Banks set the board for investment banking gains through early 2026

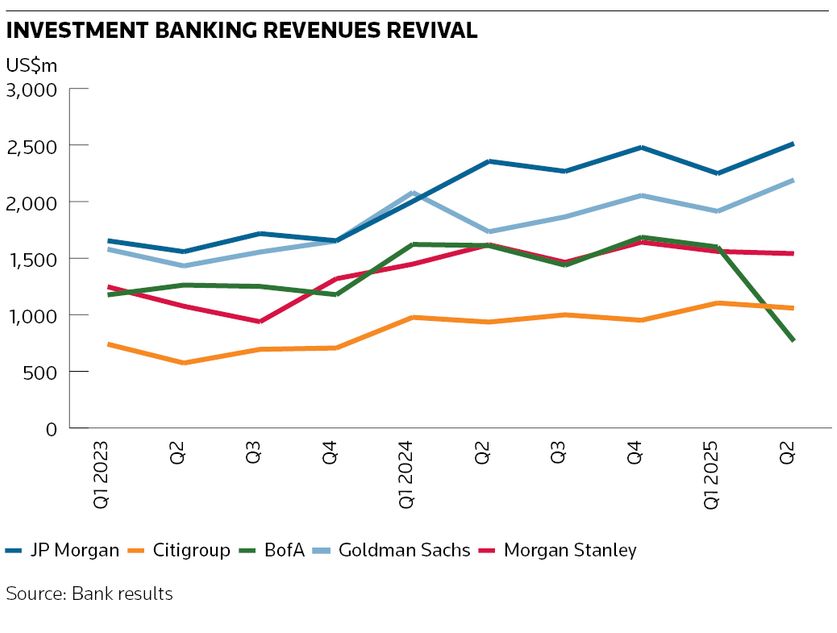

Investment banking revenues came roaring back in the second half of the April–June quarter after being hammered by the US trade policy announcement in April.

Two-thirds through the quarter banks warned that the quarter would be a washout – with Bank of America warning investment banking revenue would be down as much as 25% on the year and JP Morgan suggesting revenue would be down by 15%.

"The job of bankers is to be conservative – to carry an umbrella on a sunny day," said Wells Fargo bank analyst Mike Mayo.

Instead, investment banking revenue across the top five US banks, JP Morgan, Citigroup, Goldman Sachs, Morgan Stanley and BofA, rose about 8% in aggregate.

“The second quarter unfolded with two distinct halves,” Morgan Stanley chief executive Ted Pick told analysts on the bank’s earnings call. “The first half began with uncertainty and market volatility associated with the US trade policy and the second half ended with increasing engagement and a steady rebound in capital markets.”

The momentum is likely to continue to accelerate to at least next year, Mayo said.

“Barring an unexpected rise in inflation and higher interest rates – which is still a very real possibility – there’s a lot more confidence that the momentum from the second quarter is likely to continue for the next year and a half,” he said.

Goldman rules

No bank leaned into the rebound more than Goldman Sachs. Investment banking revenue rose 26% in the quarter to US$2.2bn largely on the strength of its M&A franchise where revenue surged a whopping 71% to US$1.2bn in the second quarter.

“Our global client franchise has never been stronger,” Goldman CEO David Solomon said. “The dealmaking environment has been remarkably resilient. While activity was slower in the first half of the quarter, announced M&A volumes for the year to date are 30% higher year over year and 15% greater than the comparable five-year average."

Goldman said there was a pickup in momentum in dealmaking in the quarter with corporates and sponsors taking part.

“The uncertainty could persist in some pockets, particularly in industries highly sensitive to trade policy," Solomon said but added that he is “optimistic on the overall investment banking outlook".

Across the top five banks, revenue from advisory rose 21% in the quarter as CEOs reengaged and sponsors came off the sidelines. At JP Morgan, advisory revenue rose more than 7% to US$844m. At Citi, it rose 52% to US$408m.

“We continue to be at the centre of some of the most significant transactions,” said Citi CEO Jane Fraser. That included being exclusive adviser to Boeing on the US$10.55bn sale of its Jeppesen unit and as lead adviser to Nippon Steel on its US$14.9bn acquisition of US Steel.

“Halfway through the year, we have been involved in seven of the top 10 investment banking fee events,” Fraser said. “In addition to sustained momentum in M&A, we continue to take share in leveraged finance and with sponsors, a priority area. We also took share in equity capital markets, with convertibles fuelling a strong quarter.”

In contrast, IB revenues fell at BofA in the quarter – down 8% overall with declines in DCM, ECM and advisory.

ECM rebound

Revenue from equity underwriting rose 9% in aggregate across the banks with Morgan Stanley leading the pack.

“Equity underwriting gained momentum following multiple years of subdued activity,” Morgan Stanley financial chief Sharon Yeshaya told analysts.

Revenue from ECM rose 42% to US$500m at Morgan Stanley. Despite a slowdown in April and much of May, convertibles, follow-ons and IPOs all accelerated towards the end of the quarter as global issuers and investors gained confidence amid a market rebound, the bank said.

At JP Morgan, ECM revenue fell 6% to US$465m while they rose 1% to US$428m at Goldman. ECM revenue rose 25% to US$218m at Citi but fell 13% to US$130m at BofA.

Morgan Stanley said strength in Asia Pacific was supported by a healthy mix of activity across equity products in the quarter.

Revenue from debt underwriting fell 4% in aggregate across the top US banks with all but JP Morgan seeing declines.

DCM revenue rose 12% at JP Morgan to US$1.2bn driven by a few large deals, the bank said. At Morgan Stanley, DCM revenue fell 21% to US$532m and dropped 12% to US$432m at Citi. DCM revenues fell 5% to US$589m at Goldman, in part due to lower leveraged finance activity, and were down 5% to US$346m at BofA.

Glass half full

First-half revenue from investment banking, advisory, DCM and ECM, rose 6% in aggregate across the top five banks with advisory increasing the most at 15% from year-earlier levels. Only BofA saw investment banking revenue fall in the first half – down about 4% to US$1.6bn. Citi, which is undergoing an investment banking turnaround, saw the biggest gain in the half with revenue up more than 13% to US$2.2bn as advisory revenue surged 67%.

JP Morgan's investment banking revenue rose 9% to US$4.8bn for the half. Goldman's revenues were up 8% to US$4.1bn and 1% to US$3.1bn at Morgan Stanley.