Wells Fargo set to grow CIB as asset cap goes

Wells Fargo is expected to expand significantly in its trading and other investment bank operations after being released from a punitive seven-year US$1.95trn cap on its assets – referred to as a “scarlet letter” by its CEO.

The Federal Reserve on Tuesday lifted the regulatory measure due to improvements in risk and governance, which will now allow the fourth-biggest US bank to pursue unimpeded growth.

The corporate and investment banking business could be the biggest beneficiary. CEO Charlie Scharf, who has been cleaning up the bank since taking over in 2019, previously said Wells is punching below its weight in most areas of investment banking and he wanted to improve that.

He said the asset cap had hurt that effort. “Our corporate investment bank has been limited in terms of what they can do because we tried very hard not to limit our ability to take consumer deposits and wealth deposits because that hurts you strategically,” Scharf said at a conference on May 28.

“That's really come out of the corporate investment bank in terms of our ability to finance trading positions and to be able to grow that business at a reasonable level. So we will add balance sheet back there.”

He said the bank was restrained at times of stress, such as during Covid-19, and when clients need to draw on revolver loans and other facilities.

“It also allows us to think more aggressively about how to use the balance sheet. So again, it's not tomorrow, but whether it's private credit, whether it's the things that we wanted to do to compete with the other non-banks that are out there, we're able to use the balance sheet differently. And so, it does open our ability to grow in ways that we haven't been able to grow since we've had the asset cap.”

Scharf said expansion will come “in a very controlled way", but the removal of the cap will also allow a change in mindset and a focus on growth. “So it's a combination of our mindset in terms of what we can focus on as well as just the scarlet letter goes away and we're not differentiated from the other companies out there,” he said.

Wells' CIB revenues have grown despite the asset cap, and the bank has continued to make senior hires. Last year it lured former JP Morgan senior executives Fernando Rivas and Doug Braunstein, with Rivas joining as co-CEO of CIB and appointed sole head in January, and Braunstein tasked with growing the corporate finance and advisory businesses.

"Corporate and investment banking is the most likely area where we could see management lean-in on growth, given the significant investments made over the last 18 months," said Bank of America analyst Ebrahim Poonawala.

Keith Horowitz, an analyst at Citigroup, said the removal of the cap is likely to see Wells open its balance sheet for commercial deposits and trading activities.

"Despite the cap, growth in trading fees has been significant, so there is underlying momentum, and the removal of the cap can serve as an additional tailwind," Horowitz said in a note.

CIB growing

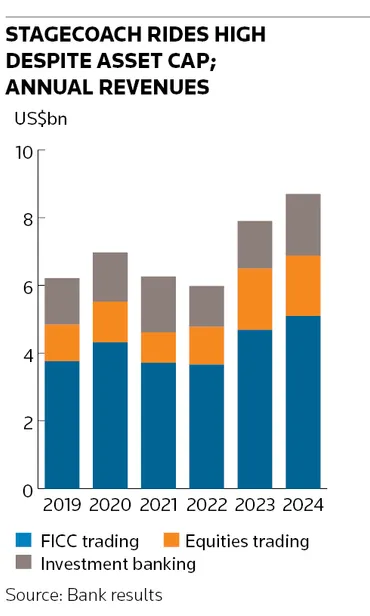

Wells Fargo has increased trading and investment banking revenues in recent years. CIB revenues were US$19.34bn in 2024, up 40% from US$13.84bn in 2019. Trading revenues for fixed-income, currency and commodities hit US$5.09bn last year, up 37% from 2019, and equities trading revenues climbed 66% from five years earlier to US$1.79bn.

Its investment banking revenues were US$1.81bn last year, up 32% from 2019.

In the latest January to March quarter, CIB revenues were US$5.06bn, up 2% from a year earlier. FICC revenues were up 2% year on year to US$1.38bn, equities revenues were flat at US$448m and investment banking fees were up 13% to US$534m.

Wells has ridden the surge in trading revenues across Wall Street but it has also taken trading market share and share in underwriting and advisory, where activity has been lacklustre across the industry.

Wells brought in US$1.25bn in fees from debt and equity underwriting, M&A advisory and syndicated loans in the first five months of this year, ranking seventh for global fees, according to LSEG data. That was up 4% from a year earlier, outperforming an 8% decline in overall industry fees. It ranked ninth for global investment banking fees in 2019.

The bank's assets in the CIB division have also increased and totalled US$632bn at the end of March, up from US$547bn at the end of 2021, as trading assets swelled to US$292bn from US$186bn.

That shows the difficulty the bank has faced, given trading assets can jump around at times of volatile markets.

The bank has previously said it sees particular opportunities to gain share in M&A and ECM, and on targeted overseas growth such as Yankee bond issuance. It has strong positions in debt underwriting, leveraged finance and bond trading in its home market, but in most other areas and geographies it lags far behind its big five US investment bank rivals.

The Fed imposed the unprecedented asset cap on Wells in 2018 after a misselling scandal in which staff opened millions of accounts for customers without their knowing, which exposed other risk management flaws at the San Francisco-based bank. It was heavily fined, senior management ousted and restrictions were imposed.

Staff will benefit too. Scharf told employees that the asset cap removal is a "pivotal milestone” and said all 215,000 full-time employees would receive a US$2,000 award as recognition.