'Sell America' trade emerges in April

International investors sold US stocks and bonds in April at their fastest pace since the outbreak of Covid-19 in early 2020, in one of the first concrete signs that overseas money managers could be reconsidering their exposure to US markets after years of investing heavily.

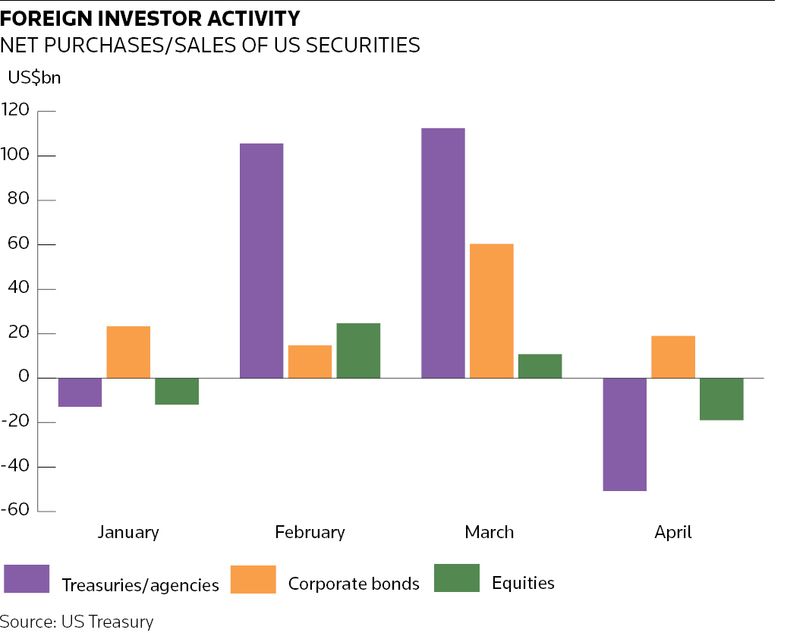

Foreign investors sold a net US$50.6bn of US equities and bonds in April, according to US Treasury data, after president Donald Trump’s announcement of sweeping tariffs early that month sent markets into a tailspin. Treasuries were the biggest casualty, with institutions from Canada and China among the most prominent sellers.

Analysts caution against reading too much into one month of data, not least because it represents a drop in the ocean compared to the deluge of money that has flowed into US assets in recent years. Overseas investors bought a net US$216.2bn of Treasuries in the first quarter, more than five times the amount they sold in April. US stock markets have also rebounded strongly since their April dip.

Still, traders say the data support what they’re hearing anecdotally: that international investors are looking for ways to trim what in recent years had become a significant overallocation to US markets.

“It's not like people are bulk-selling US assets; it's just that marginal flow into the US has reduced quite a bit and what used to go to the US is now going to other markets,” said Ales Koutny, head of international rates at Vanguard Asset Management.

“People have been overexposed to US assets for years and in our view, it’s not that they’re suddenly going underweight – it’s more that they’re bringing their exposure back towards benchmark levels, which is still enough to reflect trillions of dollars of movement.”

US exceptionalism

The stellar performance of US markets has drawn vast sums of foreign capital. Overseas investors have bought a net US$3.5trn of US securities since the start of 2022, helping push stocks to all-time highs and absorb record amounts of debt issuance. More recently, investors have started to question how long the era of US exceptionalism can last.

The Trump administration’s erratic trade policies and concerns over a potential economic slowdown have sent the US dollar sharply lower and forced international investors to review their position in US markets. That has coincided with a brightening in Europe’s economic prospects following Germany’s announcement of a €1trn spending plan for defence and infrastructure that promises to stoke growth after years of underinvestment.

Until now, official data have provided conflicting accounts of whether foreigners are taking their money elsewhere, although traders have reported signs of this happening behind the scenes.

“You can see in our custody flows that there has been more euro-dollar buying in the last five months. That means investors have been selling US assets and buying European assets. We are seeing investors increase their [dollar] hedging ratios as well, although those tend to be slower to move,” said Neehal Shah, chief FX officer, fixed income, currencies and commodities, at BNP Paribas.

Shah noted the European rearmament story and concerns over US exceptionalism are still relatively new themes. "These big global investor portfolios take a while to adjust. I believe you are going to continue to see this dynamic playing out over the course of the next year," he said.

Big impact

Analysts say even a modest rerouting of funds could have a big impact on other regions. Koutny said Vanguard’s UCITs funds franchise has seen inflows increase as much as 30 times into smaller markets across Europe, Asia and the rest of the world – the equivalent of US$100bn. That doesn’t represent a big outflow from the US, given the size of the market, but it's still a "huge inflow" for these smaller markets, he said.

But while investors may look to deploy new money in other regions, many will be wary of beating a broader retreat from the US given its track record. Washington’s softening of tariff policies has helped the S&P 500 outperform the pan-European Stoxx Europe 600 index by about seven percentage points over the last three months, although the US benchmark is still behind for the year. The US economy doing better than expected at weathering the impact of tariffs could provide further impetus for markets to rise.

Drilling into the details of the April Treasury data paints a more nuanced picture. While foreign private investors sold a net US$46.8bn of Treasuries, they bought US$15.9bn of corporate bonds and US$14.3bn of equities. Foreign official institutions sold US$33.2bn of US equities but bought US$6bn of Treasuries and US$3.1bn of corporate debt.

One problem money managers face is that no market can compete with the US when it comes to scale and opportunity. “For a fixed-income manager, it’s difficult to do away with the US market,” said Filippo Alloatti, head of financials in the credit team at Federated Hermes. "[It's] perhaps more that people are considering their options. If before the US was 60% of your overall portfolio, the question now is whether the UK or European part should increase.”

Many investors have focused on increasing currency hedges of dollar assets to protect against a weakening greenback rather than dumping positions altogether.

“In many asset classes people are not really touching their underlying asset allocation but they are looking at making tweaks to their FX hedge ratio as a first step instead,” said Ralf Preusser, global head of G-10 rates and FX Strategy at Bank of America.