European banks: holding on in trading and financing but lagging in dealmaking

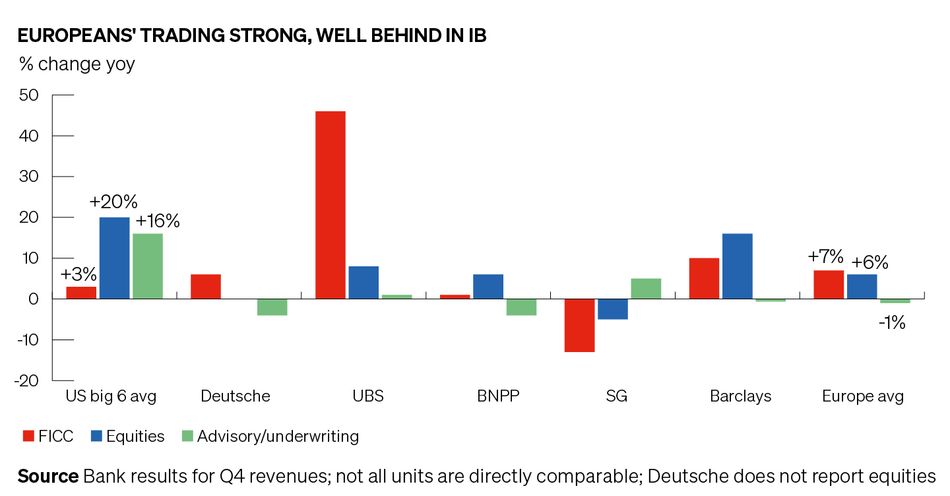

Full-year earnings from European banks – Barclays, BNP Paribas, Deutsche Bank, Societe Generale and UBS – showed them broadly holding market share in the markets’ business, but struggling to capitalise on the upswing in investment banking.

The equities business was the star for the US investment banks, rising by a median of 22% in 2025, with even higher growth for the Big Three of Goldman Sachs, JP Morgan and Morgan Stanley.

UBS and Barclays (excluding a gain on a Visa stake sale the prior year) both delivered high teens equities revenue growth but the French banks, especially Societe Generale, were laggards.

UBS’s revenues here remain a fraction of the Big Three but following the Credit Suisse integration, it is in clear number five position behind Bank of America and ahead of Citigroup. UBS saw strong growth in its equity prime brokerage revenues.

But where the Europeans did best in 2025 was their FICC markets businesses – led by Barclays, Deutsche and UBS. The French banks again lagged, with low single-digit growth. Barclays’ high teens revenue growth was the best of any of the large FICC trading franchises. Deutsche’s 13% growth was ahead of the 8.5% median for the US banks. UBS’s much smaller, FX-focused business was up more than 30%.

Deutsche and Barclays both have strong credit trading businesses, but strength was broad-based including various macro trading businesses. FICC financing has also been a big driver for both banks.

At Barclays, the markets’ business financing revenues include equity prime brokerage and fixed income financing to private credit firms and hedge funds. In the final quarter of 2025, financing was a larger proportion of Barclays’ markets revenues than trading.

Deutsche exited hedge fund prime brokerage a few years ago, but fixed income financing was nonetheless 37% of its 2025 FICC revenues, a higher proportion than even for Goldman.

Perennial question

2025 was known as the year of the return of the M&A banker with the Big Five US investment banks seeing a 25% increase in advisory revenues. European banks saw barely any growth here. Barclays has been investing heavily in the US in recent years, with little to show for it.

This leads to the perennial question about the sustainability of these subscale franchises.

A similar story can be seen in DCM and ECM. The former is a traditional strength of European banks, but Barclays' flat DCM revenues in 2025, and Deutsche’s double-digit decline contrasted with low double-digit revenue growth for the US banks.

In ECM, the dearth of IPOs in Europe was a drag for European banks. Barclays saw a sharp decline in revenues given the busy follow-on fundraising calendar in the UK in the prior year.

Despite rising revenues, the profitability of European investment banks continues to lag – behind both that of European retail banks and, more importantly, the US investment banks.

In part this is because FICC trading and financing at European franchises remain highly competitive. In equities there is a huge gap with the Big Three US banks that keeps getting bigger given the strength of these firms regionally in the US and Asia, and because they are the place to go for the hedge fund community in trading and financing.

But the bigger concern with the outlook is the uneven distribution of dealflow, with big tech companies driving so much of incremental corporate debt raising, and the IPO market this year is likely to be heavily reliant on a few extraordinarily large US tech IPOs. With the US banks deeply entrenched in Silicon Valley, it is hard to see the European banks picking up anything more than a few crumbs.

Pulling ahead

It’s still very early in the year, but LSEG statistics show the US banks pulling ahead in investment banking again. 2026 investment banking fees for the Big Five US banks are running up more than 30% year on year so far. Evercore is almost level with Barclays and Wells Fargo is catching up.

Drill down into the product categories, and this trend can be seen across the board. The US banks are dominating M&A as expected, but they are also sitting in the top five spots in DCM, and the only European bank in the top 10 for ECM is UBS.

If 2026 is the year when there is a handover from the trading bonanza to investment banking, the European banks are not ready for it.

Rupak Ghose is a corporate adviser and former financials research analyst. Read his Substack blog here.