FX options markets buckle under tariff strain

Corporates pausing hedging programmes in response to tariff uncertainty is sapping liquidity from foreign exchange options markets in moves reminiscent of the outbreak of the pandemic in 2020, traders say, causing a major headache for institutional investors scrambling to adjust to a potential sea-change for the US dollar.

New corporate hedging activity is down roughly 40% since US president Donald Trump on April 2 announced sweeping tariffs, traders say, as companies struggle to grasp what Washington’s whipsawing policies will mean for their businesses and the strength of the US dollar over the coming months. This drop-off is upending the traditional playbook that bank trading desks deploy to balance flows in the US$300bn a day FX options market just as demand for these derivatives is soaring.

Corporate treasurers frequently sell options to cheapen hedges they use to cover their companies’ FX exposure when markets are calm. That provides a reliable source of options supply that banks can sell on to institutional investors like hedge funds that use the contracts to hedge or wager on currency moves. These derivatives have been in high demand lately as the US dollar has slumped amid concerns that Trump’s tariff plans will undermine the greenback’s longtime strength.

Traders say the extreme mismatch that has emerged between options buyers and sellers is straining market liquidity considerably, pushing a crucial measure of euro-dollar options volatility to its most extreme level in more than five years.

“We’ve seen vol jump and liquidity dry up,” said Thomas Bureau, global head of FX options trading at Societe Generale. “We’re in a situation where there’s a lot more buyers of vol than sellers, which has created gaps in liquidity whenever [the euro] moves higher [against the US dollar] or the dollar breaks new low levels.”

Trump’s tariff plans have rocked financial markets since he announced tougher – and wider-than-expected – measures on April 2. The White House has since rowed back some of those plans and granted a 90-day pause on "reciprocal tariffs" for most countries.

However, the US dollar is yet to regain its footing as investors remain nervous about its longer-term prospects after a period of sustained strength. Having previously bet that Trump's second presidency would buoy the greenback, investors have since soured on the currency and looked to reposition portfolios accordingly.

Lowest level

ICE’s US Dollar Index, which measures the US dollar against a basket of currencies, fell to its lowest level since 2022 on April 21 amid fears Trump’s tariffs could push the US economy into a recession. The euro, meanwhile, has gained roughly 5% against the US dollar since the beginning of the month.

“The strength of the euro has caught some people by surprise and is encouraging a lot of hedging activity that we hadn’t seen before,” said Jackie Bowie, head of EMEA at consultancy Chatham Financial. “A lot of people are no longer looking at the dollar as a safe-haven currency and are looking for alternative places to invest, which has fuelled growing interest and activity in the euro.”

The US dollar jitters have coincided with a time when new corporate FX hedging activity has slowed to a trickle. In calmer market environments, many companies include knock-out options in their currency hedges, meaning the derivative contract will expire automatically if the underlying currency pair’s exchange rate reaches a pre-determined level.

Traders say some corporates have been restructuring old hedges since April 2 to protect themselves from the euro appreciating against the US dollar, but new activity has significantly decreased as companies wait to see what Trump’s tariff plans will mean for their businesses.

"We have seen an absence of any corporate hedging strategies over the past few weeks," said Aadith Raman, FX options trader at Nomura. "Certain names have experienced huge losses in the last couple of weeks who would usually be the natural suppliers of front-end volatility across G10 pairs, so these names are paring back their activity at the moment.”

In reverse

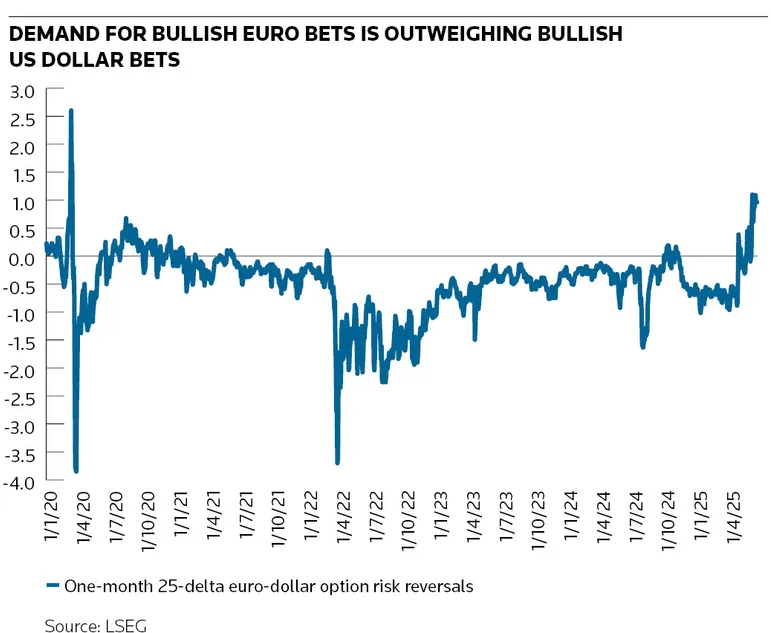

Risk reversals, which show the difference between bullish and bearish options bets on a currency, give some idea of how dislocated markets have become. Demand for bullish euro bets over bullish US dollar bets has reached its highest level since the early days of the pandemic, according to LSEG data on so-called one-month 25-delta euro-dollar risk reversals.

Options markets favouring the euro over the US dollar is “very unusual”, said Bureau, and is “something we’ve only seen in the past when there’s been a liquidity crisis”.

Traders say that is a direct result of the one-way demand for options, creating a lopsided market with poor liquidity. In times of such market dislocation, it's not unusual for bid-offer spreads to widen by three or four times their usual size, said Bureau.

"In Covid times, we had similar issues with liquidity drying up, the market being volatile and bid-offer spreads widening," said Raman. “A lack of corporate supply has meant one-way activity in most of the G10 pairs, so liquidity has been quite patchy.

“We haven’t really seen liquidity coming back in the G10 markets but, given the 90-day [tariff] reprieve, we could see bid-offer spread[s] tightening and liquidity coming back in the next few weeks.”