Banks rush into stablecoins despite central bank warnings about risks

Several banks are preparing to set aside misgivings about cryptocurrencies with the launch of their own stablecoins in the weeks ahead as they seek to take advantage of an imminent change of law in the US, which has until now tried to maintain a firebreak between the two worlds.

Societe Generale is understood to be close to launching its own stablecoin linked to the US dollar, while Bank of America has signalled it is also considering moving into the space and JP Morgan has already announced its own stablecoin-style offering. Other banks are even considering working together to launch a joint stablecoin.

The rush comes despite repeated warnings about the potential dangers of stablecoins. The Bank for International Settlements, which counts dozens of central banks as members, said the instruments “perform poorly” on the three pillars of monetary stability: singleness, elasticity and integrity.

“Society has a choice,” it said in a report last week. “The monetary system can transform into a next-generation system built on tried and tested foundations … or society can relearn the historical lessons about the limitations of unsound money, with real societal costs.”

Under president Donald Trump, the US has loosened regulation of the crypto industry, which made large donations to his campaign. Trump-owned World Liberty Financial launched its own stablecoin in March and the president has pledged to turn the US into “the crypto capital of the world”.

The Securities and Exchange Commission is crafting new guidance on token issuance, while the Federal Deposit Insurance Corp has eased restrictions for banks taking on crypto clients. The Office of the Comptroller of the Currency is even considering issuing bank charters to crypto firms.

The Federal Reserve has remained something of a holdout, however. The central bank has kept some of its restrictions in place, even as other agencies have dropped theirs. But the Guiding and Establishing National Innovation for US Stablecoins Act of 2025, known as the Genius Act, which could be signed into law next month, brings that resistance to an end.

“A lot of banks and financial institutions that were on the fence are now going all in,” said Dario de Martino, a partner at law firm A&O Shearman. “There's a wide recognition that stablecoins are reshaping payments, custody and settlement, and there are competitive risks if they don't move fast.

“The reason why they're accelerating now is because regulatory clarity has finally arrived. I've been in this space for over 10 years and it was virtually impossible to give clients a straight answer. Now, we are finally getting clarity from regulators and legislators – and that's unlocking investment.”

Exponential growth

Stablecoins work like other cryptocurrencies in that they are traded in real time and recorded on a public blockchain. But, unlike earlier cryptocurrencies, they are backed by real assets like US dollars, Treasuries or gold – making them more appealing.

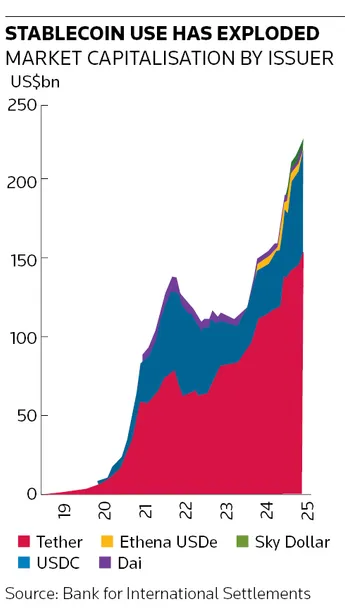

The outstanding supply of stablecoins was just US$2bn at the end of 2019. Today, it stands at around US$250bn – with Standard Chartered estimating that the market could reach US$2trn over the next three years as a result of the imminent regulatory changes in the US.

Tether, which launched in 2014 as Realcoin, is the dominant player with an almost two-thirds market share. The second largest is Circle Internet. Both companies' tokens are pegged to the US dollar and – at least in theory – are fully convertible.

Circle, which raised more than US$1bn from its IPO last month, is also seeking to capitalise from the imminent regulatory changes. In recent days, it has filed an application to create a national trust bank, which would allow it to offer custody services to institutional clients.

Instant clearing

Stablecoins could revolutionise the traditional monetary system, in which payments have to go through several steps before they are cleared, sometimes taking days in some markets. Stablecoin payments are cleared instantly on the public blockchain, reducing operational risks, delays and costs.

“The ultimate value of blockchain is realised when we get to a point where a critical mass of parties transacting with each other are on common infrastructure – creating simultaneous, smart real-time value movement and a uniform source of data,” said Naveen Mallela, global co-head of Kinexys, the blockchain platform set up by JP Morgan.

In recent weeks, Kinexys has launched its own “permissioned token” – tokens linked to commercial deposits that are recorded on a public blockchain – that it plans to roll out to its institutional clients over the coming years.

Systemic risks

The growth of the stablecoin industry has fuelled huge demand for safe, liquid assets to hold as reserve assets. Tether holds almost US$100bn of US Treasuries, while Circle holds almost US$30bn. JP Morgan estimates the industry could become the third largest buyer of Treasuries this year.

While those reserves provide reassurance to users of stablecoins, the BIS has warned that such dynamics could create a dangerous feedback loop between the cryptocurrency world and traditional financial and banking markets – especially during periods of stress.

Stablecoins' "expanding market presence ... creates a tail risk of firesales", it said. “If banks and other existing financial institutions become active in crypto markets, there is the risk of spillovers that undermine banks’ ability to lend to households and businesses, trade in traditional markets and perform their role in supporting the real economy.”

It has also raised concerns about stablecoins undermining monetary stability by facilitating “stealth dollarisation”, which central banks might be powerless to stop. It also pointed to historical collapses in confidence in stablecoins, such as in 2022 when Tether broke its peg during market turmoil.