US trio get G-SIB capital boost

JP Morgan, Goldman Sachs and Wells Fargo have had the capital surcharge that is applied to them as big and complex global banks reduced in the latest annual review of the industry. China Construction Bank has had its capital surcharge increased.

The Financial Stability Board cut the capital surcharge for a number of global banks including JP Morgan, but that may not be enough for the banks to release capital to shareholders or use it for any other purpose.

The FSB updates its list of global systemically important banks – dubbed G-SIBs – every year. This year, it kept the same 30 banks on the list as G-SIBs, but moved the three US banks to a lower "bucket" and moved CCB up.

Being a G-SIB requires banks to have a higher capital buffer, meet requirements for total loss-absorbing capacity, undergo detailed resolution planning and face more stringent supervisory scrutiny.

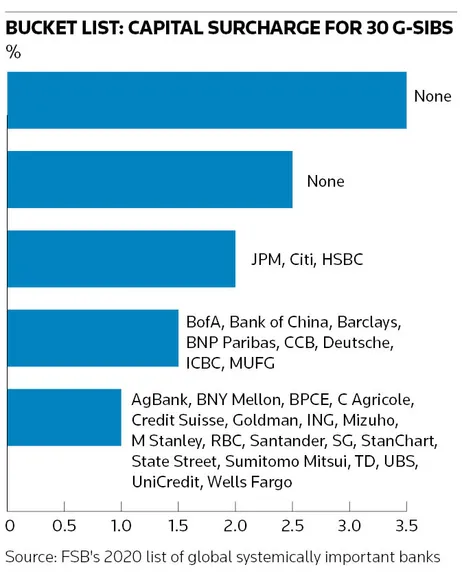

The FSB assigns each bank to a "bucket", determined by their size, complexity and interconnectedness. Each bucket is assigned a capital buffer that each bank must hold, which ranges from 1% to 2.5% for the 30 banks.

Extra capital buffers for G-SIBs were introduced following the 2008/09 financial crisis. The idea is that the greater the buffer requirement, the lower the failure probability of the G-SIB.

BUCKET LIST

JP Morgan was last year considered the most systemically important bank and was the only firm included in the bucket requiring a 2.5% capital surcharge. But the FSB said JP Morgan will now move down into the 2% surcharge bucket, where it will join HSBC and Citigroup.

While JP Morgan has long lamented the higher surcharge, the FSB's change will probably not alter the bank’s capital requirements.

The 2% surcharge set by the FSB is only its “method 1” global charge. Its US-based "method 2" local charge is the bank’s binding constraint set by the Federal Reserve – and that remains at 3.5%.

The FSB outlines how banks are "scored", but not all measures are clear-cut, so there is no certainty over the allocation.

JP Morgan’s global score changed because it is a relative calculation. As other global banks got bigger, namely Chinese banks, JP Morgan’s method 1 market share reduced, bringing down its G-SIB surcharge. But based on the Fed’s methodology in the US, that number remains.

Barring any change in the Fed’s surcharge framework, that is unlikely to change. The FSB's score was based on end-2019 data, while the next round of scores from the Fed will reflect the changes that have occurred this year at large banks during the Covid-19, which could hold better news for JP Morgan.

In the FSB's latest changes, Goldman Sachs and Wells Fargo have been moved from a 1.5% surcharge to the bucket requiring a 1% surcharge. There are now 19 banks in that lowest bucket.

CCB has moved in the opposite direction, from 1% to the 1.5% bucket, where it will join seven other banks – Bank of America, Bank of China, Barclays, BNP Paribas, Deutsche Bank, ICBC and Mitsubishi UFJ.

Changes announced each November are applied 14 months later – so the upcoming capital requirements will apply from the start of 2022.