China eases tech M&A lending rules

China has relaxed rules for lending tied to mergers and acquisition for technology enterprises in a pilot programme aimed at channelling more capital into the sector and further boosting the country's technological edge.

The National Financial Regulatory Administration’s measures announced earlier this month loosen some of the clauses of the Guidelines on Risk Management of Merger and Acquisition Loans for the first time in a decade. The changes include raising the maximum loan-to-value ratio to 80% from the current cap of 60% and the maximum loan tenor to 10 years from seven.

The programme spans 18 cities, including Beijing, Shanghai and Shenzhen, and focuses on regions with robust innovation ecosystems such as the Yangtze River Delta and the southern Greater Bay Area.

“Tech companies will have more funding resources and greater leverage for acquisitions, and the extended tenor gives them flexibility for repayments, thus easing financial pressure and improving cashflow management,” said a senior loan banker from a Chinese state-owned bank.

While the relaxed rules provide more opportunities for growth, strong due diligence will be necessary to manage risks.

“We think only top-tier tech companies that demonstrate solid credit records and robust market potential can qualify for the new rules,” the senior banker said.

The regulator has not listed the banks eligible for the programme and bankers believe that only those meeting certain criteria, such as strong M&A lending and risk-control capabilities, will be selected in the first batch.

Nonetheless, the relaxation bodes well for M&A activity and related lending. PwC said in a February report that China M&A could achieve double-digit volume growth this year thanks to ongoing reforms at state-owned enterprises, the growing overseas investments of Chinese companies, and exits by private equity funds. The industrial and high technology sectors remain the most attractive for M&A activity in China, it said.

“The regulator did not specify if the new rules are applicable to purely onshore or cross-border transactions, and we are still waiting for more details to be released,” said a second loan banker from a top-tier Chinese bank. “In general, we believe a more favourable regulatory environment and supportive financing policies will spur dealmaking and enhance the global competitiveness of Chinese tech companies, and we can expect a more robust rebound for tech M&A loans this year (both onshore and offshore) after years of decline.”

M&A lending in China totalled US$6.85bn in 2024, down from US$8.24bn the year before, according to LSEG LPC data. Loans for outbound M&A from China totalled US$1.31bn out of that, the second-lowest level in the past decade, although an improvement on 2023 when no deals were transacted.

China Inc’s overseas expansion opened many opportunities for domestic as well as international lenders in the past, including high-profile multi-billion-dollar deals such as ChemChina’s acquisition of Switzerland’s Syngenta, Geely's purchase of Sweden’s Volvo and Anta’s takeover of Finland's Amer Sports.

The last change to the Guidelines on Risk Management of Merger and Acquisition Loans was in 2015, when the maximum LTV was raised to 60% from 50% and the loan tenor lifted to a maximum of seven years from five, across all industry sectors. The following year outbound M&A loans from China surged to US$26.9bn from US$8bn a year earlier, but declined again when capital controls were tightened in 2016.

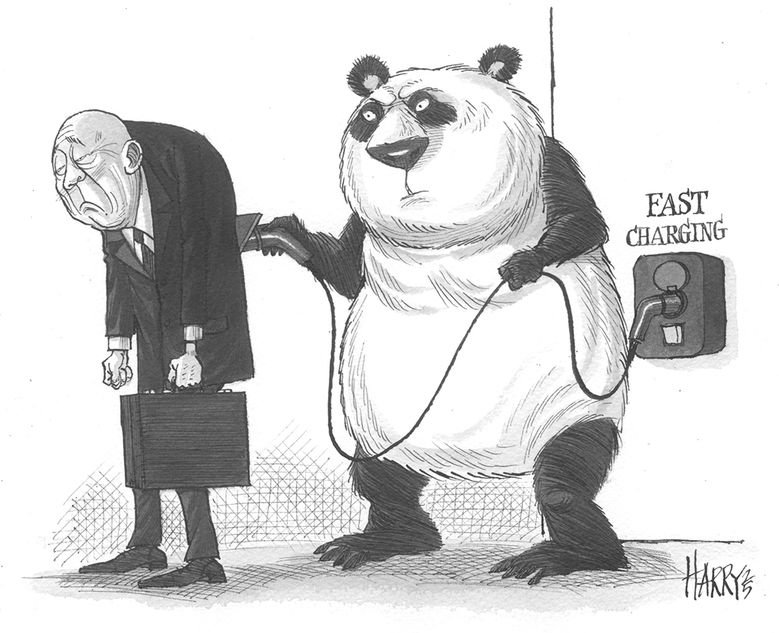

China tech dynamics

Prospects are looking up for China’s technology sector following the end of a regulatory crackdown that lasted from 2020 to 2023, also a time of high geopolitical tensions. In January, the technological breakthrough achieved by artificial intelligence start-up DeepSeek led to a re-rating of the sector's strengths and the reaffirmation by Beijing of its importance to the country's future growth.

The new climate is expected to create broader financing opportunities – not just in M&A.

On March 19, tech giant Tencent Holdings said that it spent Rmb39bn (US$5.4bn) on AI initiatives in the fourth quarter of last year.

Last month, e-commerce giant Alibaba Group Holding pledged to invest more than Rmb380bn in AI infrastructure such as data centres over the next three years.

“We can expect an increased deal flow from the sector on the back of an AI-driven tech boom amid favourable policy changes, positive signs of economic revival in China and the potential for continued global interest rate cuts," said a third Hong Kong-based loan banker.

“It is also expected that top-tier tech giants will take advantage of the momentum of China’s tech optimism and a rebounding capital market, and lock in refinancings at cheaper rates with strong bargaining power,” he said.

Last September, Bytedance, the parent of the TikTok short video app, closed a US$10.8bn loan, the largest for a Chinese company from the telecom, media and technology sector and also the largest in Asia Pacific last year.

Other potential big-ticket financings are likely to boost loan volumes this year.