Too early for Barclays to claim victory

Barclays' share price is up 40% this year and has doubled since it announced its three-year improvement plan early last year. If that plan was equivalent to a test match, the bank’s cricket loving CEO CS Venkatakrishnan couldn't be blamed for calling an early declaration and heading into the pavilion for tea (it would be a nice pavilion, too, given that Barclays recently became a principal partner for Lord's Cricket Ground).

He would have much to look on proudly when nibbling his scones. In particular, the markets business had a stellar first half of 2025 underpinned by market volatility, market share gains in trading and the continued growth of more stable financing revenues.

Like-for-like revenue growth (adjusted for currency and a one-off gain in the prior year) for both equities and FICC businesses was up more than 25% in the first half of 2025 – ahead of peers. The FICC result in particular was evidence of robust market share trends.

The three-year plan targets £1.1bn of additional revenue from market share gains and a slight increase – £200m – from industry wallet growth in the markets business. Even assuming the business has no revenue growth in the second half of 2025, it would already have beaten its 2026 revenue targets one year early.

Financing revenues at 35% of the first-half markets revenues was best in class among peers, reflecting the continued leadership position in fixed income financing and entry into the top five of prime brokerage. Growth in financing was targeted in the plan to add £600m by 2026, and the first-half run-rate implies that has already been achieved. Fair play.

Eye on the ball

And yet looking across the bank as a whole it would be too early to declare a job well done. The truth is that all European bank stock prices have boomed in the past year, and Barclays’ valuation multiple remains at a discount to peers. Indeed, if Venkat and his team take their eye off the ball, 2026 targets that now look conservative could still be missed. Nowhere is this more so than the investment bank, which, for good or bad, has driven the fortunes of the bank for most of the last two decades.

Barclays' investment bank saw its return on tangible equity fall from 14% in deal-hungry 2021 to 9% in 2022 and a mere 7% in 2023. The target contained in the three-year plan is for a ROTE of more than 12% in 2026. That seems sensible, even a touch cautious. Indeed, the ROTE for the first half of 2025 was 14.2% – nicely up on the 10.8% in the prior half year – and, given seasonality, the full year is likely to come in around the 2026 target, one year ahead of plan.

But if Barclays wants to close the valuation gap with US investment banks and more diversified European banking groups, it feels like 12% needs to be a floor not a stretch. The target is shy of the 15%–20% ROTE that many leading US players have achieved in the recent past.

Indeed, the real risk to Barclays is that its markets business starts to soften and the investment banking franchise is neither large enough nor strong enough to pick up the slack.

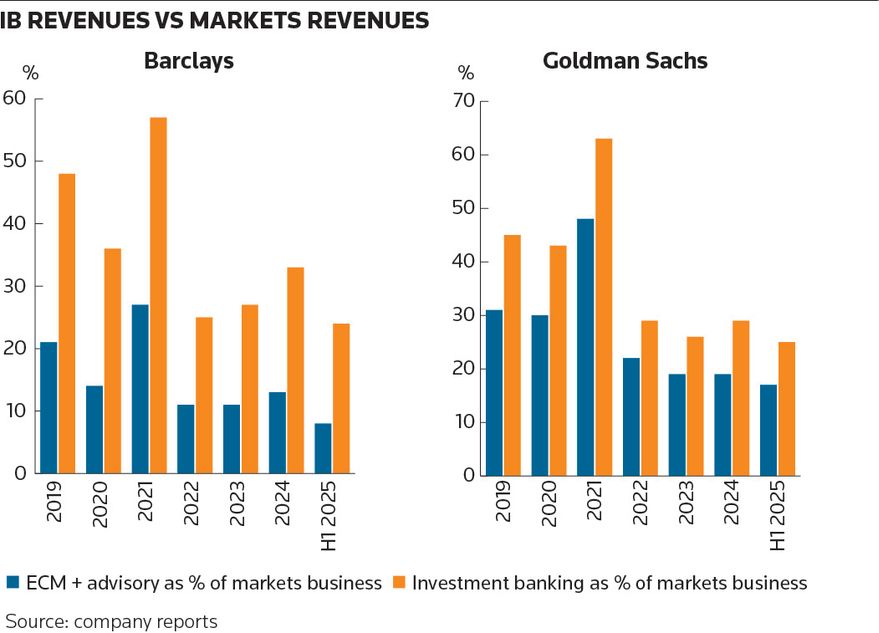

While markets revenues in the first half of 2025 are annualising up 39% on the average of the last six years, ECM and M&A are down a quarter and DCM is up only marginally. The investment banking franchises (ECM, M&A advisory and DCM) generated revenues in H1 2025 that were a mere 24% of the revenues of the markets business, which compares with an average of 38% over the prior six years.

Although such dependence on markets businesses is also the case at other top banks, the crucial difference is the mix within the investment banking units. When outlining its three-year plan Barclays had highlighted that it was too dependent on its top five DCM franchise.

Not much has changed. In the first half of 2025, Barclays DCM bankers generated twice as much in revenue as their ECM and M&A colleagues. In contrast, the leading investment banking franchise, Goldman Sachs, only generates one-third from DCM with the rest from M&A and ECM.

Painfully slow

Despite the rejigging of management, Barclays’ progress at rebalancing towards the more equity-related dealmaking has been painfully slow. There is a mix element to this, given the quieter home UK market, but the proportion of Barclays investment banking revenues coming from the much busier US market is just as high as the top five US banks.

The three-year plan had a target of around £1.25bn of additional revenues across investment banking fees and the international corporate bank by 2026, with the assumption that dealmaking would drive most of the uplift. The current run-rate implies the need for a significant pickup to hit these targets.

According to LSEG statistics, Barclays investment banking deal fees are down 9% so far this year – worse than the flat industry wallet. In the prior year Barclays had grown with the industry but lagged US peers.

Barclays' large DCM business has lagged the industry this year with particular weakness in loans. Reported revenues for ECM and M&A shrunk in the period. In H1 2025, Goldman made more than five times more revenues from ECM and M&A than Barclays, a jump on prior years. The gulf between Barclays and the US firms keeps getting bigger.

With only £151m of H1 2025 ECM revenues, the year-on-year growth rate was impacted by the presence of jumbo fees Barclays generated on the National Grid equity raising in the prior year period. A small glimmer of hope is that fees from M&A deals that are still to be booked are showing a little momentum.

If the diverging fortunes of the two pillars of Barclays continues to the end of the three-year plan next year, the bank may face some tough decisions on resource allocation. After trying for more than 20 years to build a world-class investment bank, HSBC finally gave up the effort this year and jettisoned parts of its ECM and M&A business. The read across to Barclays is far from precise. Barclays has a much stronger franchise in investment banking. But it also has a much bigger cost base.

Rupak Ghose is a former financials research analyst