India’s Gujarat International Finance Tec-City, an offshore financial centre in prime minister Narendra Modi’s home state Gujarat, is a tax-free opportunity for financial institutions to wade deeper into a growing market but presents some challenges on the social infrastructure front.

The hub, which aims to serve as a gateway for inbound and outbound investments, has been touted as India’s answer to rival international financial centres such as Hong Kong, Dubai and Singapore.

GIFT City offers many tax benefits, including a 100% direct tax exemption for 10 years and lower withholding taxes on offshore bonds and loans originating there. The International Financial Services Centres Authority, GIFT City’s regulator, has introduced measures this year allowing Indian companies to list there and global fund managers to trade in overseas derivative instruments.

The financial centre is situated close to an international airport serving Gujarat's largest city, Ahmedabad, with a population of around eight million. It currently occupies about 1,000 acres and includes financial, commercial and residential complexes. A metro station that would link it to Ahmedabad's network is reportedly being planned.

IFSCA chairperson K Rajaraman told IFR there are more than 6,000 employees within the IFSC special economic zone, a number that is growing, and about 25,000 people working across the SEZ and a domestic tariff area that is also part of the complex.

“The first set of people who will come here are probably Indians and maybe Indians from Gujarat [wanting to move] closer to home,” said Rajaraman. The cost of living in Gujarat is lower than in Mumbai or in other major financial centres like Singapore and Hong Kong, he said, and property prices and salaries are lower too – attractive factors for banks looking to set up shop.

He said more and more companies are setting up at GIFT, including technology companies.

“The financial market and intermediaries cannot ignore GIFT City any longer,” said Hirva Mamtora, managing director at India Exim Finserve, a unit of government-backed Export-Import Bank of India. “We will gradually see all the financial intermediaries open a unit here and fill the gap of offshore financing here.”

Besides Indian financial institutions, several global banks have registered entities in the city, including JP Morgan, Citigroup, Deutsche Bank, Morgan Stanley, Bank of America, BNP Paribas, ANZ, and HSBC, which was the first global bank to get an investment banking permit at GIFT.

BNP Paribas' GIFT City unit currently offers term loan services in the form of external commercial borrowings or offshore loans.

"We look forward to extending our full suite of capabilities to both international and domestic clients," said Sanjay Singh, CEO and head of territory for BNP Paribas India. "Soon, we shall begin offering trade financing products like buyers/suppliers credit, supply chain financing as well as products for the financial markets and treasury." He said the bank closed a few large deals within the first three months of setting up its branch and has a strong pipeline.

Hiring challenges

However, sources say many banks still have skeletal staff in the financial hub, often hiring just a compliance officer or a branch head equivalent. And, while setting up operations at GIFT makes business sense, moving or hiring staff there not been easy.

“Hiring compliance officers for GIFT City has been a challenge,” a Hong Kong-based compliance executive with a global bank said. “No one really wants to move there.”

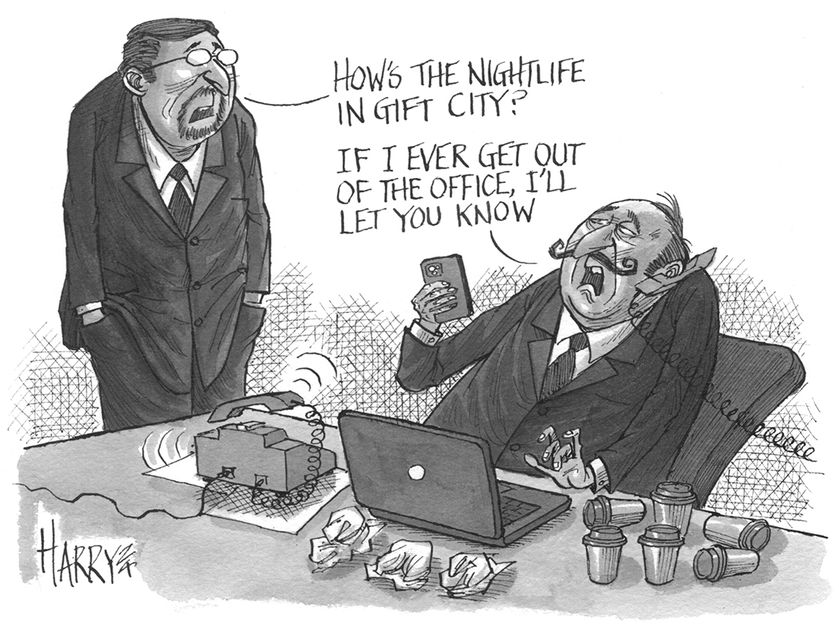

A debt capital markets banker who has recently set up a unit at GIFT said that while people are increasingly willing to move to GIFT from financial centres such as Mumbai to benefit from increased opportunities and growth, the lack of social life still gives them pause.

A financial ecosystem is gradually developing at GIFT, but many key decision-makers are not based in the city yet. It remains unlikely that a lawyer or banker will bump into other dealmakers at a coffee shop or be able to set up a business lunch on a whim, things people take for granted in the central business districts of Singapore, Hong Kong or Mumbai.

Nightlife (or rather the lack thereof) is another issue. Since last December GIFT City allows alcohol consumption in designated "wine and dine" areas, but this is a far cry from the bar-lined streets of Hong Kong's Lan Kwai Fong or Singapore's Boat Quay. Sales of alcohol also remain banned elsewhere in Gujarat state.

Dead after 6pm

“It is not like a fully fledged financial centre like Bandra Kurla Complex in Mumbai where there is social infrastructure like cafes, bars and recreational facilities,” the banker said. “It is pretty much dead after 6pm and on weekends.” However, entertainment options are expected to develop in the coming years. This month, European DJ Alan Walker performed at a venue in GIFT City.

“Attracting talent remains a challenge," said a fund manager who has an office in GIFT City. "If you ask a trader from Mumbai to move to GIFT City, he may still be reluctant.” He highlighted that while the lower cost of living may be a draw for people moving from overseas, personal tax considerations remain a hurdle.

Personal income tax in financial hubs like Singapore, Hong Kong and Dubai is less than 20% compared with India, where it is about 30%.

Still, some global banks say hiring in the financial hub has been straightforward.

“It was easy for us open a unit and start the operations,” said Piyush Agarwal, senior managing director at the Indian corporate banking department of Mizuho, which opened a GIFT branch in September. “It is not difficult to find talent in GIFT City.”

He expects an ecosystem to develop eventually as alternative investment funds, private equity funds, asset managers, asset lessors and insurance companies set up shop. “[This will make it] self-sustainable and there will be ease of doing offshore business from GIFT, even after the tax breaks expire in 10 years,” he said.

The nation’s premier management school, Indian Institute of Management, has one of its top campuses in Ahmedabad, about 30 kilometres away from GIFT, generating a supply of highly qualified graduates. And infrastructure in the city is developing to make it more family-friendly. Australia’s Deakin University and University of Wollongong have set up international campuses in GIFT while Mumbai’s famed Lilavati Hospital is also opening a branch there.

With all this development, some say resistance to relocating to GIFT is fading.

“The financial system here is developing at a robust pace and people are willing to move with their families from big cities to GIFT to be part of this upcoming financial centre where there is growth,” India Exim Finserve's Mamtora said, adding that a stint at GIFT City also looks good on resumes.

For instance, Saurabh Singhal, a former Asia Pacific advisory board member at the Chief Marketing Officer Council, and earlier group head of marketing and marketing technology at DBS Bank, moved to the city in April as its chief commercial and fintech officer after a 15-year stint in Singapore.

Even so, Mamtora said it is unlikely that non-resident Indians will choose to move to GIFT City, even though they may consider moving their money there.

(Additional reporting by Suzannah Benjamin)