REFILE - Ammo, tanks and AI drones: defence offers bright spot for bankers

Europe’s defence industry is emerging as a rare hotspot for dealmaking activity as strong revenue prospects encourage companies to consider acquisitions, alliances, listings or fundraisings, although bankers said that while the pipeline of deals is long, it might be slow moving.

Bankers said potential IPO candidates include Franco-German military defence system supplier KNDS; IDV, the defence unit of Italian truckmaker Iveco, Prague-based ammunitions maker The Czechoslovak Group and a spinoff by Germany’s ThyssenKrupp of its warship division.

Cross-border M&A may be a challenge as countries protect their defence industries, but domestic acquisitions are expected as firms aim to be national champions. Joint ventures and international alliances could also prove fruitful, as Italy’s Leonardo and Germany’s Rheinmetall have already shown.

“I think there will be more in-country M&A, more IPOs and more big partnerships,” said an industry banker at a major investment bank, who asked not to be named.

Perhaps more exciting is the prospect of work for a swarm of smaller innovative firms in defence technology. They are likely to be targets for the big incumbent military equipment providers that need new and more agile products. Or the younger firms may raise funds for growth from a deepening pool of investors willing to buy into the sector, and use it to disrupt the established order and make large-scale production more efficient and procurement easier.

Bankers said there are dozens of such companies, including Bavaria-based drone technology developer Helsing, which raised €450m in July in a Series C financing round that valued the firm at about €4bn, or Quantum Systems, which raised €40m in September and is aiming to expand production.

"The traditional players will continue to benefit – there is a need for armoured vehicles, tanks, transportation, air defence, missiles and ammunition,” said Frank Bretag, UniCredit's head of industrials advisory, which includes a defence subsector.

“But we’re also going to need new capabilities above and beyond the traditional technologies and equipment and an interaction between the traditional and the new, whether that’s drones, air defence, cloud computing, artificial intelligence or space capabilities.

“There is a lot of need from the traditional players to establish know-how on that, which they could do via acquisitions or cooperation with other players."

"Time to re-arm"

All the activity is a result of a seismic reshaping of the military landscape in Europe after Russia’s full invasion of Ukraine in February 2022 and fears that the US commitment to defending Europe is waning. Europe is expected to increase defence spending by €800bn or more.

EU governments want European companies to be the main recipients, although they lack production capacity, and US firms are also expected to reap some of the windfall.

Share prices, valuations of private companies and investment banking fees have all jumped on the back of that prospect.

The STOXX Europe Aerospace & Defense Index closed on Wednesday at 2,098 points, almost four times the level in October 2020, up 64% since the start of 2024 and up 23% this year, despite a modest pullback over the last month.

The jump in valuation for private firms is best shown by US defence technology company Anduril, which is reported to have been in talks to raise US$2.5bn at a valuation of US$28bn, double its valuation six months earlier when it raised US$1.5bn.

Similarly, the valuation put on Helsing in July was more than double its price tag in a fundraising less than a year earlier, and other private firms have seen valuations soar, which bankers said give them capacity to strike deals of their own.

“After the rise in share prices and in private valuations, there is acquisition currency available. There is also a very deep pool of additional capital available on the private side that can be used,” said Lars Duerschlag, UniCredit's head of TMT advisory, which includes a defence technology subsector.

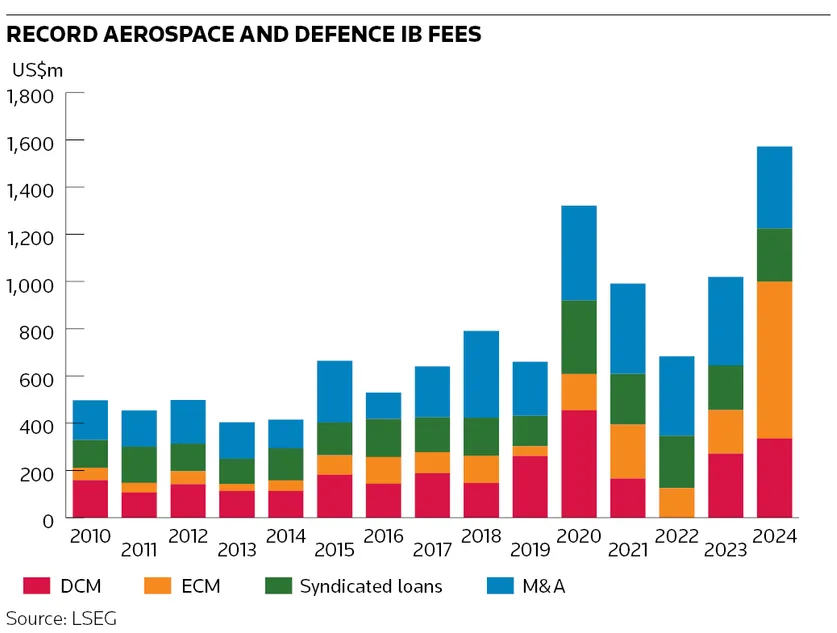

Last year was a record for investment banking fees from aerospace and defence deals. Fees from M&A, debt and equity underwriting and syndicated loans hit US$1.57bn, up 54% from 2023 and only the third time annual fees had topped US$1bn, according to LSEG data going back to 2000.

Fees from equity capital markets contributed US$665m of last year’s tally, more than double any other year on record. Most of the activity came from US firms, including the US$1.66bn IPO of StandardAero in September, although in Europe there were listings for Renk, Theon and Exosens.

This year has got off to a slower start for bankers, however, and fees to April 14 stood at US$218m, less than half the level a year earlier. Still, US missile and drone systems firm Karman has been one of the best-performing new listings.

Patience needed

Bankers said the slowdown is partly because it is unclear how, when and from where the increased defence spending will come. They said it will flow through to capital markets, but patience may be needed.

“It’s undoubtedly going to be a sector, particularly in Europe, where a lot is going to have to happen if we’re going to reach the new [defence spending] targets that have been put in place, but we’re at the early stages,” said a senior capital markets banker at a major European bank.

He said the “first domino” could be in sovereign debt markets to finance greater defence spending. “We’re probably a little bit away from the next phase, whether that’s going to be consolidation or companies raising equity to fund growth. But in terms of strategic dialogues and debates around that, it is high on the agenda and going on,” he said.

Bankers said there is no doubt a long-term shift is underway with the EU, UK, US and other countries pledging big military spending.

“The moment has come for Europe to re-arm,” a European Commission white paper said on March 19, calling for a generational increase by 2030.

The paper estimated that member states’ defence spending was €326bn last year, or 1.9% of combined GDP. That needs to rise to at least 3% of GDP and possibly as much as 4%, analysts and economists say, after the war in Ukraine provided a wake-up call for how far military supplies have been depleted and production capabilities are far short of what is needed.

“This is not short term – there is a 10 to 15-year or longer evolution of spending, investment, implementation, new technologies and maintenance that is needed," said Duerschlag.

As an example of the maintenance needs, he said in the past a tank’s technology may have been updated every six to 12 years. In today’s conflicts, some drones are getting software updates every two weeks so they are harder to hack.

Deals on radar

Bankers are on watch for deals among several of Europe’s big defence firms. ThyssenKrupp said in February it is planning to spin off a minority stake in ThyssenKrupp Marine Systems, after previously planning to sell it to Rheinmetall. KNDS is also reported to be considering a listing in Frankfurt in late 2025 or 2026.

Iveco is looking at spinning off its IDV defence unit, although the unit could also be in the sights of firms keen to expand, including Leonardo.

Bankers said family-owned The Czechoslovak Group, or CSG, is also a candidate for an IPO or more acquisitions. CSG’s revenues soared 131% last year to €4bn, and it spent US$2.23bn on US ammunition maker The Kinetic Group in November.

With cross-border acquisitions likely to face intense political scrutiny, bankers said alliances could be more likely.

Leonardo has signed many such deals, including joint ventures with Rheinmetall and Turkey’s Baykar, and established a joint company with Britain and Japan to develop, design and build a stealth jet.

There is also potential advisory work helping firms to “retool” areas of industrial manufacturing. Rheinmetall, for example, has taken a look at Volkswagen plants to assess if the sites and their workers could switch from auto production to military equipment.

The bond markets will also provide an avenue for necessary fundraising. Some ESG funds that had banned investments in defence-related assets have now lifted restrictions, including some of Allianz Global Investors' Article 8 funds.

Investors step in

The handful of large military contractors, or “primes”, also need to be looking over their shoulder for the rise of tech upstarts using processes from commercial manufacturing.

California-based Anduril was founded in 2017 and is winning major contracts with US and other Nato countries on the promise it can hyperscale supplies quickly, and with less supply chain risk.

It provides a template for other firms to try to emulate, helping lure in more investors to the industry, bankers said. That is crucial. Venture capital and private equity have long been investors in US defence firms but have been wary of investing in the sector in Europe.

Bankers said it was significant that Anduril’s latest fundraising was led by tech billionaire Peter Thiel's Founders Fund, while Accel and Lightspeed Venture Partners were among the investors in Helsing and funds have launched in Europe this year to invest in defence technology.