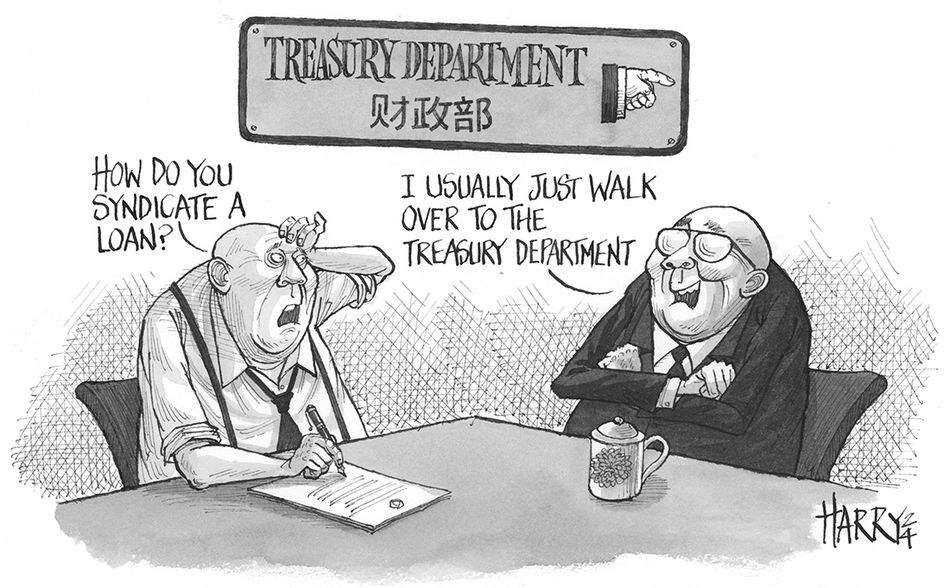

Asia’s largest loan market could move from clubbish behaviour to true syndication aligning with international practices if draft measures proposed by China’s banking regulator become reality.

On March 22, the National Financial Regulatory Administration announced the measures that introduce key changes, including reducing the minimum hold ratio of a sole lead bank on a syndicated deal from 20% to 15%, lowering the minimum distribution ratio from 50% to 30% and allowing for partial selldowns of loans in the secondary market. The proposals are aimed at improving the management and supervision of loan syndications, which are usually run as club deals rather than widely distributed.

The NFRA, which was established in May last year as the new regulator for the finance industry (except the securities sector), has set a deadline of April 20 for public feedback on the measures, which could have positive implications for syndicated loans in China. With US$203.49bn in financing volumes in 2023, China is the largest loan market in Asia Pacific, according to LPC data.

“Some of the proposed changes are a result of ongoing discussions between market players and the regulatory body,” said a Beijing-based loan banker. “These will bring domestic loan syndication practices more in line with international standards and will definitely open up opportunities for banks.”

According to another Shanghai-based loan banker the measures provide banks with increased flexibility as a result of the ability to distribute loans after the initial signing and drawdown process. This is particularly true in instances where borrowers are in urgent need of funds.

In such situations in the international syndicated loan market, the lead banks would pre-fund the deal and syndicate it at a later stage, thus allowing the borrower to draw down the funds first and also be in a position to sell down their exposure.

“This was not possible in the past as it would be considered a partial secondary selldown, and this was one of the reasons why a lot of deals in onshore China were completed on a club basis,” explained the Shanghai-based banker.

Under the existing rules in China, lenders can only sell their entire exposures on a loan in the secondary market. As partial selldowns are not allowed, it has contributed to the clubbish behaviour.

Hurdles to overcome

While the draft measures have the potential to bring key changes to the loan market in China, there are still challenges to overcome. For instance, although partial secondary loan selldowns will be allowed, whether such activity takes off remains to be seen. After all, the secondary loan market in Asia Pacific has historically been underdeveloped and lacked transparency as lenders tend to hold on to the loan assets until maturity.

In China too, the dominance of the domestic banks and a dearth of high-quality assets pose challenges for secondary loan trading activity.

“Perhaps certain Chinese lenders may choose to manage their exposure to specific borrowers through secondary sales when they reach the group limits for that particular company, but Chinese banks usually have huge loan books, and this is not a common practice,” said another Shanghai-based loan banker. “It would be too early to say there are going to be significant secondary trading volumes at this stage.”

Bankers also pointed out that the implementation of some of the draft measures could be tricky. For instance, a buyer in the secondary market might need additional information or documentation that the borrower may not be willing to provide.

“Loan drawdowns in China require complex documentation, particularly regarding the use of funds,” said the second Shanghai-based banker. “Transferring a loan to non-original syndicate members involves a review process by the buying bank. If there are discrepancies or a lack of cooperation from the borrower, the transfer may encounter difficulties.”

Additionally, the draft measures require that when transferring a loan, priority shall be given to other existing syndicate members, adding another layer of complexity to the process.

The draft measures also emphasise the need for banks to improve transparency in terms of their pricing mechanisms, separate interest and fees, and strengthen information disclosure to borrowers.

Other proposed changes include the introduction of the syndicate subgrouping model, in which members under different subgroups of a syndicate may provide borrowers with facilities carrying different terms under a single syndicated loan agreement.

This is akin to structuring a loan with tranches, which is normal practice in the international loan market, although the latter does not call for the creation of subgroups within a lender syndicate.

Under the proposed model in China, a syndicated loan shall comprise three or fewer subgroups, each joined by at least two lenders, and an agent bank must be assigned for the subgroups.