the latest date for which records are available, and this accounted for half of the global market, according to the European Banking Authority.

“SMBC APAC’s SRT is not the first from Asia Pacific, but certainly one of the largest,” said the head of loan syndications at a bank in Hong Kong. “It is an exercise to manage part risk, part risk-weighted assets and part return on assets.”

A Singapore-based senior investment banker said SMBC’s transaction was a positive development for banks in the region.

“It’s good to get a marker for the secondary price of your loans because there isn’t much of a secondary loan market in Asia,” he said.

SRTs give investors a way to take exposure to assets they would not normally be able to access, and the growth of private credit funds focused on Asia means there is a keen investor base.

“We see fund managers looking for partnerships with banks that originate,” said a senior loan banker in Singapore. “A lot of institutions are coming to us. It’s complementary to our business.”

Pricing for SRTs is based on the average spread of the underlying assets plus a premium. The tenor needs to match that of the underlying assets to avoid “rollover” risks when assets need to be replaced in the pool.

“One of the risks related to SRTs is if they mature at a similar time, as such creating a kind of ‘maturity wall’ at which the capital relief would suddenly end from banks’ point of view,” wrote the EBA in a report in June.

The European Central Bank also warned in a report last month that SRTs will not necessarily transfer risk away from banks “if protection sellers cannot withstand high losses in downturns” and the notes are not sufficiently collateralised.

The EBA noted that SRTs might not actually reduce risk in the banking sector, given that banks may be lenders to the private credit firms or nonbanking financial institutions that provide SRTs, creating “circles of risk”.

According to the EBA’s risk assessment questionnaire published in June, private credit funds make up about a third of the investments in European SRTs, followed by other investment funds with 18%, insurance companies with 14%, and pension funds with 13%.

A paper from the Bank for International Settlements’ Financial Stability Institute this month noted that “using the capital freed up via synthetic securitisations to increase lending or to pay dividends or buy back shares increases a bank’s leverage, making the bank and the financial system more vulnerable during a downturn”.

Additional reporting by Prakash Chakravarti