Long-dated bond markets on a knife edge despite selloff easing

Government bond markets have taken a breather in recent days following a brutal selloff in long-dated debt that has ignited a fierce debate over whether the forthcoming deluge in issuance from countries across the globe – along with signs of weakening investor demand in some markets – will lead to more pain in the months ahead.

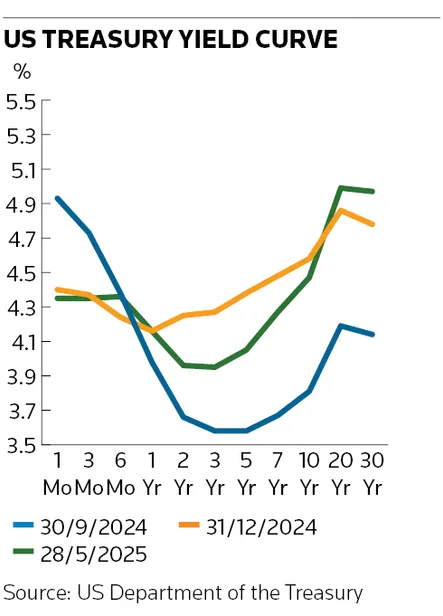

Thirty-year Treasury yields held steady at about 4.9% on Friday after rising earlier in May to their highest level in more than 18 months amid a widespread selloff across global debt markets from the UK to Japan.

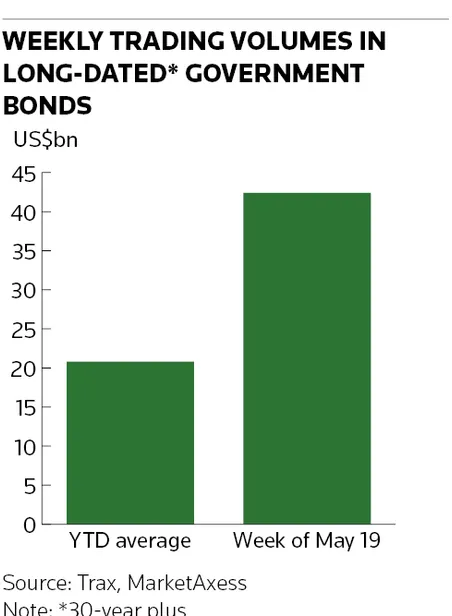

Trading volumes in ultra-long-dated government bonds hit their highest level in more than a year in the week of May 19 with activity levels jumping to more than double 2025’s average, according to market data from bond trading platform MarketAxess. That contrasted with a notable slowdown in trading activity in short-dated government bonds, which had their second-quietest week of the year.

Some analysts said concerns over government debt loads are overdone and markets will settle down as focus shifts back to US president Donald Trump’s tariff policies and investors scan for clues on a potential slowing in the US economy. But others signal more trouble ahead for the long end of government bond curves, forcing some countries to respond with adjustments to their borrowing plans.

“Long-dated government bonds are now where investor views are expressed. This steepening of the yield curve is a global event,” said Filippo Alloatti, head of financials in the credit team at Federated Hermes, who holds so-called curve steepeners through futures contracts, a strategy that benefits from long-dated bond yields rising relative to shorter-dated yields. “Across the US, UK and Japan you’re seeing increasing supply of government debt and weakening demand."

A confluence of events across global debt markets has sparked concerns over the fate of long-dated bonds. Fiscal deficits have ballooned since the start of the pandemic in 2020, forcing governments to ramp up their debt issuance to plug gaping holes in their budgets.

Investor focus on the US has intensified after Moody’s lowered the government’s credit rating earlier in May citing concerns over its debt pile. Projections that Trump’s tax and spending plans will cause the deficit to widen to about 7% – a level not typically seen outside recessions – has only added to market jitters.

Stepping back

This has all coincided with some of the biggest buyers of government bonds stepping back from the market. Central banks, which have hoovered up debt for much of the previous decade to stoke economic growth, are now shrinking their holdings. Meanwhile, analysts point to waning demand from pension funds and life insurers for long-dated bonds in markets such as the UK and Japan after years of providing crucial support for those securities.

“Part of the underlying problem is issuance strategies have not yet adjusted to the fact that the marginal buyer of government bonds globally is no longer the life and pensions industry and as a result the duration profile should be quite different,” said Ralf Preusser, global head of G-10 rates and FX Strategy at Bank of America. “Either treasuries and debt management offices will have to acknowledge that, as they have done in the UK, or yield curves will continue to steepen.”

The UK Debt Management Office has already signalled that it will shorten the maturity profile of its debt issuance as appetite from pension funds for long-dated securities has declined. Analysts say a similar story lies behind the moves in the Japanese bond market, where local life insurance companies have become less active. Many traders expect Japan’s finance ministry to adjust its issuance plans as a result.

“There is a structural problem in super-long-term JGBs with excessive supply and shrinking local demand,” said Yusuke Miyairi, G-10 FX strategist at Nomura. “The global dynamics seem to support the MoF issuing shorter-dated bonds rather than long-dated bonds. That could help the structural problem of excessive supply and bring some relief [to long-dated bonds].”

Steeper still?

Whether such moves will be enough to tame long-dated bond yields remains a hotly contested question. BofA believes there is room for bond curves to steepen further, led by Japan and the US, and has pencilled in 30-year US Treasury yields to rise by roughly 20bp more relative to 10-year yields.

“What’s led to the acceleration of the steepening trend [after Trump's so-called liberation day on April 2] is a bigger focus on risk premium in rates markets,” said Preusser. “In the US, you have inflation risks that are not really priced in and a renewed focus on fiscal risk and the path of the debt-to-GDP ratio, which doesn’t look great. All this is happening when the US has become more reliant than ever on overseas investors.”

Others, however, signal that long-dated bond yields may have peaked. Matthew Hornbach, global head of macro strategy at Morgan Stanley, said people have been worrying for years about government deficits creating a negative feedback loop of higher yields, wider deficits and more borrowing leading to still higher yields – without it ever coming to pass.

“The size of deficits does matter, to be sure, and this discussion around higher deficits has almost certainly had an impact on the market,” he said. “But we don’t think that the type of change we’re forecasting in the US deficit [from high 6% to low 7%] will put more upward pressure on Treasury yields. Ultimately, when other realities bite, such as the effect on growth from tariffs and central banks’ response to that, these concerns will fade away very quickly.”