Societe Generale gains ground in fixed income trading push

Societe Generale’s drive to expand fixed income trading is starting to bear fruit, as the French lender pushes ahead with plans to diversify its markets division beyond the structured equity derivatives business that has underpinned its trading revenues for years.

SG’s average daily trading volumes in spot foreign exchange are up 70%–80% this year, the bank said, comfortably outstripping growth in the wider market. This has propelled SG into the top 10 on all the main multidealer trading platforms for FX spot globally and into the top five in EMEA, SG said.

The rapid strides in FX follow the appointment earlier this year of veteran trader Francisco Oliveira as co-head of global markets to spearhead an expansion in fixed income and currencies trading. That is running alongside SG’s concerted effort to broaden the scope of its stock trading unit by doing more in cash equities and prime brokerage.

Taken together, SG believes this revamp of its trading division is creating a more diverse and stable stream of revenues – a strategy the bank has adopted after suffering heavy equity derivative losses five years ago.

“It’s very hard for investors to put an accurate valuation on your trading revenues if they’re too volatile,” said Hatem Mustapha, a 25-year SG veteran, who co-heads global markets with Oliveira. “Our strategy is to grow our revenues, but to grow them in a stable and sustainable way.”

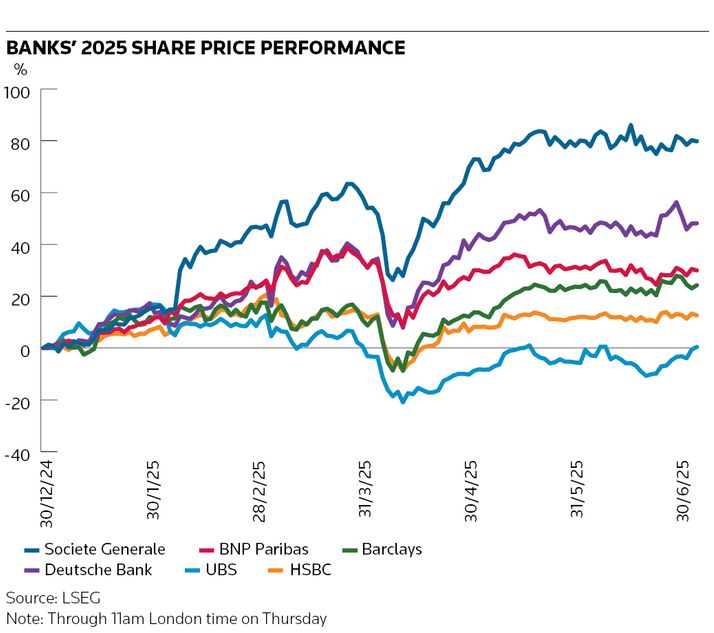

Investors appear to approve of the approach. SG is the best performing major investment bank stock over the past year, according to LSEG data, with shares up about 80% this year. Many analysts forecast further gains after years of lacklustre performance.

That positive outlook contrasts starkly with the slump in SG's stock price after Slawomir Krupa outlined his strategy for the bank after taking over as chief executive in 2023. As a former head of SG's investment bank, Krupa has focused on shoring up the bank’s capital and simplifying its business mix since taking the top job.

Expanding in fixed income is an important part of the plan for a more balanced – and less risky – trading division. Equities accounted for about 60% of SG’s €5.9bn of markets revenues last year, making it an outlier among investment banks that typically earn more from trading bonds and currencies. This reliance on equities – and exotic derivatives in particular – proved its undoing in 2020 when stock markets plunged with the outbreak of Covid-19.

While several banks nursed losses running into hundreds of millions of dollars, the derivatives hit was especially painful for SG because of the concentrated nature of its markets business. Trading revenues dropped 21% that year. Crosstown rival BNP Paribas, by contrast, reported a 22% uptick in its markets division as a surge in fixed income trading helped it absorb its equity derivatives losses.

Foundation stones

Oliveira, who joined in January from BNPP, said SG already has the foundations to grow in FX and interest rate trading thanks to the infrastructure the bank already had in place. “We’re now delivering on that and the magnitude of growth is fast,” he said.

“FX is potentially the most commoditised asset class after equities, which requires you to be able to service at scale,” said Oliveira. “This business is profitable for us and it generates a lot of cross-selling opportunities with clients. It’s a door opener for more fixed income products: options, swaps, emerging markets and other things.”

While FX and rates trading have been the primary focus, Oliveira said credit trading – traditionally a smaller business at SG – is still a priority. “It’s really embedded at the core of markets with our banking colleagues, but there is work to be done in terms of infrastructure investment,” he said.

SG has signalled it will deploy capital selectively to support growth in the markets business. It is also making investments in infrastructure and technology as a greater proportion of fixed income moves to on-screen trading and algorithms have become more prominent.

At the same time, SG continues to leverage its prowess on the more structured side of the business. Structured FX volumes with corporate clients are up 30% this year, SG said. It also registered a fivefold increase in structured rates volumes in the bond market volatility that followed Germany’s announcement of €1trn of increased spending.

“It was a major opportunity for structured rates products and we could grab it thanks to our scale, our systems and the connectivity with clients around the globe,” Oliveira said.

Equities overhaul

The overhaul of SG’s equities division has been arguably more dramatic. The bank has embraced simpler activities that provide more predictable income streams, while dialling down risk significantly in its exotic structured derivatives business.

The 2020 acquisition of Commerzbank’s equities operations expanded SG's presence in listed products like exchange-traded funds, while its Bernstein joint venture with investment giant AllianceBernstein has catapulted it forward in cash equity trading and research. The French bank has also been building its prime brokerage, through which it lends money to hedge funds, a business that now accounts for a huge share of industry revenues.

“Historically our franchise has been focused on equity derivatives. We’re now working to complete our equities franchise as we create the whole value chain for clients with cash equities and prime brokerage, which will also give us greater balance,” said Mustapha.

More profitable

Despite drastically reducing its risk in structured equity derivatives, Mustapha said this business is more profitable than it was in 2020 following a shift to higher margin products.

“When volatility is low, people are always tempted to sell tail risk,” said Mustapha, who credits his background in risk management for shaping his approach to running the business. “Our whole model is not to sell tail risk. We have a completely different risk profile today compared to 2020.”

SG’s earnings show how the bank is generating more revenue while taking less risk. SG posted a record first-quarter €1.1bn of equities revenues – about 60% more than it made over the same period in 2019. The bank has slashed market risk-weighted assets by 30% since the end of 2020 and reduced potential losses under stressed scenarios by 70%. SG only had two days of losses in its markets business last year, compared with around 20 to 25 days a few years ago.

Room for growth

SG clearly sees more opportunities for growth in global markets. Mustapha said much of the uptick in first-quarter equities revenues came from cash equities and prime brokerage – areas in which SG is expanding with ambitious growth plans.

“The large macro and multi-strategy funds are excited to meet us. Clients want to diversify their prime relationships, they don’t want to be too concentrated,” he said.

Mustapha emphasised the importance of developing long-term client relationships that bring repeat business and revenues that are stickier and more predictable – and less volatile. That very much reflects the guiding principles of SG’s new-look markets division. Steady, stable, predictable – a far cry from the more concentrated, and higher-risk approach of the past.

“When you have diversification between different businesses – derivatives, cash, flow, financing – and different regions – Europe, the US and Asia – you benefit from this portfolio effect and you can increase revenues while reducing their volatility,” said Mustapha. “The market valuation of our revenues should improve if people see that they are sticky and recurring.”